The death of Davos Man, Elon pulls a Steve Jobs, 1 billion humanoid robots by 2040, Bill Gates' New World Order, and why you shouldn't drink water out of a plastic bottle...

The decentralization of the Davos Man

As a matter of full disclosure, one of my favorite people on the planet, Accel Partners cofounder and global power broker Joe Schoendorf, and I had a good decade run (1996-2006) producing the coolest cocktail party at the World Economic Forum in Davos, Switzerland. The idea for the party popped up rather spontaneously, hanging out in the Belvédère Hotel bar, where we observed that basically none of the big shots and politicians at WEF had any idea what we were up to in Silicon Valley. So the 'Davos meets Silicon Valley' cocktail party was born and held at the marvelous Kirchner Museum in the heart of the Davos village, where we became famous for serving California's finest varietals hand-picked by Joe, our in-house winery owner and sommelier.

During that decade of fun, Silicon Valley was busy commercializing the Internet, inventing cloud computing and social networking, and introducing the smartphone—basically re-writing how we do everything all over again. It was natural for us to turn Davos meets Silicon Valley into the coming out party for a whole new generation of entrepreneurs on the verge of disrupting all of our lives. We introduced the Google Twins—Larry and Sergey when Google was two years old, a 21-year-old Mark Zuckerberg, Chad Hurley when YouTube, the company he co-founded, was barely a year old, and Skype cofounder Niklas Zennström just when they introduced Internet video.

My favorite regular guests included musician and entrepreneur Peter Gabriel, Peace Prize winner Shimon Peres (RIP), Michael Dell, The Alchemist author Paulo Coelho, and Hasbro Toys founder Alan Hassenfeld. That’s my Davos posse right there. I’ll never drink that much good wine ever again.

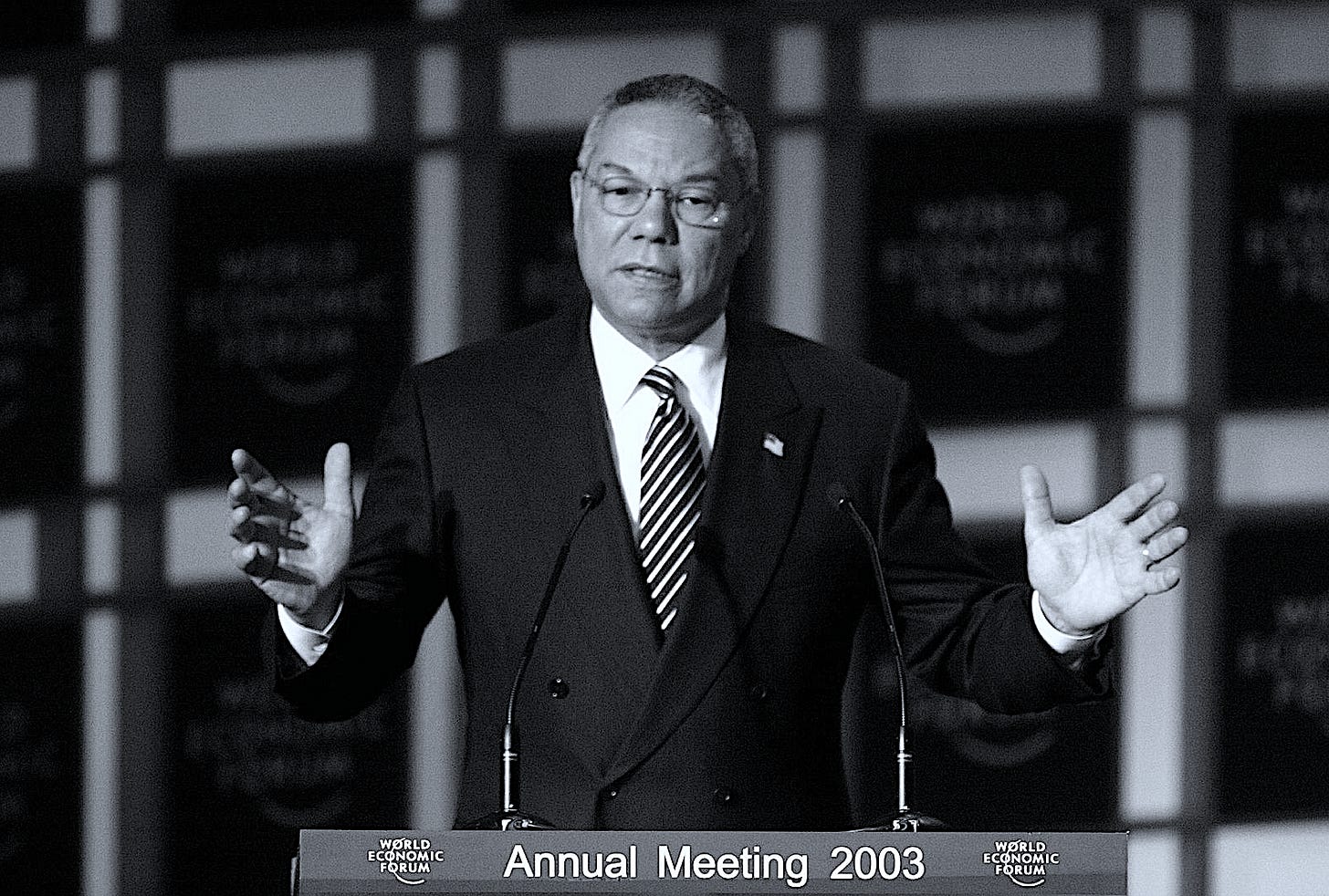

After 2006, I dropped off the Davos bus with many affectionate memories. WEF has always leaned Western European, which by definition means jealous of and often spiteful towards the US. Not always without good reason. I was there in 2003, in the front row, when then US Secretary of State Colin Powell showed the Davos throngs the same infamous photograph of Iraq’s ‘weapons of mass destruction factory’ that he showed earlier at the United Nations, as our primary evidence to engage in full on war. We all know the rest of that story, and we have a lot to be sincerely sorry about for that quagmire.

The primary challenge to the World Economic Forum and the irony of this year’s theme—‘Rebuilding Trust’—is that the average world citizen no longer trusts centralized power, and Davos is a symbol of that power. Conversely, the actual theme of this year’s WEF [there is always an officially stated theme at the start—and then the real one emerges by the end of the show] is that the Davos Man is desperately afraid of ‘rising populism.’ So, how do WEFers rebuild trust with people they no longer trust? 🤔

“Democrats need to be more respectful of Trump’s supporters and think a little more carefully when they talk about MAGA. Take a step back, and be honest. Trump was right about NATO, mainly right on immigration. He grew the economy quite well, his tax cuts and trade reform worked, and he kept the US out of wars, and he was largely right about China—and that’s why the people voted for him—not for his family values. All this negative talk about MAGA posing an existential threat to American democracy is going to hurt Biden’s election campaign.’

—Jamie Dimon, JPMorgan Chase CEO, on CNBC’s Squawk Box from Davos, Switzerland. Dimon has described himself as ‘barely a Democrat.’

Other than showing some empathy for the ordinary person above, a classic Davos Man is JP Morgan Chase’s dazed and confused CEO, Jamie Dimon. At this year’s WEF, he was found grumbling in the corner of the cocktail parties, ‘I don’t care about Bitcoin,’ he says, ‘I call it the pet rock, and I’m not going to talk about it anymore.’ Meanwhile, his money-managing competitors at home saw $14B in US Bitcoin ETF volume and amassed over $1.2 billion in new investor money in the first week of trading. Bitcoin is also trading just above $42,700, up more than 100% in the past year.

Our view is Jamie is an intelligent man who sees the writing on the wall. Still, he is clearly in denial because he knows when the Web3 dust settles, Wall Street will become a shadow of its old self, and he becomes a dinosaur of days gone past—the Bob Iger of finance— left mumbling in the corner.

If we were producing the 'Davos meets Silicon Valley' party today, our guests would be people like Vitalik Butrein and Joe Lubin, the cofounders of Ethereum, Elizabeth Stark, cofounder of Lightning Network, Anatoly Yakovenko and Raj Gokal of Solana Labs, Ripple cofounder Chris Larsen and Coinbase founder Brian Armstrong.

"The decentralized future is not just about creating new applications; it's about rethinking how we organize society. You shouldn't have to trust any single person, institution, or centralized organization to transact and get things done. If crypto succeeds, it's not because it empowers better people. It's because it empowers better institutions."

—Vitalik Butrein, Cofounder and developer of Ethereum

The WEFers might be helplessly self-unaware, but the global Silicon Valley mission in 2024 is very clear: Rebuild trust by making the people who go to WEF irrelevant 🤣 The Web3 kids would undoubtedly enjoy tobogganing in the Swiss Alps between sessions, and Joe’s choice of California’s finest wines, but they would be found hanging together in the corner of our party, looking out on the Davos crowd and poking each other saying, ‘These blowhards are toast.’

This will happen, but as Ripple CEO Brad Garlinghouse says below, the US, in particular, still needs to put in the work before we can claim victory over the WEFers.

Ripple’s Brad Garlinghouse challenges the US to get our regulatory act together

Ripple CEO Brad Garlinghouse sat down in Davos with business journalist Maria Bartiromo from Fox Business to talk about the impact of the Bitcoin ETF approval and the state of crypto regulation. We recommend listening to the entire interview, but we have excerpted some key passages below.

Maria: What is your take on the impact of this spot Bitcoin ETF approval?

Brad G.: It is a validation from institutions and even from the SEC that crypto has gone from the outskirts to the mainstream. It’s also a further indication that more institutions are coming into the crypto asset market. In spite of what Jamie Dimon says, JP Morgan is investing heavily in blockchain technologies. But in order for blockchain to thrive and benefit the largest population, we can’t have insular, closed networks. If we create [blockchain apps] that are interoperable across all banks, we can show dramatic improvements in how we think about moving money or really conducting any transaction.

Maria: You have called SEC chairman Gary Gensler a political liability to the United States.

Bard G.: Gary Gensler has prioritized hiring more lawyers to litigate the industry—a kind of regulation through enforcement approach. Most of the crypto industry wants to follow the rules. We still care about things like KYC— know your customer, and anti-money laundering—AML—those principles that are sacrosanct.

We need to take the time to codify rules like other countries are doing around the world. Even the 27 countries in the European Union have come together to create a construct for how crypto should be regulated. In the United States, we haven’t done this work.

Just yesterday, there was a court hearing between Coinbase and the SEC, and the judicial system once again slapped down the SEC because they’re overreaching what the laws say. It’s the reason why they [the SEC] lost the case against Ripple and were also dragged kicking and screaming into approving the Bitcoin ETF.

Gary Gensler acts on his own agenda, not the people’s agenda, and it’s frustrating to spend so much time in the courts when we could work together as they do in Japan, the UK, the UAE, and here in Switzerland. These are big economies. They’re doing the work to provide clarity while the US is operating on a political agenda, not a policy agenda. In the meantime, while we are waiting for the US government to sort this all out, 95% of our customers are non—US financial institutions, and 75% of our hiring last year was outside the United States.

Maria: What about FTX? Ironically, Gary Gensler has been meeting frequently with Sam Bankman-Fried.

Brad G.: FTX isn’t about a crypto fraud. FTX is about a fraud that happens to be in crypto, and it was definitely a self-inflicted wound for the industry. I’m excited for what is ahead in 2024 as the headwinds of these self-inflicted wounds have been largely abated.

Brad also noted that during the early days of the commercialization of the Internet, it was the US who took the lead on clarifying how the new network was regulated, and we reaped many geopolitical and commercial benefits from this action. The same could happen with the blockchain revolution, but the US is seriously behind in this race. Sadly, these critical subjects are barely an afterthought for most of our politicians and the current slate of US presidential candidates

Did you know?

(Overheard on the streets of the global Silicon Valley. Got any hot insider tips? Email us editor@cryptoniteventures.com)

Billionaire Boys & Girls Club

Apple founder Steve Jobs sold all of his stock in the company he cofounded twice in his life. The first time was in 1985 after then-CEO John Scully booted Steve from the Macintosh group he commanded for rabble-rousing. So, with no product power, Steve quit and sold all but one share of his Apple stock (he owned 11% of the company at the time) for a little north of $21M—reasoning the company would never do well without him. Had Steve held on to that original stake, the value of his founder’s stock would be worth $330B today.

The second time was when an ‘anonymous party’ sold 1.5 million shares of Apple stock in 1997, causing Apple to hit a 12-year low in stock price. Coincidently, that 1.5 million shares corresponded with the same number Steve got for selling Apple NeXT. 😉 The sale set off a boardroom coup of CEO Gil Amelio, who tapped Steve Jobs as ‘iCEO,’ as in interim, not Internet.

At the time, Cryptonite editor Tony Perkins conspired behind the scenes with long-time Apple marketing chief and Silicon Valley icon Satjiv Chahil to pen and publish in Red Herring magazine an ‘Open Letter’ to then CEO Gil Amelio asking him to ‘Please resign,’ and let Steve takeover. Little did they know, they were adding a little more fuel to the fire than they thought. Someone 😉 mysteriously placed a copy of the Open Letter on every Apple board member’s chair at the meeting where Mr. Amelio was ousted.

What people may forget is that after the ouster, Steve took over Apple without any long-term commitment beyond being willing to be interim CEO and with no Apple stock because of his previous protest sale of all his shares. In retrospect, the very shrewd Mr. Jobs waited until he had some successes under his belt, including getting Bill Gates to save Apple by investing $150M of Microsft money in Apple, then he went to the board and asked for what he needed to press on—5% of Apple! We recall that the Apple board thought it was an overreach at the time, but they had no choice but to approve the grant. (Note: Microsoft’s $150M investment in Apple in 1997 would be worth $185B today.)

Who’s counting—but when you add up all the Apple stock that Steve Jobs sold in protest—his family would be worth closer to $350B rather than the reported $12.8B they are today, which would boost the family to the #1 wealthiest spot at $25B above Elon.

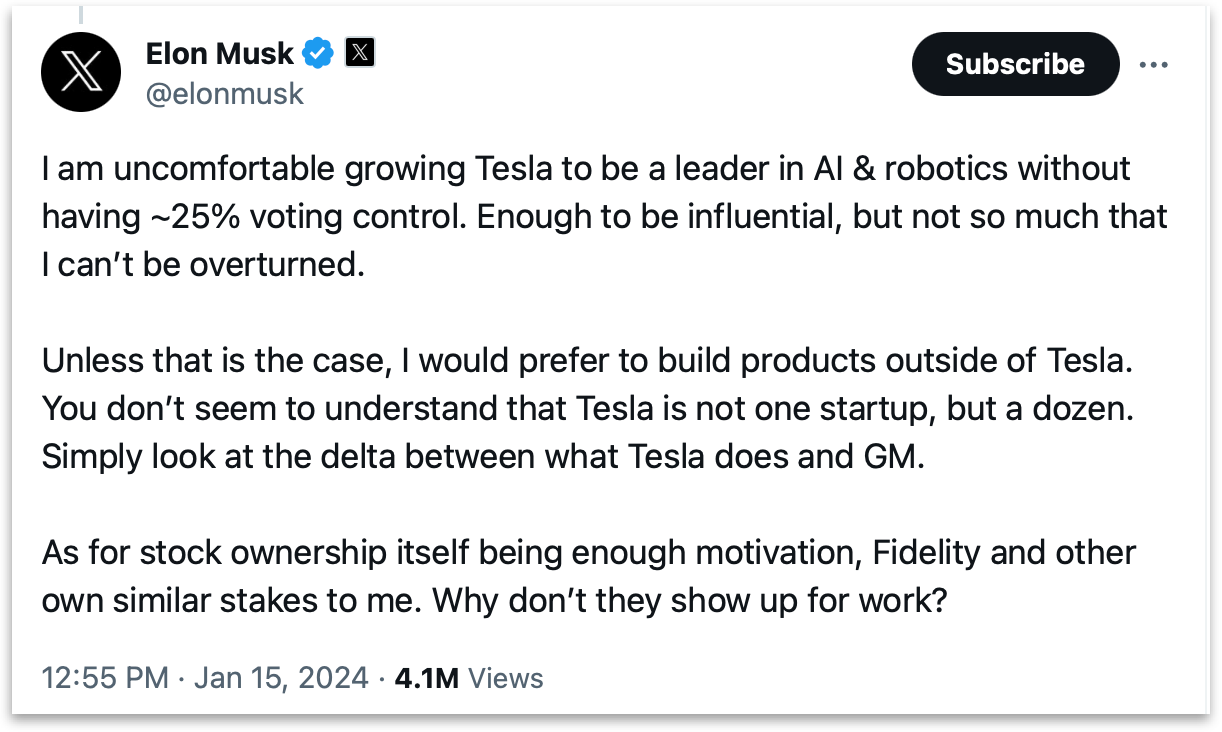

Speaking of Elon, it looks like he is trying to pull a Steve Jobs by now demanding ~25% voting control of Telsa (a 5% bump-up from Elon’s current ownership position), or else he will take his AI and robotics ideas elsewhere, where he controls 100%. Wall Street analysts think Tesla’s newly introduced Optimus Gen 2 humanoid robot marks the beginning of an AI-driven robot boom that will disrupt 30% of the world’s workers and represent a $30T opportunity. They also calculate that this will add $500B worth of value to Tesla stock, and Elon wants some of that—or at least the control it represents.

Our view on Elon’s ask is that if you are doing something great, then you have earned the right to ask for more. The greatest companies remain founder-led—and stakeholders want their full attention. If Elon got lost in space on one of his rockets, owning Tesla’s stock would become one big gamble. Give the man his due; Elon remains the best bet on the planet Earth.

Apple’s board might have thought Steve Jobs’ was overreaching in his stock grant demand back in 1998, but once satisfied, he poured his life into the company until it became the most valuable enterprise in the world—and everybody won. We would expect Elon to do the same.

VC Whispers

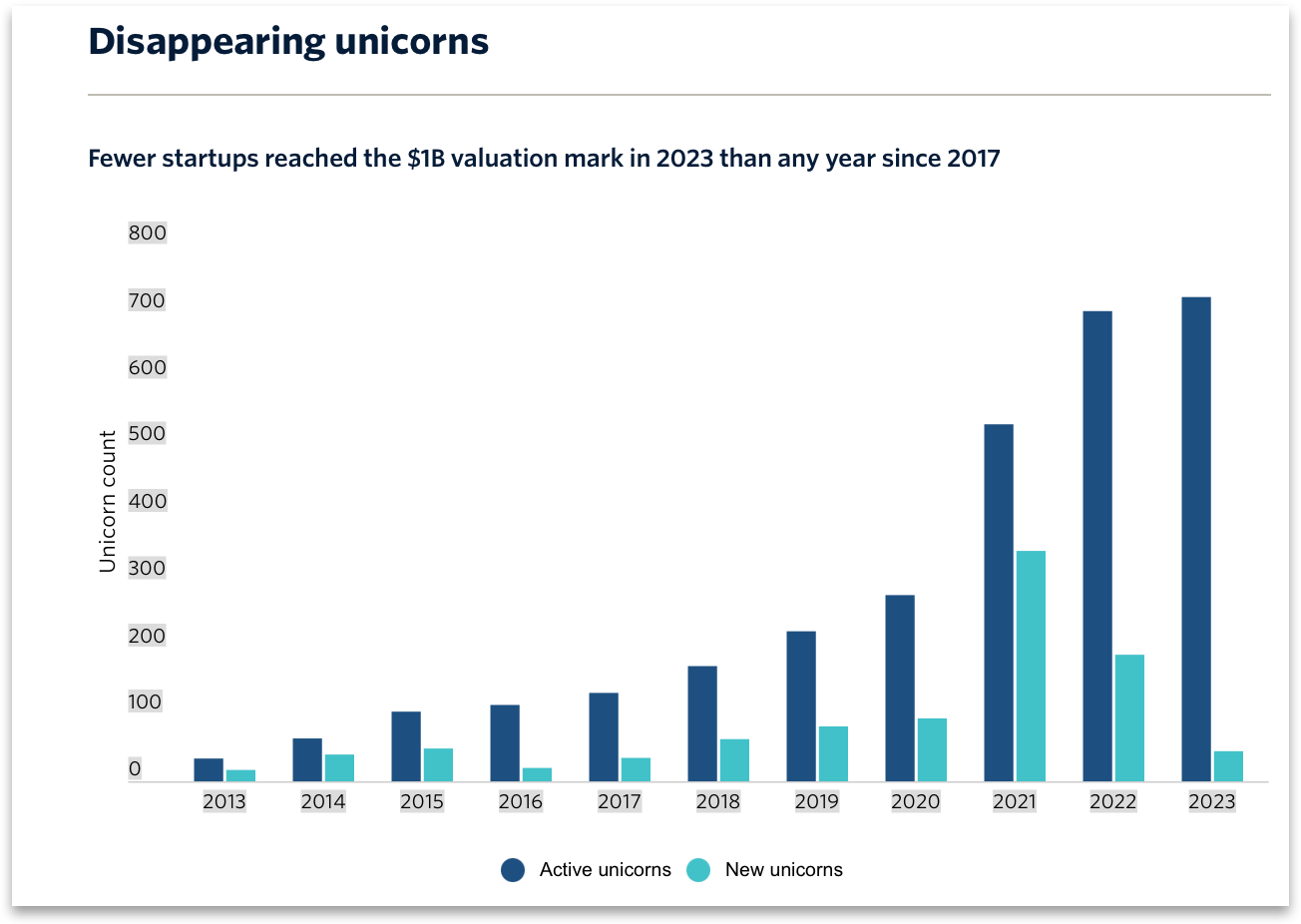

With valuations in flux, only 45 startups hit the billion-dollar mark in 2023, the fewest new unicorns since 2017, according to the Q4 2023 PitchBook-NVCA Venture Monitor. 44% of the new bunch were GenAI companies, including defense-tech startup Shield AI, large language model specialist Adept, and deep-learning AI infrastructure developer Lambda. While GenAI companies saw valuation step-ups in 2023, a lot of other sectors saw downturns.

One shining light in the tech IPO market is Reddit’s plans to go public in March—in what is sure to be one of the most anticipated tech listings of the year (especially because the wife of cofounder Alexis Ohanian is Serena Williams—the Queen of women’s tennis 🎾). Founded in 2005, Reddit’s total revenue for 2023 hit $670M—up a whopping 38% over its 2022 numbers—yet the company is still not profitable.

AI Tracker

In a post-ouster-and-reinstatement interview with Axios, OpenAI’s Sam Altman says 1. We should expect our future AI search results to reflect our moral and religious views more closely (good and bad, as bad actors can and will use AI to manipulate people politically); 2. Sam doesn’t think the criticism that he has too much on his plate to be an effective CEO is fair (we disagree), and 3) The bottom line added value of AI is how it can make both you and your enterprise more efficient.

We agree with Sam’s point #3, as we have been looking at everything we do to plan how AI can give Cryptonite more production with less stress. For research and search, recommend Perplexity.ai over Google, OpenAI, or other choices, as we noted in our feature below.

In Bill Gates's podcast Unconfuse Me, he floated an idea to his guest Sam Altman, CEO of OpenAI (which Microsoft owns half of), that is sure to get the hearts of conspiracy theorists pumping. When discussing the potential need for a ‘global regulatory body’ to monitor AI standards and abuses, Billionaire Bill floated the idea of a ‘global government’ as well.

‘If the key is to stop the entire world from doing something dangerous, you’d almost want global government, which today, for many issues, like climate and terrorism, we see that it’s hard for us to cooperate,’ Bill told Sam. ‘That feels possible to me,’ says Sam. ‘ I wasn’t that sure before, but I made a big trip around the world this year and talked to heads of state in many of the countries that would need to participate in this, and there was almost universal support for it.’ 🤔

In Silicon Valley, Bill G has been known more for his chess-playing prowess than his creative imagination when it comes to business. For years, Bill G's idea was for the 'Tablet PC,' and it finally arrived—It's called the iPad, and Apple made it. Bill gave his view on the immediate values of OpenAI's ChatGPT-4, Microsoft's biggest AI bet while at Davos.

'The improvements with OpenAI's ChatGPT-4 have been dramatic because it can essentially read and write, and thus, it's almost like having a white-collar worker to be a tutor, to give health advice, to help write code, to help with technical support calls. Incorporating that technology into the education or medical sectors will be fantastic.'

—Bill G. on the potnetial of OpenAI

Meanwhile, the once metaverse champion turned AI general intelligence enthusiast, Zuck, says he is stockpiling GPUs with the goal of owning 600,000 of these super chips by the end of the year. More than half of that pile will be Nvidia's H100 chips.

"We've come to this view that, in order to build the products that we want to build, we need to build for general intelligence. We have built up the capacity to do this at a scale that may be larger than any other individual company,' brags Zuck.

Meta is currently focused on training its large language model, Llama 3, to have code-generating capabilities and advanced reasoning and planning abilities. Code Llama was developed by researchers at Meta's Fundamental AI Research lab (FAIR) and was released to the development community last August.

Follow the Crypto

Surprise surprise! BlackRock is on track to become Bitcoin’s largest holder. The world’s biggest money manager launched its iShares Bitcoin Trust spot Bitcoin Fund last week, bringing in half a billion dollars in inflows, and acquired 11,500 Bitcoin in the first two days. Right behind the BlackRock fund was Fidelity Wise Origin ($422M), Bitwise Bitcoin ($238M), Ark 21Shares ($105M), (Valkyrie Bitcoin Fund ($28M), and Invesco Galaxy ($28M).

Robots

VC interest in funding robots remains robust, with Tesla's Optimus project offering humanoid robots priced around $20k only adding to the excitement. Recent robot fundings include 1X, known for developing EVE, which raised $87.5M in new funds; Collaborative Robotics, founded by former VP @ Amazon Robotics Brad Porter, who landed $30M in a Series A led by Sequoia Capital; and Figure (see photo below), that closed $70M in its Series A.

Elon predicts there will be 1 billion humanoid robots ever present all over the planet by 2040s, 'provided the foundations of civilization are stable.' He hopes Tesla will be a significant contributor by eventually making millions of Optimus robots.

Not to be outpaced, BMW announced a commercial agreement with Figure to deploy its first humanoid robot, which is designed to grow its skillset over time.

Straight outta Silicon Valley

Apple shipped 235M iPhones in 2023—more than any other smartphone competitor for the first time ever—representing a 20% global market. Former leader Samsung shipped 227M in 2023—which is experiencing intense competition in the increasingly fragmented Android devices market. IDC also said overall smartphone shipments were at their lowest in a decade because of a weak global economy but expects shipments to recover in 2024.

Long-time Zuck is confident and power-lady Sheryl Sandberg, who stepped down as Facebook’s COO in June 2022 after a 14 year-run, announced last week she is leaving the board as well. Ms. Sandberg now dedicates much of her time to her LeanIn.org nonprofit, which focuses on empowering women in the workplace.

While we honor Ms. Sandberg as an example of a brilliant woman reaching the highest levels of a male-dominated tech industry, we are disappointed she has been silent regarding the legal claims by 42 US states against Meta for ‘intentionally and profoundly altering the psychological and social realities of a generation of young Americans by ensnaring’ them in addictive cycles through its algorithms for profit motives. The states further claim that the Meta platforms have facilitated sex trafficking and created a ‘marketplace’ for child predators. The silence of the LeanIn.org founder here hurts.

Google is cutting hundreds of jobs in its 30,000-person ad sales unit as part of a broader reorganization effort to offset accelerating investments in its AI staff that are locked in a battle with OpenAI. Google is also operationally moving toward deploying more machine-learning customer service tools that cut Google’s headcount as well.

Know Thy Enemy

China's economic growth rate (excluding the Pandemic period) is at a three-decade low, exasperated by a property-market meltdown and low consumer confidence. Other factors include the lowest recorded birth rate in CCP history (9M births vs 11M deaths in 2023) and the overall aging of the the Chinese population. China's share of the global population aged 65 and up rose from 16% in 1970 to 26% in 2023, while its share of births dropped from 26 percent to 6.8%.

In response, CCP boss Xi said the time had come to 'actively foster a new culture of marriage and childbearing and strengthen guidance on young people's view on marriage.' This messaging could not be more ironically tragic, given that for more than three decades, under the CCP's one-child policy, there were 336M abortions and 196M sterilizations forced upon their helpless citizens.

Meanwhile, back on the People's Liberation Army (PLA) of China's ranch, powerful generals and even the former Defense Minister Li Shangfu have been disappearing from public view one after another without explanation. (Li Shangfu's predecessor, Wei Fenghe, has been absent since last March, too.) High-ranking PLA officers and three aerospace executives from China's military-industrial complex were booted from the National People's Congress (NPC), the CCP's rubber-stamp parliament.

CCP Boss Xi Jinping's stated military goal is to 'modernize' the PLA and transform it into a 'world-class' fighting force. The best guess by experts is that some of the generals and industry executives have been double-dealing in advanced technology and equipment for personal gain. Xi has made rooting out corruption and disloyalty a hallmark of his rule since coming to power in 2012.

The latest purge came from the PLA's Rocket Force, an elite group that oversees China's fast-expanding arsenal of nuclear and ballistic missiles. Xi has described the force as a 'core of strategic deterrence, a strategic buttress to the country's position as a major power, and a cornerstone on which to build national security.'

'The purges show that corruption cannot be completely eradicated from China's one-party centralized system—despite Xi's authority and relentless efforts. Power tends to corrupt. Absolute power corrupts absolutely. Xi is determined to fight corruption, but corruption is a product of the system he is defending. It is a Catch-22.'

—Yun Sun is the director of the China program at the Stimson Center in Washington.

The Rocket Force will play a central role in any conflict over Taiwan or the South China Sea—two focal points of tension between China and the US—by leading the first strikes on enemy forces and deterring US intervention.

Chaos & Complexity

Peter Thiel cofounded a Confinity and payments company that merged with Elon Musk's company, X.com, to create PayPal, which ended up selling to eBay for $1.5B. Peter went on to seed fund SpaceX and Facebook, cofound Palantir Technologies, and start a hedge fund and 3 VC firms. We met Peter when he was still a student at Stanford, where he was Class Valedictorian, and we have always appreciated his thinking.

Peter recently sat down for a chat with British ‘philosopher’ John Gray after his speech at the Roger Scruton memorial lecture in Oxford, and here is our favorite riff from that conversation regarding his opinion that we, and scientific discovery, are ‘stuck.’

John Gray: For some people, if they gave up that faith in science, they would be left with nihilism, or left with despair, or left with unbearable anxiety.

Peter Thiel: Yes, although there’s a very complicated history of science. In some ways it was a byproduct of Christianity, in some ways it was in opposition to Christianity. And certainly in its healthy, ambitious, early modern forms, whether it was a substitute or a complement to Christianity, it was supposed to be a vehicle for comparable transformation. The indefinite prolongation of human life was an early modern science project in which people still believed in in the 17th and 18th centuries. There was a sub-movement within the revolutionary Soviet politics in the 1920s called Cosmism, where a part of the project of the revolution had to be to physically resurrect all dead human beings, because if science didn’t do that it would be inferior to Christianity.

So there is this anti-Christian or derivative from Christianity, very ambitious version of science. And of course, there is also a more defeatist version of science, where science actually tells us about limits and things you cannot do. To use a literary example, when Hamlet’s evil mother, Gertrude, says that all that lives must die, the question one must ask is, is that a law of nature? Or is this just a rationalization for the rottenness that is Denmark? And certainly the early modern conception was that you wanted to transcend this, both in a Christian or a scientific form. By late modernity, as science decayed, that sort of ambition is only on the fringes of science, not the mainstream.

One particular example of science’s slide from early modern ambition into late modern torpor is the climate change debate. If one took climate change seriously, there are all kinds of progressive science things one could do. You could be pushing for the construction of hundreds of new nuclear reactors. You could be pushing for nuclear fusion. But in practice, we don’t lean into that. We’re instead told that we should ride bicycles. So much of science today has this Luddite feeling.

What the Math Says

Using data from 2000 to 2020, researchers at the University of Illinois Chicago are predicting over half of the US's 25,000 cities will become ghost towns by 2100, particularly in the Northeast and Midwest. Why? 1) As fertility rates continue to decline, people leave cities; and 2) Cities have higher taxes and living costs. 'The implications of this massive decline in population will bring unprecedented challenges, possibly leading to disruptions in basic services like transit, clean water, electricity, and internet access' as cities shrink and populations age,' the researchers noted.

Other researchers are more skeptical. ‘I have never seen a national study that looked so far into the future—It’s pretty reckless given the amount of uncertainty the future holds,’ observed Justin Hollander, an urban planning scholar at Tufts University. The bottom line is depopulation is happening everywhere, and the paper is right to demand that we think and plan creatively and ecologically to make these migration transitions.

Pura Vida (pure life)

A diet that includes more fiber (artichokes to zucchini) is good for our gut, and what is good for our gut is good for our skin. Studies also show that fermentation of high-fiber foods generates short-chain fatty acids (SCFAs ) that help tighten up loose cell junctions, making it more resistant to bacterial overgrowth and sealing a leaky gut. The more variety of plants, the more skin-healthy nutrients we will receive.

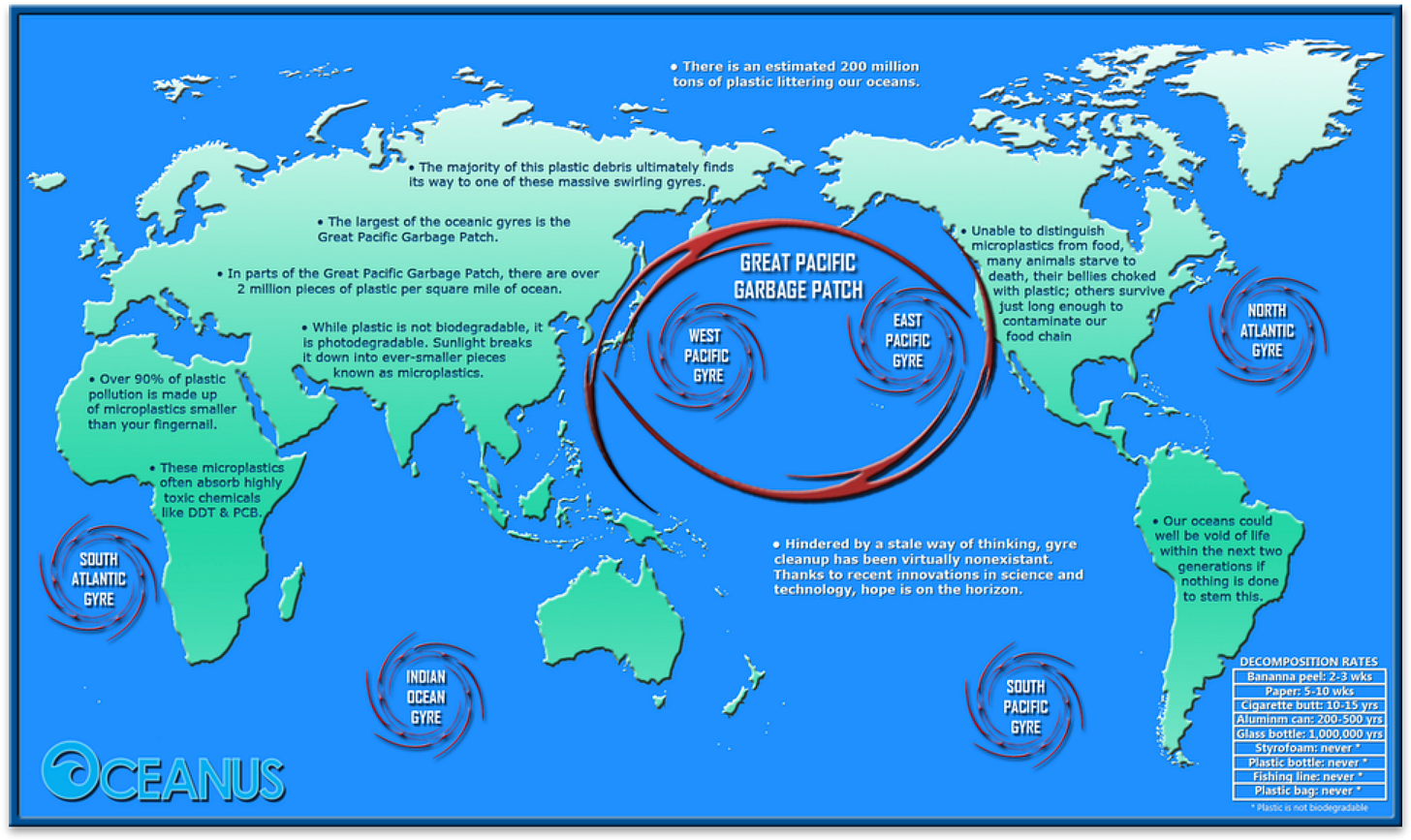

Columbia University’s Lamont-Doherty laboratory leveraged AI-powered imaging technology to examine water samples from three popular plastic water bottle brands and found hundreds of thousands of nanoplastic flecks per liter of water—10 to 100 times greater than previously estimated. Worse, the flecks are so miniscule that they can be absorbed into human cells and tissue, as well as across the blood-brain barrier.

"Even if a particle fleck is not that toxic at a larger particle size when they become smaller, they become toxic because pollutants and pathogens can be carried on the surface and interfere in the cells, in the tissues, inside of the organelles. We are in environments where plastic is everywhere."

—Beizhan Yan, Columbia environmental chemist and study co-author.

The laundering of synthetic clothing, automobile tire wear, and food packaging are the largest sources of airborne plastics. Another group at the University of Waterloo in Canada is using AI to examine nanoplastics in exhaust and wastewater from commercial and residential washers and dryers. ‘It’s an example of using AI for good,’ says Wayne Parker, U of Waterloo professor of civil and environmental engineering.

Wow - quoting Jamie Diamond? Yuck! Chase is a big part of the global warming crisis via its ongoing loans/backing of all the major petrol extractors! The economy has grown bigger and better for more citizens under Biden - not Trump. And as for the trillion dollar tax break - add it to our national debt and trickle down economics is a lie/myth that has never worked - ever because of the sickness called greed in this Gilded Age 2.0. DAVOS and WEF both represent the Deep Corporate State that MAGA cult members constantly refer to but are too ignorant to understand. And your Crypto currency has only become a ponzi scheme for day traders at best and a money laundering syndicate for wars and crooks at worst. DAVOS is the problem - Not the Solution to a better future for all humans and the other creatures/plants etc, we share this planet with. We must get rid of Stock Market Casino which feeds the monopoly beast and creates perverted false wealth via ridiculous speculations/over evaluations. It mainly serves the top elite 10% that own and manipulate 90% of the stocks via illogical derivative shell games, buy backs etc. Replace this rigged stock market system, driven by unsustainable quarterly profits with private or collective ownership only, where a company only grows as big as is possible based on real work, real products, and real profits in real time! Patagonia is such a billion-dollar private and sustainable company - and for the skeptical/greedy - Cargill is a multibillion-dollar private company - but kind of evil. Hyper local economies would be better for all citizens and the planet. I know I am right about this but probably won’t happen in my lifetime.

Didn't realise there were still some more snake oil left.