Bitcoin spot ETF's rock! Eternal life SV-style, Elon's new robot, Taiwan's new 'dangerous separatist' president, and EV helicopter rides to Manhattan...and Santa Cruz

Bitcoin has now officially hit Main Street—the fight for digital gold is on!

Gensler grudgingly approves Bitcoin ETF—Not so hot on ETH funds

The US Securities and Exchange Commission (SEC) cleared eleven spot Bitcoin ETF issuer applications (see list below), and the trading has begun. It promises to be fierce competition for the next level of investors who like the idea of hedging their bets with a 1% to 2% Bitcoin holding but are more comfortable investing in a publicly traded fund rather than holding BTC in a crypto wallet.

Overcoming this friction and perceived pain for those over 40 is a big deal. Bitcoin is now Wall Street and Main Street official, and the floodgates for billions of new dollars from institutions and consumers should flow into the crypto markets. Multi-trillion-dollar players such as Fidelity, BlackRock, and Franklin will have a clear marketing budget advantage over upstarts like Valkyrie and Bitwise. Still, there is plenty of Bitcoin gold to mine.

Standard Chartered analysts this week said the ETFs could draw $50B to $100B this year alone, driving the price of Bitcoin as high as $100,000. Coinbase is tied to most spot Bitcoin exchanges and traded funds, so its stock should also see a long-term bump.

Today, crypto continues to be viewed as a long-term growth opportunity at Fidelity. The company stores billions of dollars in customer crypto assets, while the headcount in its crypto unit has steadily risen to more than 600 from just a few dozen in 2018.

“Blockchain technology isn't just a more efficient way to settle securities. It will fundamentally change market structures, and maybe even the architecture of the Internet itself."

—Abby Johnson, Chairman & CEO of Fidelity Investments

In the end, SEC Chair Gary Gensler had to concede, however defiantly, to an appellate court ruling that found that the SEC had failed to adequately explain why it rejected Grayscale’s application to convert its listed Bitcoin trust into an ETF. Mr. Gensler has repeatedly denied applications by crypto fund providers over the years based on the posture that they had failed to ensure Bitcoin and crypto funds would not be vulnerable to fraud and market manipulation.

“While we approved the listing and trading of certain spot Bitcoin ETP shares today, we did not approve or endorse Bitcoin. Investors should remain cautious about the myriad risks associated with Bitcoin and products whose value is tied to crypto. As I’ve said in the past, and without prejudging any one crypto asset, the vast majority of crypto assets are investment contracts and thus subject to the federal securities laws. The approval of ETFs should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities.” 🥱

—SEC Chair Gary Gensler’s statement

‘This is a big idea—a new financial superhighway. It is the first global, decentralized, digital, rules-based monetary system in history.’

—Cathie Wood, Ark Invest boss and partner @ Ark 21Shares Bitcoin ETF.

Crypto Upstart Funds vs. Wall Street Heavyweights

Clearly, much of the competition will boil down to fees, and you can see in the table below how the eleven approved funds are positioning their funds at the starting gates. The early upstarts like Grayscale will be competing in an increasingly crowded field as traditional asset managers exercise their marketing muscle to sell new BTC funds.

The Crypto Upstarts

Valkyrie Bitcoin Fund (BRRR: Nasdaq) Fee: 0.25% (0.0% for first three months). Founded in 2020 in Tenn., $11M in VC in 6/22 led by Coinbase Ventures & C Squared. Valkyrie has $110M under management.

Grayscale Bitcoin Trust (GBTC: NYSE Arca) Fee: 1.5%. Founded in 2013 by Barry Silbert and DCG, Grayscale has $27B under management.

Bitwise Bitcoin ETF (BITB: NYSE Arca) Fee: 0.20% (0.0% for first six months, or $1 billion). Founded in 2017 with $92M in angel/VC, with total assets under management of over $150M,

WisdomTree Bitcoin Trust (BTCW: Cboe BZX) Fee: 0.30% (0.0% for first six months, or $1 billion). $100B under management.

Hashdex Bitcoin ETF (DEFI: NYSE Arca) Fee: 0.94%). $600M under management.

Legacy Wall Steet players

BlackRock iShares Bitcoin Trust (IBIT: Nasdaq), Fee: 0.25% (0.12% for the first 12 months, or $5 billion). BlackRock has $9T under management.

Ark 21Shares Bitcoin ETF (ARKB Cboe BZX) Fee: 0.21% (0.0% for first six months, or $1 billion).

Fidelity Wise Origin Bitcoin Fund (FBTC: Cboe BZX) Fee: 0.25% (0.0% through July 31, 2024). Fidelity Investments has $4T under management.

Franklin Bitcoin ETF (EZBC: Cboe BZX) Fee: 0.29%). Franklin Templeton has $1.5T under management.

Invesco Galaxy Bitcoin ETF (BTCO: Cboe BZX) Fee: 0.39% (0.0% for first six months, or $5 billion). Invesco Galaxy has $1.5T under management.

VanEck Bitcoin Trust (HODL: Cboe BZX) Fee: 0.25%). VanEck has $89.5 B under management.

Kudos to the Bitcoin pioneers

Many people and firms deserve major kudos for driving Bitcoin mainstream, along with early adopters like Abby and Cathie. The Winklevoss twins and Grayscale founder Barry Silbert from DCG and Grayscale CEO Michael Sonnenshein were the first to push for the approval of a spot product to expand direct access to the digital coin to investors for years. BlackRock CEO Larry Fink went from crypto skeptic to Bitcoin champion in the last two years as his iShares Bitcoin Trust unit sought ETF approval.

All this is to say that literally trillions of dollars of management money reputation are on the table right now, and managers are saying, ‘We bet Bitcoin is going to be around, and it is the model to re-write how we operate for the better, so get on board and hold tight.’ We like that attitude.

“If crypto succeeds, it's not because it empowers better people. It's because it empowers better institutions."

With this crypto victory in hand, we expect a revived focus on pushing for spot price Ether ETFs. The consensus on Wall Street seems to be that the SEC will first want to gain experience from the Bitcoin ETF markets, and any action in this area is not expected until sometime after the US Presidential election.

News Flash—Valkyrie already wins big

Just as we were pushing the send button, London-based CoinShares officially exercised its option to acquire Valkyrie Funds. Final due diligence, legal agreements, and board approval are pending.

When the deal dust clears, CoinShares’ existing 4.5B will bump up by approximately $110M, representing Valkyrie Bitcoin Fund, which began trading last Thursday on Nasdaq, other ETF products, including The Valkyrie Bitcoin and Ether Strategy ETF, and The Valkyrie Bitcoin Miners ETF.

From our cover gal, Ms. Wald’s official statement on the deal, it's clear that Valkyrie was making a move for more critical mass backing to stave off the Titans and be a harbinger of further consolidation to come.

“CoinShares has established itself as a premier player in the digital asset space, and we’re excited to see how they continue advancing the space by leveraging Valkyrie’s team and expertise. CoinShares' renowned capabilities and proven success, in combination with our strengths, promise to propel us forward in the American digital asset investment sphere, particularly within the digital asset ETF market. Being part of such a strong and successful group marks a promising new chapter for us.”

— Leah Wald, cofounder & CEO of Valkyrie

Notably, Valkyrie’s BRRR ETF only traded roughly $9 million worth of shares in the first days of trading, a fraction of other players, such as the Grayscale Bitcoin Trust, which saw $2.3B in volume in the same period.

Did you know?

(Overheard on the streets of the global Silicon Valley. Got any hot insider tips? Email us editor@cryptoniteventures.com)

Billionaire Boys Club

Living longer is a big investment focus of the billionaire set. Ethereum cofounder Vitalik Buterin, Peter Theil, Jeff Bezos, Sam Altman, Larry Ellison, the Google Twins—Larry Page and Sergey Brin—and others have pledged billions toward companies pursuing immortal life. Retro Biosciences wants to help you make the first step by adding ten healthy and vigorous years to your life. This extension promise was enough to get the attention of the 38-year-old OpenAI cofounder Sam Altman, who, as the sole investor, pumped $180M into the Redwood City, California-based company. Founded in 2022 by CEO Joe Betts-LaCroix, with fellow scientists Matt Buckley and Sheng Ding, the Retro team has grown to 50 scientists.

"Life would be infinitely happier if we could only be born at the age of 80 and gradually approach 18.” —Mark Twain

Retro is focused on making breakthroughs in autophagy (a cellular recycling process), the rejuvenation of blood plasma, and three research programs tied to the Nobel Prize-winning science partial cell reprogramming. The reprogramming process has been successful in many animal experiments, where the cells of an older creature, such as a Great Dane, can be treated with a combination of proteins or molecules and turned into much younger cells. Retro and a handful of other startups consider reprogramming the most promising longevity technology yet to appear.

For a deeper look at the billionaires’ often comical race to immortality, we recommend a Bloomberg BusinessWeek article, Silicon Valley’s Quest to Live Forever Has Many Warring Factions, by Ellen Huet. Ms. Huet will take you inside the competition between the factions she describes as the traditional Biotechs, the anti-medical establishment Wellness Obsessives, and the Radicals who believe death is a fallacy.

The Fountain of Youth is a mythical spring that restores the youth of anyone who drinks from it and has taken on different story forms for thousands of years. One of the earliest accounts is from in the 5th century BC Greek historian Herodotus (a.k.a. The Father of History), who wrote of a fountain of youth in the land of Macrobians. The legend rose again in the early 1500s when Spanish explorer Ponce de León who was searched for the mythical waters, particularly in Florida, after hearing about the myth from the Taino Indians of the Caribbean.

UnSocial Networking

Tucker Carlson may have abandoned his X show to start his own ‘network’🤔, but Elon is not giving up on Xtv. During CES this week, X announced they have cut ‘free speech’ deals (presumably up-front money + revenue share) with former congresswoman and presidential candidate Tulsi Gabbard from Hawaii, former CNN anchor Don Lemon, and Jim Rome to create their own shows.

We need to learn a lot more about Xtv’s programming plans to gauge its prospects for success and business model—but so far, it all has a Web2ish, old-Twitter re-run vibe. Xtv’s competitive advantage is, of course, its 666 million users per Statistica. X Boss Lady Linda Yaccarino is also right to look to video advertising as a means to get X growing again.

‘He required everyone—small and great, rich and poor, free and slave—to be given a mark on the right hand or on the forehead. And no one could buy or sell anything without that mark, which was either the name of the beast or the number representing his name. Wisdom is needed here. Let the one with understanding solve the meaning of the number of the beast, for it is the number of a man. His number is 666.’

—Revelation 13:16-18; Commentary.

VC Whispers

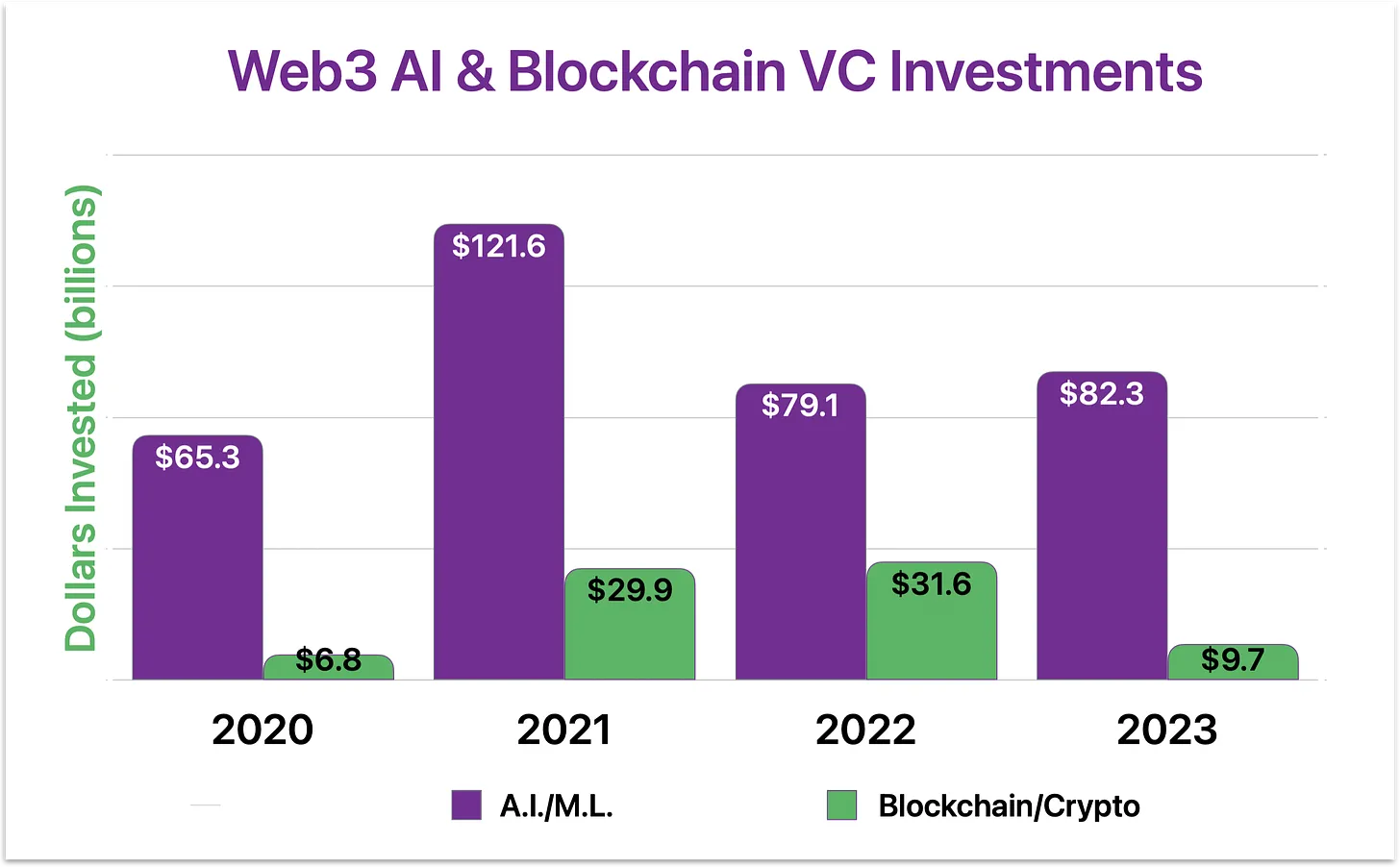

Blockchain-friendly VCs started 2023 on the back of the FTX and BlockFi busts and finished the year by dramatically cutting the number of deals they funded. Founded in 2018, Coinbase Ventures (CV), the most active VC in the industry, made 64 fewer investments in crypto startups in 2023 than in 2021. Shan Aggarwal from CV told Pitchbook, ‘Our focus has been on writing larger investments and follow-ons as we believe it’s a generational opportunity to invest in the space.’ Despite the slowdown, he says CV has ‘not reallocated capital away’ from venture investing.

“Bitcoin gives us, for the first time, a way for one Internet user to transfer a unique piece of digital property to another Internet user, such that the transfer is guaranteed to be safe and secure, everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer. The consequences of this breakthrough are hard to overstate.”

Marc Andreesen, Co-Founder, Andreessen Horowitz, in January 2014

We expect VCs to retrench in the AI investment space in 2024 and let their portfolios settle, and blockchain and crypto investment will grow again as more money pours into crypto markets.

AI Tracker

Murdoch-controlled Fox Corp. has partnered with Polygon Labs to develop Verify, a tool that leverages blockchain’s transparency to ensure the authenticity and source of media content and help media companies block crawling AI bots. Verify is powered by open source and uses advanced searching and scalable zero-knowledge (ZK) technology—a method for one party to cryptographically prove to another that they possess knowledge about a piece of information without revealing the actual underlying details.

“All barriers to entry are obliterated. How to contend with AI, blockchain, crypto, and the metaverse are at the top of our agenda.”

—Lachlan Murdoch, Fox Corporation and News Corp successor

Fox is using the tool to protect Fox News, Fox Sports, Fox Business, and Fox’s local television stations and pitching Verify to other AI-bot-weary media outlets. Meanwhile, the New York Times filed a copyright infringement lawsuit against OpenAI (ChatGPT) for using its content to train its LLMs and producing articles nearly verbatim. OpenAI asserts that training its models on copyrighted material is permitted under ‘fair use,’ and it also allows publishers to opt out of the process, which the Times did last August.

Read OpenAi’s blog post published last Monday that describes its LLM approach to training copyrighted content from news outlets and other sources. It points out that it has already cut several licensing deals with the likes of Axel Springer, who owns Politico and Business Insider, and the Associated Press.

Going Green

Honda unveiled a new EV Honda 0 Series, including its Saloon sedan and Space Hub SUV, at CES for a projected 2026 launch. To mark a new era, Honda is tweaking its signature ‘H’ mark from the current incarnation, which dates to 1981. Three years ago, Honda set an ambitious target of achieving 100 percent electrified vehicle sales by 2040.

Honda is also working with US auto-titan General Motors’s robotaxi subsidiary Cruise on a driverless taxi service. The Cruise operation, however, was put on hold and eliminated roughly a quarter of its workforce since October after California halted testing self-driving vehicles when a Cruise taxi ran over a woman in San Francisco.

Santa Cruz, California-based EV helicopter pioneer Joby Aviation (JOBY) has partnered with Delta Air Lines to bring its four-passenger eVTOL (electric vertical take-off and landing) craft to NYC to taxi passengers from JFK and LaGuardia Airports to the Downtown Heliport (KJRB) in Manhattan by 2025 in minutes.

We prefer our test flight to be around Joby’s Santa Cruz HQ. Check out how the propellers tilt.

Follow the Crypto

The Venezuelan national oil-backed petro cryptocurrency (PTR) shut down this week after six years. The PTR was created (ordered) by Venezuelan President (dictator) Nicolas Maduro as a potential end-around US sanctions but was never backed by the country’s central bank or parliament. The PTR failed because it never achieved full functionality, was crippled by scandal, and was never accepted at home or abroad despite efforts by Maduro to promote it.

The moral of the story might be that a cryptocurrency designed by a regime that has been accused of disregarding and repressing the voices of the Venezuelan people, dismantling democratic institutions, and abusing state power might be dead on arrival—and it apparently was. Our view is South America will be one of the greatest benefactors of the Web3 boom, as will other regions within Africa, India, and China, where unbanked populations are clustered.

Genesis Global Trading, a subsidiary of pioneering cryptocurrency powerhouse Digital Currency Group (DCG), has agreed to wind down operations, forfeit its BitLicense, and pay an $8M fine because a probe by the New York State Department of Financial Services unearthed the firm’s failure to uphold a robust compliance framework in the company’s anti-money laundering and cybersecurity protocols.

Genesis is one of the portfolio companies that helped make DCG a key player in the American crypto industry. However, the company became entangled in the tumultuous crypto market collapse of 2022, leading to heightened regulatory scrutiny and eventual bankruptcy in early 2023. This story, as the story behind the collapse of FTX and the ouster of Binance founder CZ, punctuates the necessity for thoughtful compliance mechanisms to filter out bad actors and protect customer assets.

Robots

Tesla’s Optimus Gen 2 humanoid robot—Tesla Bot— is out, and one more step forward for Master Elon’s vision of a future of abundance. The Tesla Bot shares AI software and sensors with Tesla’s Autopilot system 7 and is designed to perform tasks that are considered dangerous, repetitive, or boring.

Elon has ambitious plans for Tesla Bot and hopes to start selling them by 2027 at somewhere under $20K. The Tesla Bot has impressive control over its hands and fingers and possesses tactile sensing, all made possible by six actuators that convert energy and signals into motion. You will be impressed.

The Mirokai robot by Paris, France-based Enchanted Tools was seen roaming the CES tech show last week in Las Vegas. The robot is designed for medical environments to carry and move equipment and medications. Enchanted has raised $17M from undisclosed investors. Mirakai and the other robots roaming CES this year left Vegas casino workers, chefs, servers, and baristas feeling nervous about their jobs for good reason😩.

Straight outta Silicon Valley

Job trimming in Silicon Valley continues into the New Year, with popular gamer network Discord laying off 17% of its workforce (170 people). Discord doesn’t rely on online advertising but is instead supported by subscribers who pay a monthly fee for extra features like high-definition streaming and a new online marketplace for digital avatars and virtual goods. Discord has raised over $1B in VC and late-stage money from 73 blue, primarily blue-chip investors and was last valued at about $15B at the top of the market in 2021.

Other recent job cuts were made at Google ‘to focus on the company’s biggest product priorities,’ Unity Software (25% cut), Amazon’s Audible unit (5% cut), and Microsoft’s LinkedIn SF office, where they laid off 668 employees. Our observation is that social networks, like the streamers, have had to adjust back from the user time boost they enjoyed during the Covid quarantine. There is also a general concern by Big Tech CEOs, including Marc Benioff from Salesforce and Zuck with Facebook workers, that employee production is way down, especially within remote worker ranks.

Know Thy Enemy

China skeptic and presidential candidate Lai Ching-te and his Democratic Progressive Party (DPP) won Taiwan’s election last week with more than 40% of the popular vote. Beijing has branded Mr. Lai as a ‘stubborn worker for Taiwan independence’ and a dangerous separatist. Kuomintang (KMT), Beijing’s preferred political partner, gained roughly 33% of the vote, and China’s Taiwan Affairs Office dismissed Lai’s presidential vote victory, even though his rivals have conceded.

As we predicted, the looming showdown between the CCP and the US over Taiwan and Indo-Pacific region security will only turn China-USA relations even frostier. This situation will be exasperated by the GPU shortage currently ravaging the startup and Big Tech ecosystem and the growing paranoia on both sides over access to advanced technologies, such as AI and super chips.

“As president, I have an important responsibility to maintain peace and stability in the Taiwan Straits, and safeguard Taiwan from threats and intimidation from China. The Taiwanese people have successfully resisted efforts from external forces to influence this election. We trust that only the people of Taiwan have the right to choose their own president. I will act in accordance with our democratic and free constitutional order, in a manner that is balanced and maintains the cross-Straits status quo.”

—Presidential-elect Lai Ching-te, in an official party translation of his comments in Mandarin.

Still, in his post-election comments in Mandarin, Lai invoked the official name of Taiwan — the Republic of China — at least twice.

The DPP has not accepted the so-called ‘1992 Consensus’ and ‘one China’ between the then-KMT government and CCP, which Beijing assumes as the basis for cross-Straits engagement. Chinese President Xi Jinping regards reunification with the mainland as ’a historical inevitability.’ Xi told Joe Biden on the sidelines of the APEC San Francisco summit in November that Taiwan is the “most important and sensitive” issue in China-U.S. relations.

China has never relinquished its claim over Taiwan—which has been self-governing since the Chinese nationalist party, or Kuomintang, fled to the island following its defeat in the Chinese Civil War in 1949.

Chaos & Complexity

Nine western states, led by California’s Gov. (and former SF mayor) Gavin Newsom, seek to ban homeless people from public areas, and the US Supreme Court is ready to hear the case. This bump up to the Supremes comes after the 9th US Circuit Court of Appeals ruled that removals break the Eight Amendment ban on ‘cruel and unusual punishment.’

There hasn’t been this much energy going into addressing the homeless challenge since the politicians cleaned up The City last month to welcome Joe Biden and the ‘dictator,’ Xi Jinping, and other ‘world leaders’ and delegates who descended on our streets.

Downtown San Francisco feels like a movie set for the sequel to Apocalypse Now. After billions in public money, The City lights continue to dim. A quarter of a million people have fled the Bay Area since COVID-19 hit. California currently reports over 170,000 homeless individuals, with 7,800 in San Francisco. The City is expected to hit a record of over 800+ drug deaths (mostly fentanyl-related) for 2023, topping the record of 726 in 2020.

The Apocalypse vibe and smash-and-steal looting in downtown has scared away over 100 retailers—a decline of more than 50 percent from 2019. Starbucks, Whole Foods, IKEA, Nordstrom, and the Disney store have all shut down some of their San Francisco locations. Office vacancy rates hit a record high of 34 percent in September.

Big Tech, once the shining light of San Francisco’s job creation and prosperity machine, is wiping its hands off San Francisco. LinkedIn is sub-leasing the top five floors of its 26-story building; Meta announced it is abandoning its 435,000 sq. ft. downtown building when the lease runs out, and Airbnb, Paypal, Slack, Lyft, and Salesforce have packed up and split the scene entirely.

We have very strong opinions on how to solve these issues (see link to post below). Still, it requires stepping outside of ourselves, leading with compassion, and operating without fear to act on our challenges in radically new ways. We also have to let go of the idea that the politicians are going to solve all our problems because look what happened as a result of thinking that way. Everything got worse.

Let's end the War on Drugs and bring peace to the addicted

Driving that train, high on crack cocaine Back in th…

Gen Z

A report by Coinbase shows that more than one in three in the millennial and Gen Z age bracket own crypto, while only 12% of older generations do. Gen Z sees the current financial system as slow, outdated, and too expensive. This perceived ‘pain in the market’ by Gen Z is, in good part, why the Web3 transformation will be so BIG. This is the DeFi spirit!

Well, Gen Z better makes a lot of money on Crypto because another recent survey says 58% of employers believe Gen Z is unprepared for the workforce. About 60% of employers said they are willing to offer more benefits, pay higher salaries, and offer remote or hybrid positions to attract older workers rather than recent graduates.

Sixty-three percent of employers consider Gen Z employees to be entitled, while 58% said they get offended too easily. Nearly 20% of employers said they’ve had a recent college grad bring a parent to an interview. It can all be summed up in the poor Gen Zer’s TikTok tearful rant on the trials and tribulations of the 9-to-5 life that garnered over 300,000 likes 😳.

What the Math Says

The rate of people disassociating from traditional political parties and identifying as independents continues to spike up and now represents 43% of US adults. US citizens continue to shed their political party affiliations and increasingly feel uncomfortable with being defined by dated partisan labels and slogans. A healthy trend, we say.

All Gallup survey respondents who identify as independents were also asked whether they lean more toward the Republican Party or the Democratic Party. A Republican advantage first appeared in 2022 and is now up by 2%.

Pura Vida (pure life)

As few as 4,000 steps a day can maintain brain health and help prevent Alzheimer’s disease, a new study suggests. ‘Our research links regular physical activity to larger brain volumes, suggesting neuroprotective benefits.’ notes study co-author Somayeh Meysami, MD.

A chart in Peter Attia’s #1 NYT bestseller, Outlive: The Science and Art of Longevity, shows if you want to be able to climb stairs when you are 75, you need to be in the top 95th percentile of cardiovascular fitness during your life. You might want to add some stairs to your daily walk ;)

Massaging these natural oils into your scalp might help fight hair loss, whether you’re dealing with hormonal changes or stress-related hair issues, such as Rosemary, Lavender, Peppermint, and Cedarwood.

Cryptonite Partnership Opportunities

Introducing the 2024 Cryptonite 300 competition—Private Web3 companies worth the bet

Welcome to the kick-off of the 2024 Cryptonite 300 (C300) competition. Eligible companies are generally venture capital-backed enterprises driven by Web3 innovation, including artificial intelligence (AI) and machine learning (ML), blockchain and crypto, and the metaverse and virtual reality (VR).

The Cryptonite Founder's Pitch Program

Creating Category Leaders If you are a hustling innovation entrepreneur ready to pitch your story and boost your funding and branding efforts, it might be time for you to do a Cryptonite Founder’s Pitch on a Cryptonite Live! webcast and reach our 500,000+. Our job is to bring your pitch alive and put it in front of the investors and influencers who matte…

The Cryptonite Brand Partner Program

Creating Brand Leaders in Innovation If you represent a service firm, big tech, or high-end consumer brand and want to build relationships, trust, and personalized experiences within the global innovator community, Cryptonite is our partner. Cryptonite offers a brand-personalized set of opportunities across our publishing, video, event, and analytics pla…

Cryptonite recommended Global Innovation Events

Global Events for Innovators Cryptonite Identifies must-go global events for entrepreneurs and risk investors in the blockchain, crypto, AI, and metaverse space. Here is the current list of recommended events. January 2024 Cryp…

Great breakdown of ETFs and their impact! The accessibility and diversification they offer make them such a powerful investment tool. Enjoyed the insights!