What question would you ask the US Presidential candidates in 2024?

Aa part of out Voting Block USA Intiative, we are developing key questions to ask the all US Presidential candidates in 2024 to hold their feet to the Web3 fire.

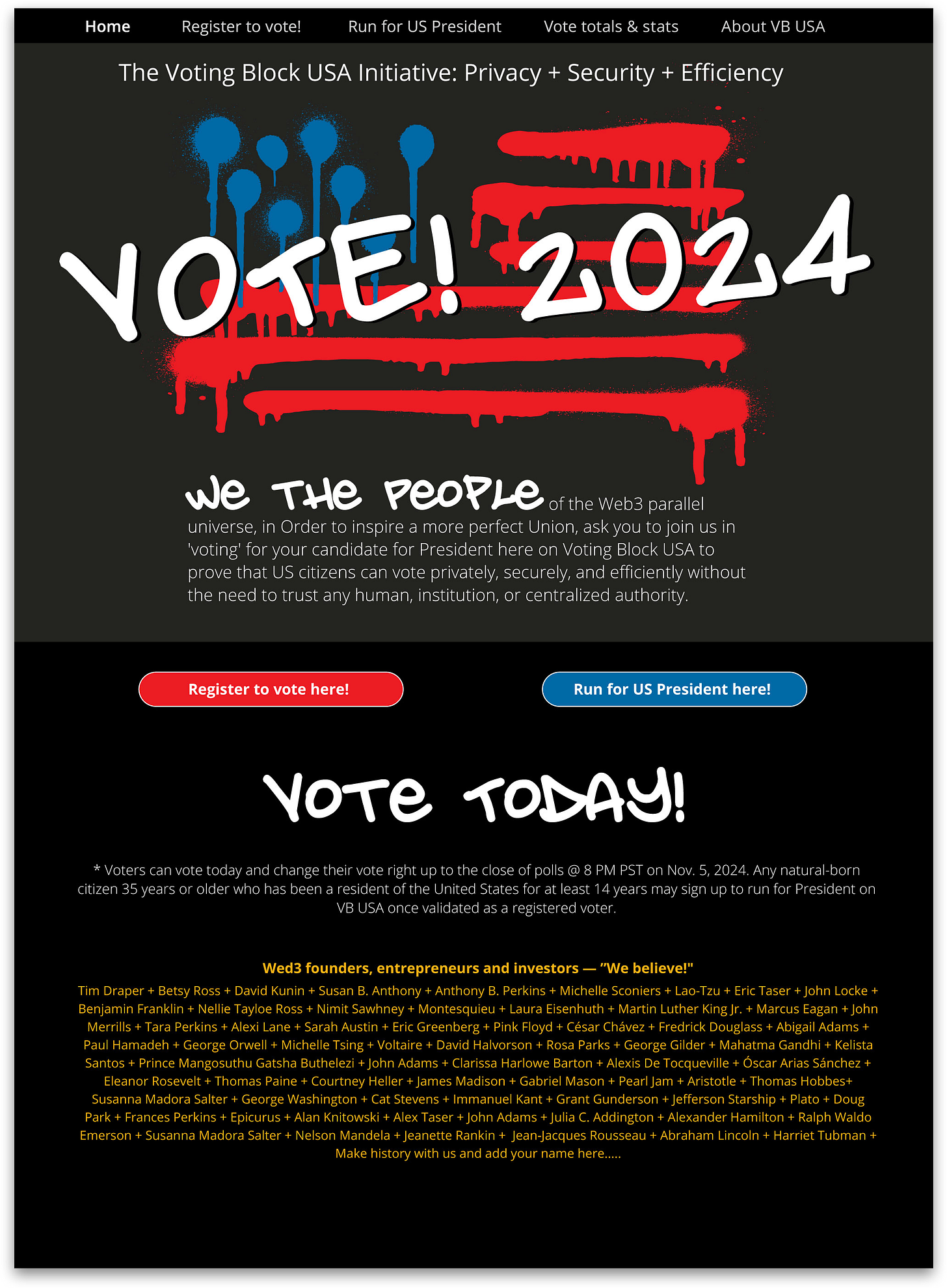

Voting Block USA

The Voting Block USA (VB USA) non-partisan, non-profit initiative is moving up, with dozens of top Web3 investors and entrepreneurs signing up to support the project! We will be announcing our first round of supporters soon.

If you would like to join VB USA’s distinguished list of supporters for our first announcement, you can indicate your support by filling out a simple form here or merely reply to this email with a ‘Yes!’

VB USA’s objective is to launch a blockchain-based ‘voting system’ for the 2024 Presidential elections to prove to US citizens we can vote privately, securely, and efficiently without the need to trust any human, institution, or centralized authority. We are readying for our January blockchain voting dApp debut. You can get the complete breakdown of how we are approaching this project here.

To help provide an intellectual and practical framework for the project, we are developing a list of 12 question categories to challenge both officially registered candidates in the real world and new entrants who sign up to run for President on the VB USA platform. So far, some of our early supporters have high-level access to Robert Kennedy, Jr., Nikki Haley, and Vivek Ramaswamy, so we are confident that we can gain the attention of most of the candidates and test their imaginations as to what is possible in the Web3 parallel universe.

To get rolling, our team has drafted five question categories so far and is looking to the Web3 community to help fill out the dance card. You can post your proposed questions below in the comments section or send them to us privately by replying to this email. We can help with some of the background research and word-smithing, so don’t worry about that part.

It is imperative that VB USA is NOT viewed as partisan to any particular candidate or party, and we want to keep our questions focused on the possibilities for Web3 technologies, and other new innovations to reinvent the public sector into a more transparent, private, secure, and efficient agency we can trust. Our questions are meant to inform and create debate.

Let’s give them facts and then test their innovation IQ

FACTS: Eleven countries have fully launched government-backed digital currencies (Central Bank Digital Currencies—a.k.a. CBDCs), with India and Brazil committed to doing the same in 2024. Sixty-four countries are in advanced phases of exploration—development, pilot, or launch. Nineteen G20 countries are already conducting pilots, including Australia and Russia.

By January 2022, the CCP-controlled People's Bank of China launched the digital yuan (called e-CNY) and crypto wallet on the Apple and Google app stores in China in a pilot program for 260 million Chinese citizens. They are testing the e-CNY in over 200 domestic payment scenarios, including public transit, stimulus payments, and e-commerce. This makes China the world leader in government-backed digital currencies. China is also actively engaging with other countries and international organizations to begin shaping global standards for the future of money, pitching that the e-CNY can contribute to financial inclusion and stability worldwide.

"e-CNY transactions hit 1.8 trillion yuan ($250 billion) by the end of June 2023, marking a rise from over 100 billion yuan as of August last year. Right now, the balance of e-CNY is tiny, still only accounting for 0.16% of China's M0 money supply, but this small balance supported a big number of transactions, which means that the velocity of digital currencies is significantly higher and more efficient than existing forms of currency."

Yi Gang, Governor of the CCP-controlled Peoples Bank of China

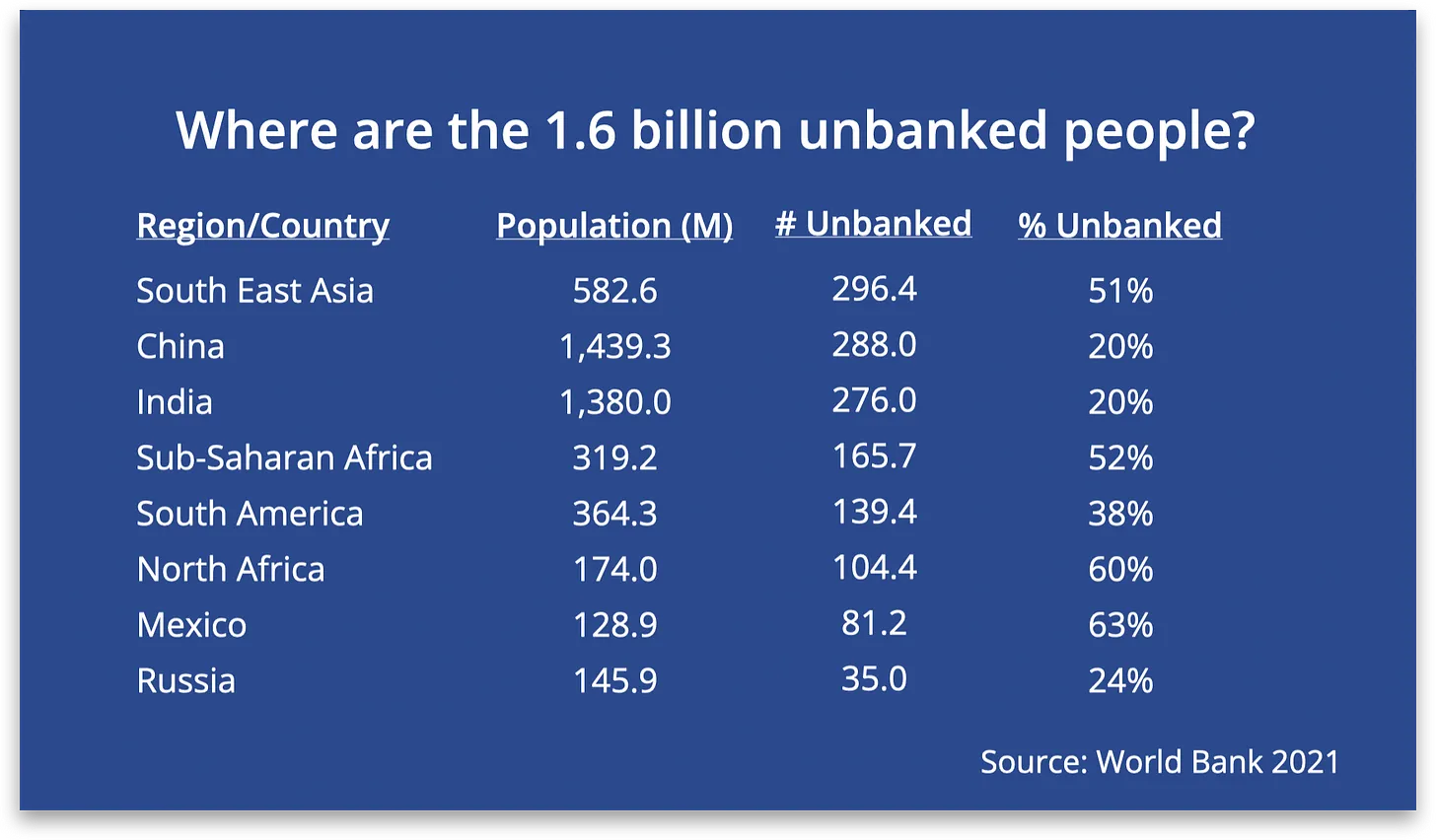

QUESTIONS: Does the fact that the US has yet to pilot a government-backed digital USD represent a risk the US could lose its economic leverage and global financial power in the world? Would you be for or against complimenting physical currency by minting digital US dollars that any person with a crypto wallet can instantly buy, trade for, sell, or privately own and store at a tiny cost? Do you believe that a digital USD could help achieve financial inclusion and stability in the US and in the ‘unbanked’ regions of the world?

FACTS: Until Bitcoin, the only other currency in history that has been valued ‘outside the system’ and on a time-creation basis is Gold. Gold value is based on the time it takes to extract it from the earth. Interestingly, Gold roughly takes the same amount of time today to mine as it did a thousand years ago, which makes it peculiarly monetary by nature. Bitcoin is very similar to Gold because it is finite like Gold (only 2.1 million BTC will be created) and is also mined. It currently costs miners (computer time + electricity) at least $17,000 to produce one BTC in the US versus $5,000–10,000 last year.

QUESTIONS: There is a growing contingency of those who believe that Bitcoin should replace the US Dollar as the global reserve currency because it is time—entropy-based, has a limited supply, and operates on a decentralized blockchain technology base system and, therefore, more secure, and independent of governmental control. What is your opinion on the long-term viability of Bitcoin? Do you think that Bitcoin could serve as the new global reserve currency? If so, would you support that transition?

FACTS: Right now, we measure money by the price of commodities and commodities by money, so fiat currencies live in this circular $7 trillion currency trading faux business environment (the biggest industry in the world!) controlled by money-changers at eleven banks—The system that's building a monetary house of cards that Americans feel increasingly jittery about for good reason.

“Real money’ is a measuring stick, a metric of value, reflecting the scarcity and irreversible passage of time—entropy-based, equally distributed, and founded on the physical limits of the speed of light and the span of life. Bitcoin and Gold are both real money in this sense. Government monopoly money is not. Our money has become a magic wand for central banks that fuels currency trader manipulation and causes constant global monetary crises.”

—George Gilder, economist, futurist, and author, Life After Capitalism, 2023; Life After Google 2018; The Scandal of Money, 2016; Wealth & Poverty, 1981.

QUESTION: One proposed option to break this cycle would be to return to a gold-backed US dollar standard; it would be linked to a physical commodity and prevent the government and the currency traders from manipulating the currency, reducing inflation and increasing market stability. Do you see that the US dollar is akin to ‘monopoly money' and thereby risks not being able to compete with time-based currencies like Bitcoin and other tokenized real-world assets (valued at $310B today and projected to grow to $16T by 2030)? Do you agree with this proposition and the return of the gold standard as a way to mitigate these risks and compete long-term?

FACTS: It is possible today to create an AI-driven decentralized IRS application so close to 100 percent of US citizens could validate and help file their taxes in a way where not a single person, institution, or centralized agency could access or view their returns. If a person were required, under existing criminal and civil law, to present their returns, they would still be required to do so.

QUESTION: If this could be proven to you, would you support this change in the manner by which the US government processes our tax returns?

FACTS: It is possible today to create a decentralized platform where US citizens can directly purchase groceries and other supplies for single mothers and the hungry on a peer-to-peer, transparent, and traceable basis with the help of existing grocery delivery services such as Instacart and Amazon. Truhoma is a female-led company from Slovenia that has already created this form of application, which qualifies the needy through local agencies. There is also a way to create a token that people can use to validate and deduct amounts from their taxes in conjunction with the IRS dApp described above.

QUESTION: If this could be proven to you, would you support these types of peer-to-peer blockchain social services with the ability for people to deduct their donations from monies owed on their taxes?

“I don’t think everybody in DC actually fully realizes how powerful the crypto voting community block is. 56 million people in the US have already used cryptocurrencies. That’s 5x as many people that have an electric vehicle. The 2024 election is our time to hold candidates’ feet to the fire and say, What is your position on the possibilities of blockchain and crypto?”

—Brian Armstrong, Founder & CEO, Coinbase

Key influencers speaking out in favor of blockchain-based voting

"Blockchain-based voting has the potential to reshape the way we think about democracy, enabling more direct and secure participation by citizens in shaping their governments."

—Sam Altman, CEO of OpenAI

"Blockchain-based voting can increase voter turnout by making it easier for people to participate, especially those who face barriers like long distances to polling stations or physical disabilities."

— Joseph Lubin, Co-founder of Ethereum and ConsenSys

"Blockchain technology can help eliminate voter suppression and enhance the security and accessibility of elections, making them more inclusive and representative."

—Perianne Boring, Founder and President of the Chamber of Digital Commerce

"Blockchain-based mobile voting would make our elections more secure and accessible. It will also broaden access to voting, reduce the influence of big money in politics, and strengthen democracy."

—Andrew Yang, Entrepreneur and 2020 Presidential Candidate

‘Blockchain-based voting can enhance the inclusiveness of elections, allowing citizens to securely cast their votes from anywhere in the world.’

—Maria Ressa, CEO and Executive Editor, Rappler

"Blockchain has the potential to provide secure, transparent, and auditable systems for voting, which could enhance trust in the democratic process."

—Sheila Warren, Head of Blockchain and Data Policy, World Economic Forum

"Election security is one of the most critical issues facing our democracy today. Blockchain technology can play a critical role in addressing this challenge by securing voting processes and ensuring that more eligible voters can participate in a secure and convenient manner.

—Brad Smith, President of Microsoft

Blockchain-based voting introduces a new era of electoral transparency, making the process more resilient against hacking and fraud.’

—R. David Edelman, Director of Project on Technology, Economy & National Security at MIT

"By leveraging blockchain technology, we can create a voting system that is not only more secure but also more convenient, allowing people to vote from the comfort of their own homes while ensuring the integrity of the process."

—Brian Forde, Former White House Senior Advisor for Mobile and Data Innovation

"Blockchain technology can bring voting systems into the digital age, ensuring that every vote is counted accurately and that the will of the people is truly reflected in the results."

— Mike Novogratz, Founder and CEO of Galaxy Digital Holdings

"The biggest benefit of blockchain-based voting is that it offers a way to have a tamper-proof electronic vote counting and voter identification system that anyone can use, without needing to trust any single person, institution, or centralized service provider."

—Vitalik Buterin, Co-founder of Ethereum