Cryptonite's predictions for 2026: OpenAI down, cryptos and IPOs up, a Persian Empire comeback, DeepSeek as CCP tool, personal AI rules, LatAm rockin', EU sucks, and more trouble...

Our prognostications in 2026

Today, Cryptonite presents our top 12 predictions for 2025 below. When you look at the results of our 2025 predictions, you are going to want to pay attention. While our prognostications are often controversial at first blush, we understand what our readers need to know to survive and prosper, and you can expect us to bat close to a thousand again in 2026!

The GenAI shuffle erodes OpenAI’s market share (and market cap)

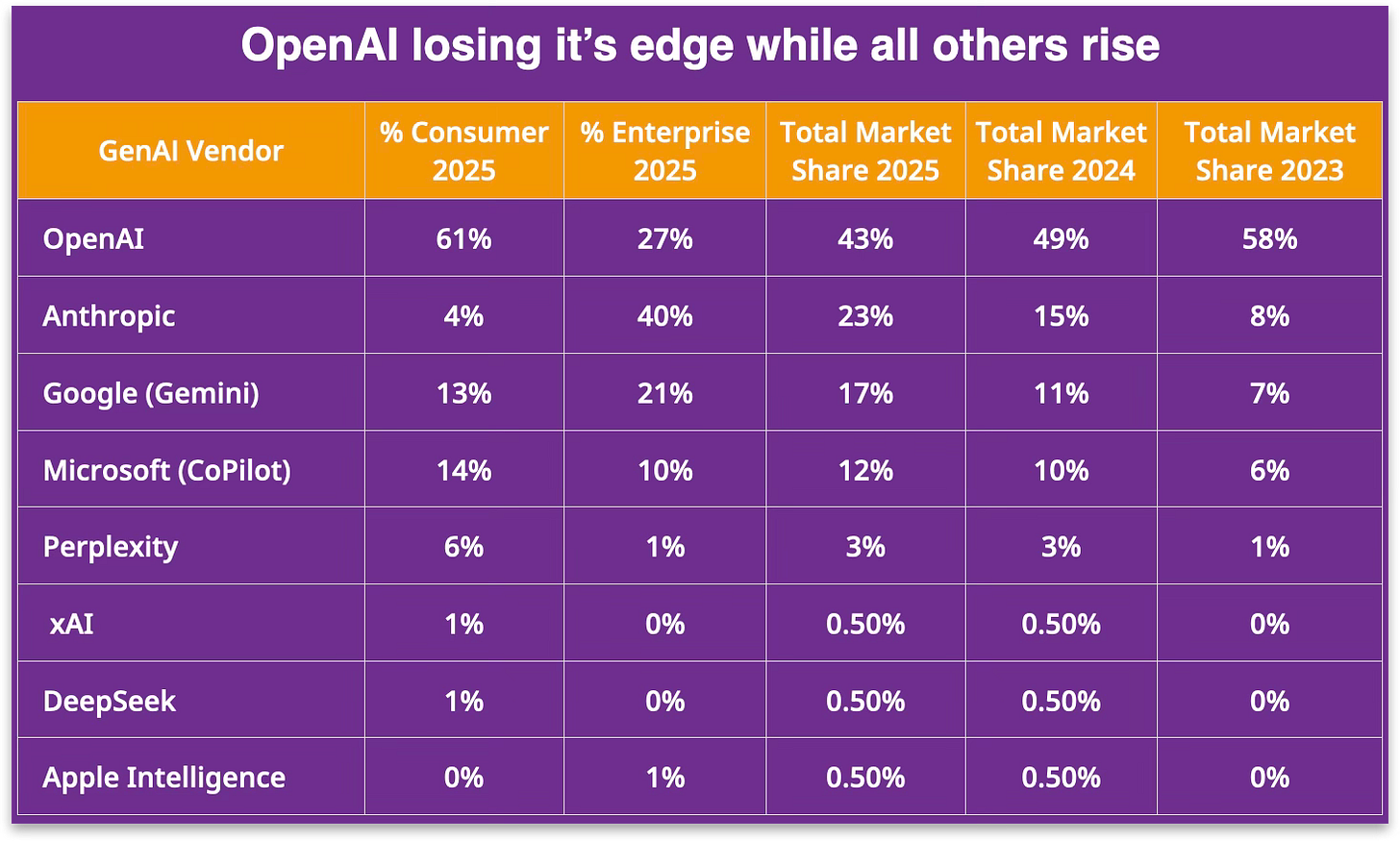

OpenAI will continue to see a steady erosion of its market share in the generative AI space in 2026, particularly in enterprise adoption and overall foundation model dominance. From 2023 to 2025, OpenAI’s enterprise share dropped from close to 50% to 27%, while competitors like Anthropic surged to 40% and Google (Gemini) climbed to 21%. In the broader chatbot market as of late 2025, ChatGPT still holds a leading 61% share, but that’s down from prior peaks, with gains by Microsoft Copilot (14%), Gemini (13%), Perplexity (6%), and Claude AI (4%).

This shift is driven by intensifying competition, infrastructure cost pressures, and the rise of more efficient, accessible open AI alternatives (see DeepSeek below), which will put pressure on OpenAI’s outsized valuation, estimated at $500 billion, and will not hold up in later rounds or an IPO. Conversely, we expect Anthropic’s supreme positioning and success will result in the biggest tech IPO in history this year. (See below for more on the 2026 IPO market).

DeepSeek, Huawei, and the CCP’s plan to take over the Third World.

Quite ironically, the Chinese Communist Party is pitching its homegrown DeepSeek open-source AI solution to emerging markets—particularly in Africa—as a tool for ‘local data sovereignty and flexibility’ over Western platforms. This offering pairs the DeepSeek platform with Huawei’s cloud storage services, with the political intent of fostering Africa’s and other developing countries’ dependency on the totalitarian regime. This sovereignty pitch is, of course, illusory as DeepSeek often stores chat histories, prompts, and locations on Huawei servers accessible by the Chinese government. This setup enables surveillance, with Huawei already accused of aiding African authoritarian regimes in spying on opponents.

Malaysia launched a national ‘Strategic Artificial Intelligence Infrastructure’ in 2025, described as a sovereign full-stack AI ecosystem using Huawei GPUs and Ascend chips, with DeepSeek as its core LLM—the first national-scale deployment of DeepSeek outside China.

DeepSeek was founded in 2023 by Liang Wenfeng, also the founder of a Chinese quant hedge fund, High-Flyer. DeepSeeks’s open-source approach rivals or exceeds Western counterparts like OpenAI’s o1 in benchmarks for reasoning, math, and coding, while claiming far lower training costs and efficiency on less advanced chips. By open-sourcing its models and offering APIs at over 90% lower cost than OpenAI’s equivalents, DeepSeek has democratized access to high-quality AI, allowing resource-constrained startups, enterprises, and governments to build or fine-tune their own applications without heavy dependence on big US players.

US companies like Perplexity AI and Lovable have also leveraged DeepSeek’s models to slash costs and accelerate development, commoditizing what was once OpenAI’s moat. Overall, DeepSeek accelerates OpenAI’s loss of market share by serving as an AI arms supplier to smaller players. If trends continue, expect further fragmentation, with open-source models like DeepSeek’s capturing a larger share of the pie in the cost-sensitive enterprise and consumer segments.

While no single US VC-backed platform has matched DeepSeek’s exact cost and training efficiency claims, Together AI, Fireworks AI, Grok/xAI, and Meta’s Llama efforts represent the strongest US contenders to build competitive, scalable, open-source-focused GenAI infrastructure.

Top US VCs like Sequoia, a16z, and Lightspeed have poured billions into the broader open AI ecosystem to counter China’s dominance. The US focus has shifted toward infrastructure that enables open models rather than standalone frontier model releases comparable to DeepSeek.

Dear Readers,

💡 We’re a community-supported site, with the goal to keep our content free for thousands of young readers worldwide. Subscribe now at a 33%-discount for just $6/month—the price of a medium cup of designer coffee—and help power Cryptonite. 🚀

🔒 Paid members also unlock perks, like early access to our next-generation Web3 company research, reporting, and analytics, special event invites, and discounts.

Your subscription fuels the decentralization of power movement—and proof that independent, transparent voices, with whom you might not always agree, but trust, have the power to own their voice and content.

Thank you for being part of the journey.

— The Cryptonite Team. Huff Puff 😅

Personal AI apps arrive for the betterment of all

Personal AI refers to AI apps designed to emphasize privacy, content ownership, and customization, and overlaps with broader AI virtual assistants and edge computing. Unlike large language models (LLMs) that draw from vast, shared datasets, personal AI is built as a ‘personal language model’ or small language model that learns from an individual’s unique online voice, preferences, behaviors, memories, and data. This allows your digital assistant to provide highly customized assistance for everyday tasks, while prioritizing on-device processing to keep data private and out of centralized cloud systems.

Apple App Store Readiness

Apple is actively preparing the App Store for the ‘new generation of AI bot apps’ by updating guidelines to support AI integrations, enabling third-party developers to build on Apple Intelligence APIs, and partnering with external models (e.g., OpenAI’s ChatGPT for Siri fallbacks). This creates a marketplace where AI apps can thrive, monetized through Apple’s ecosystem (e.g., in-app purchases, subscriptions), while ensuring they adhere to privacy standards.

Personal AI represents a booming industry that will further disrupt first-generation cloud-centric LLMs and erode their market share. Funding trackers indicate that there are already close to 200 VC-backed startups in the AI-assistant and personal, on-device AI tools sector. Y Combinator alone claims to have funded 142 AI assistant startups through early 2026.

Click here for a complete list of the top VC funds dominating the AI assistants and on-device tools market due to their early bets, expertise, and networks, often collaborating on rounds. This list also includes some of their top portfolio companies in the space.

The best way to imagine this opportunity is to look at your iPhone and begin imagining how each of the mobile apps you depend on could be revolutionized by the Personal AI model. Voice-controlled, proactive personal AI agents will start displacing (and consolidating) the millions of traditional passive Web2 cloud apps for everyday tasks. The voice AI market is projected to exceed $50B by 2030, with a significant 2026 acceleration in personal task automation.

The AI bots are indeed coming, and we will enjoy less screen time and dramatically more personal efficiency as a result.

New fav AI bot of Paul Veradittakit, Pantera Capital: ‘Consumer AI platforms like Surf.ai help crypto-curious individuals evolve into active traders via intuitive advanced AI models, proprietary crypto datasets, and multi-step workflow agents. I believe Surf’s sophisticated technology and accessible design position their app as the go-to crypto research tool, delivering instant, on-chain-backed market insights 4× faster than generic options.’ PV

Apple Intelligence offers a ‘Third Path’

Some industry analysts see Apple as a ‘sleeper’ in the GenAI services race due to its deliberate, ecosystem-focused approach rather than offering broad-market AI services like OpenAI, Google, or Microsoft. Apple’s strategy under Tim Cook emphasizes AI as an enabling technology woven into iOS, macOS, and apps like Siri, Photos, Messages, and Safari, without making it a single app.

We had hope that Apple was jumping into the AI app game with all its design and UI elegance when it was rumored to be in discussions to acquire Perplexity AI in mid-2025. The sales price for Perplexity AI was valued around $14–18 billion, which could’ve been Apple’s biggest acquisition ever, and peanuts compared to their $130 billion+ in cash reserves, but alas, no such luck.😢

NVIDIA acquired AI chip startup Groq in a $20B deal in 2025, marking the largest transaction in NVIDIA’s history and signaling a push for faster, more efficient AI chips amid data center demands. Groq had raised $1.75 billion across six funding rounds since its founding in 2016, with a valuation of $6.9 billion as of September 2025. Social Capital, which provided Groq with its Series A and B money, is the biggest VC fund winner with a return that should exceed 100x.

Mr. Cook has indeed consistently framed AI as a foundational tool to ‘power everything Apple and optimize and differentiate its core offerings for its loyal customer base of over 2 billion active devices. But this perceived lag in AI competitiveness in 2025 translated into stock performance that has trailed AI leaders like Google, Nvidia, Microsoft, and Meta.

Hidden behind all the AI hype, Apple Intelligence launched in phases starting in 2024, designed brilliantly for on-device processing to prioritize privacy and efficiency, and also leveraging Apple’s custom silicon for low-cost, energy-efficient AI inference at the edge. This hardware advantage positions Apple well for a future where AI runs locally on billions of devices, reducing reliance on cloud-based competitors and avoiding the massive training costs others are incurring. Apple’s ‘App Store readiness’ described above also positions the company very well to take advantage of the inevitable Personal AI app boom.

Our bet is Apple will emerge stronger as the AI market shifts toward practical, privacy-centric applications—making it a classic sleeper that wakes up to dominate in its own lane.

Cyrus’s life and reign left an indelible mark on the ancient world. Known for his military genius and innovative governance, Cyrus pioneered principles of tolerance and human rights. He was viewed as the ideal monarch and was called the ‘father of his people’ by the ancient Persians. His legacy endures in the Hebrew Bible (e.g., Ezra 1:1–4 and Isaiah), where Cyrus is depicted as God’s anointed liberator who ended the Babylonian Captivity in 538 BCE, freeing the Jewish exiles, allowing their return to Jerusalem, and funding the rebuilding of the Second Temple. Imagine that! This act of clemency not only solidified his reputation but also resonated for centuries through Judeo-Christian traditions, symbolizing divine intervention and humane kingship.

Iran joins the free world in 2026!

Since the 12-Day War with Israel last June, punctuated by our devastating airstrikes on Tehran’s nuclear program, the Islamic Republic’s economy has collapsed from hyperinflation (its currency dropped in December to 1.4 million to $1 😳) and sanctions fallout. Protests erupted in Iran in late December 2025 and have spread to over 180 cities across all 31 provinces, with the regime killing 2000+ protestors, and arresting another 18,000+, and initiating a major Internet blackout. Protestors are chanting ‘Death to Khamenei’ and ‘Seyed Ali (Khamenei) will be overthrown.’

While threatening a crackdown, Iranian President Masoud Pezeshkian let it slip to state TV that Tehran is ‘at total war with the United States, Israel, and Europe. They want to bring our country to its knees.’

Breaking News!

President Trump called on Iranian protesters to take over government buildings on Tuesday in his starkest call in support of an Islamic Republic leadership regime-change, with 2,000, dead and one young Iranian man set to be hanged. These numbers reflect one of the deadliest suppressions in modern Iranian history since the chaos of the 1979 Islamic Revolution.

“Iranian Patriots, KEEP PROTESTING – TAKE OVER YOUR INSTITUTIONS!!!” Save the names of the killers and abusers. They will pay a big price. I have cancelled all meetings with Iranian Officials until the senseless killing of protesters STOPS. HELP IS ON ITS WAY. MIGA!!!”

—Trump wrote on Truth Social.

The Bogeyman also called on Americans and other foreign citizens to depart Iran. ‘I think they should get out,’ Trump told reporters during a day trip to Michigan. Trump has repeatedly threatened military action over the killings of protesters, but hasn’t tipped his hand on possible follow-through.

In Silicon Valley, we love our Persian community, who have added much entrepreneurial energy, innovation expertise, great food, and festivity to our often monochromatic tech culture. It’s also our experience that, while these fine folks are excelling in the US, they remain passionate about their Iranian roots and proud of their historical contributions to science, mathematics, religion, and philosophy. We share the diaspora’s passion for protecting Iranian identity and culture, and also a desire for a free and democratic Iran.

Prominent Persians who emerged as Silicon Valley trailblazers

Pierre Omidyar, whose parents were Iranian immigrants, founded eBay in 1995, turning it into a global e-commerce giant and becoming one of the world’s wealthiest philanthropists. Dara Khosrowshahi, who fled Iran as a child during the revolution, rose to lead Expedia before becoming Uber’s CEO in 2017, steering the ride-hailing behemoth through turbulent times to great success. Arash Ferdowsi co-founded Dropbox, revolutionizing cloud storage, while investors like Pejman Nozad transitioned from selling rugs to backing hits like Dropbox and SoundHound through his firm Pear VC. Others, such as Omid Kordestani at Google and Ali Ghodsi at Databricks, shaped search engines and big data, proving how the Iranian diaspora turned exile into a cornerstone of Silicon Valley’s innovation engine.

We boldly predict (i.e., hope and pray) that in 2026 the great Iranian people will successfully overthrow their evil, theocratic dictatorship, escape global isolation, and begin creating an open, democratically elected, secular government that provides equal rights to all their citizens and encourages new prosperity. This historic, largely peaceful🤞🏼transition would finally bring true peace to the Middle East. We concede this is purely a gut call, but here are the indicators that fuel our confidence in regime change for the betterment of its people.

The double shock and awe of the US sending B-2 Stealth bombers deploying ‘bunker buster’ bombs and Tomahawk missiles to take out Iran’s nuclear facilities, setting back their program years, and our a surprise military raid and arrest Venezuelan tyrant and former dictator (and huge Iran ally) Nicolás Maduro has left Iran’s militarily and its Supreme Leader and authoritarian regime humiliated, and embolden its people.

The end of the Venezuelan/Iran partnership is devastating for Iran. Historically, both countries relied on each other to circumvent US-led sanctions and to overcome their limited access to global markets. While the theocratic regime can still depend on China for oil sales and Russia for military support, Venezuela was uniquely valuable to Iran for providing a barter outlet for Iranian products and helped monetize its stranded oil. The loss of Venezuela as a strategic partner further isolates Iran and intensifies its economic strain in 2026.

The severe drought afflicting Iran, now in its sixth consecutive year, significantly undermines the Supreme Leader’s grip on power, as it amplifies Iran’s economic strain, poverty, and mismanagement. Health risks from water-borne diseases, land subsidence, and depleted aquifers threaten public safety, while urban water cuts in Tehran—a city of over 10 million—could trigger mass displacement.

The historically pro-regime bazaar merchant class (known as ‘bazaaris’) has turned on its leaders and joined in the protests calling for regime change and a Democratic transition. This is not just symbolic; bazaar strikes can paralyze commerce and signal broader elite discontent. The difference between the 2026 protests and previous protests is that the richest and poorest of Iran, the most religious and the most secular, are joining together and calling for regime change.

‘For the first time in the 47 years of struggle by the Iranian people against the Islamic Republic, the idea of returning to the period before January 1979 has become the sole demand and the central point of unity among the people. We are witnessing the most widespread presence of people from all cities and villages, on a scale unlike any previous protests. At this point, it no longer seems that we are merely protesting. We are, in fact, carrying out a revolution.’

—Mehdi Ghadimi, an Iranian journalist who spent decades protesting the regime before being forced to leave the country.

Trump has been a highly vocal supporter of the protesters in Iran. He posted on his social network, “If Iran shoots and violently kills peaceful protesters, which is their custom, the United States of America will come to their rescue. We are locked and loaded and ready to go. Thank you for your attention to this matter! President DONALD J. TRUMP.’

The Boogeyman has also tapped top Tech Bro, Elon Musk, to provide free broadband Internet access to Iran via his satellite company Starlink, as he has done for the Ukrainian and, more recently, for the Venezuelan people.

To add further economic pressure, Trump just declared in a post: ‘Effective immediately, any Country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any and all business being done with the United States of America. This Order is final and conclusive. Thank you for your attention to this matter!’ The countries most affected by this hike are China, Turkey, the UAE, Iraq, Germany, and South Korea.

Trump confirmed that Iranian officials recently reached out to propose negotiations and ‘a meeting is being set up’ between Iran’s Foreign Minister Abbas Araghchi and Trump’s special envoy Steve Witkoff. Trump recently cancelled these meetings due to the regime’s continued killing of protesters.

One reason so many took to the streets is Crown Prince Reza Pahlavi’s first-ever call to action in an Instagram post, which generated 88 million views and 3.2 million likes. Protesters burn the Islamic Republic flag and replace it with Iran’s real flag: the Lion and Sun. Pahlavi may be the figurehead of the monarchists, but our observation (as well as Trump’s) is that he does not represent the majority of Iran’s 92 million people or the millions of Iranians in the diaspora.

Our concern is that Pahlavi has no track record of creating successful businesses or institutions or of demonstrating executive and management skills. He also does not have a revolutionary infrastructure inside or outside of Iran. Yet he describes himself as ‘leader of the revolution’ and the ‘only alternative’ to the regime. His only prominence appears to stem from nostalgia for pre-revolutionary Iran.

Successful revolutionary leaders rise by being part of the great struggle, enduring the hard times, and being jailed for the cause, and are elevated by their peers to leadership for their bravery. As an example, prominent opponents of the regime include the rapper Toomaj Salehi, 2023 Nobel Peace Prize winner Narges Mohammadi, and the dissident Hossein Ronaghi, all of whom have spent months in jail under severe torture. They are examples of the true leaders and heroes of the resistance against this evil regime.

The Crown Prince does not seem to have the background or vision to be The One to lead. This is, of course, not the US’s call, but we see this choice of leadership as the biggest wild card in the pursuit of change.

Cuba will be next. Cuba’s regime is a house of cards built on precarious alliances, one of which has collapsed, and another we predict will go down. Remove the Venezuelan and Iranian pillars, and Cuba topples as well, leaving the authoritarian socialist republic economically bankrupt, diplomatically adrift, and internally agitated and brittle.

This revolution isn’t about the left or right. It is about people wanting to be a nation, rather than an ummah. The protesters want to be citizens, not soldiers of a reactionary Islamist cause that sponsors anti-West terrorist proxies all over the planet.

In the background, the emerging forces of global decentralization, driven by Web3 innovation and the shifting power dynamics it inspires, are sharpening. Iranians want to discard malignant, centralized, controlled powers once and for all, and reclaim the soul of a great nation that was, and still can be. We are praying for the rebirth of the authentic Persian culture that has given so much to civilization over thousands of years, and we are betting it happens in 2026!

O God, with your judgment endow the king, and with your justice, the king’s son; He shall govern your people with justice and your afflicted ones with judgment.

From fraud and violence he shall redeem them, and precious shall their blood be in his sight. May they be prayed for continually; day by day shall they bless him.

—Psalm 72

IPO Market Opens Up - Anthropic stages historic IPO

The two most successful IPOs in the sectors we cover in 2025 were New York-based stablecoin provider Circle Internet Group (CRCL) and New Jersey-based AI data center CoreWeave (CRWV). Circle listed in June at $31 per share, shot up to a whopping $299.99 in the first couple of weeks, then soft landed at $84.85 by year’s end, reflecting a 174% gain and the best performing tech IPO of the year award. CoreWeave listed last March at $40 per share, shot up to $187 in the first three months, swooped back down to $77.94 by year’s end, reflecting a 95% gain, and was the only VC-backed AI IPO to go public in 2025.😳

As we revealed in our best for 2025 review post, there were only 11 AI/Crypto/Robotics IPOs in the market—less than half the number we predicted. In retrospect, private AI companies were raising billions from private investors at very high valuations, so why would they need to go public?

In 2026, we are betting on the following events to help fuel a robust IPO market. (more support data here):

President Trump will announce this month that his top White House economic adviser, Kevin Hassett, will be his nominee to replace Jerome Powell as Federal Reserve Chair, whose term expires on May 15, 2026. Mr. Hassett will aggressively cut interest rates in 2026 to support Trump’s economic agenda at a faster, deeper pace than under Chairman Powell.

2026 will be the year of the AI company valuation reset for many private startups that raised later rounds at hefty prices. OpenAI (reportedly eyeing an IPO of $ 500 to $1 trillion) is one of the companies whose value will take a hit.

Considering both points above, and despite the fact that we are not fans of walled AI cloud services, we bet AI enterprise services leader Anthropic will stage a highly successful IPO early in 2026. Anthropics’ last funding round valued the company at $350 billion, which, if it holds up, would create the largest tech IPO opportunity by valuation and proceeds, rivaling Alibaba’s $231 billion valuation in 2014.

A healthy IPO market and AI company consolidation will increase the tech M&A activity in 2026 to possibly historic highs. Many companies pursue dual-track strategies, simultaneously preparing for an IPO while exploring M&A, calculating that the threat of an IPO can drive up their sale price.

Which companies will be acquired in 2026 is harder to predict, as many early-stage companies are often acquired to ‘buy talent.’ The following are the companies we believe have a solid chance of going public or engaging in a profitable M&A transaction in 2026 across the sectors we track.

Artificial Intelligence

Anthropic (2021): Develops AI research and safety-focused products, including the Claude family of large language models; top investors: Amazon, Google, Menlo Ventures, Jane Street.

Cerebras Systems (2015): Designs specialized AI processors and systems for large-scale training and inference workloads; top investors: Benchmark, Coatue Management, Altimeter Capital, Foundation Capital.

Cohere (2019): Builds enterprise-grade language models and AI tools for business applications and research; top investors: Index Ventures, Tiger Global Management, Nvidia, Salesforce Ventures.

Crusoe Energy Systems (2018): Delivers AI-optimized cloud infrastructure using wind and solar-powered data centers; top investors: Valor Equity Partners, Founders Fund, Lowercarbon Capital, Bain Capital Ventures.

Databricks (2013): Offers a unified cloud platform for big data analytics, machine learning, and AI workflows; top investors: Andreessen Horowitz, Insight Partners, Tiger Global Management, Franklin Templeton.

OpenAI (2015): Advances AI research and deployment through models like ChatGPT, focusing on transformative applications; top investors: Microsoft, Thrive Capital, Andreessen Horowitz, Sequoia Capital.

Perplexity AI (2022): Operates an AI-driven search engine delivering conversational answers with cited sources; top investors: IVP, NEA, Nvidia, Bessemer Venture Partners.

Quantinuum (2021): Provides quantum computing hardware and software for applications in drug discovery, cybersecurity, and AI; top investors: Honeywell, JPMorgan Chase, Nvidia, Mitsui & Co.

Autonomous Vehicles and Space

K2 Space (2022): Builds large, high-power satellite platforms for commercial and national security orbital missions; top investors: Redpoint Ventures, Hedosophia, Altimeter Capital, Lightspeed Venture Partners.

Nuro (2016): Develops autonomous delivery vehicles for efficient last-mile logistics and goods transportation; top investors: Greylock Partners, Tiger Global Management, SoftBank Vision Fund, Google.

SpaceX (2002): Designs reusable rockets and spacecraft for space exploration, satellite deployment, and Starlink internet; top investors: Founders Fund, Andreessen Horowitz, Sequoia Capital, Valor Equity Partners.

Blockchain Apps

Chainalysis (2014): Supplies blockchain data analytics and compliance software for crypto investigations and risk management; top investors: Accel, Paradigm, Blackstone, GIC.

Consensys (2014): Develops blockchain infrastructure tools for Ethereum, decentralized finance, and Web3 applications; top investors: ParaFi Capital, Microsoft, SoftBank Vision Fund, Temasek.

Crypto

BitGo (2013): Offers institutional-grade digital asset custody, wallets, staking, and settlement services; top investors: Goldman Sachs, Galaxy Digital, DRW Venture Capital, PayPal Ventures.

Kraken (2011): Operates a secure cryptocurrency exchange platform with trading, staking, and institutional services; top investors: Blockchain Capital, Digital Currency Group, Hummingbird Ventures, Tribe Capital.

Ledger (2014): Manufactures secure hardware wallets for cryptocurrency storage and private key management; top investors: Molten Ventures, Samsung Ventures, Digital Currency Group, Draper Esprit.

Robots and Drones

Agility Robotics (2015): Creates bipedal humanoid robots for warehouse automation and collaborative tasks; top investors: DCVC, TDK Ventures, Ford Ventures, Amazon Industrial Innovation Fund.

Anduril Industries (2017): Builds AI-powered autonomous systems and defense technologies for military and security; top investors: Founders Fund, Andreessen Horowitz, General Catalyst, 8VC.

Figure AI (2022): Develops AI-driven humanoid robots for manufacturing, logistics, and labor-intensive industries; top investors: Microsoft, OpenAI Startup Fund, Nvidia, Jeff Bezos.

Skydio (2014): Produces AI-enabled autonomous drones for inspection, defense, and public safety operations; top investors: Andreessen Horowitz, Linse Capital, NVIDIA, Axon Enterprise.

Crypto market cap exceeds $5-$6 trillion, but…

At year’s end, the total crypto market cap sat at roughly $3 trillion. We are going to stick our neck out and predict that the crypto market cap will top $5 billion in 2026. The Trump-free crypto optimism that kicked off in November 2024 drove a near-doubling in value, reaching a peak market cap of $4.2 trillion by last October. New SEC/CFTC leadership provided clarity on token rules, the GENIUS Act (signed July 2025), which enabled banks to issue stablecoins, and the expansion of crypto ETFs, including spot products for Solana, XRP, Litecoin, etc., fueled the initial boom.

Our gut says the late-2025 crypto correction suggests not all the positive benefits of the ‘free crypto’ oriented US administration are factored in. Bank-issued stablecoins are happening, broader ETF inflows are flowing, and resolved regulation turf wars will unlock trillions of new capital.

The full rollout of GENIUS/CLARITY and faith in ‘Crypto as a digital gold hedge’ will continue to boost institutional and corporate confidence in implementing Bitcoin treasury strategies. In 2021, fewer than ten public companies owned Bitcoin. At year’s end, 151 public companies owned $95 billion, rising to 164 and $148 billion when governments were included.

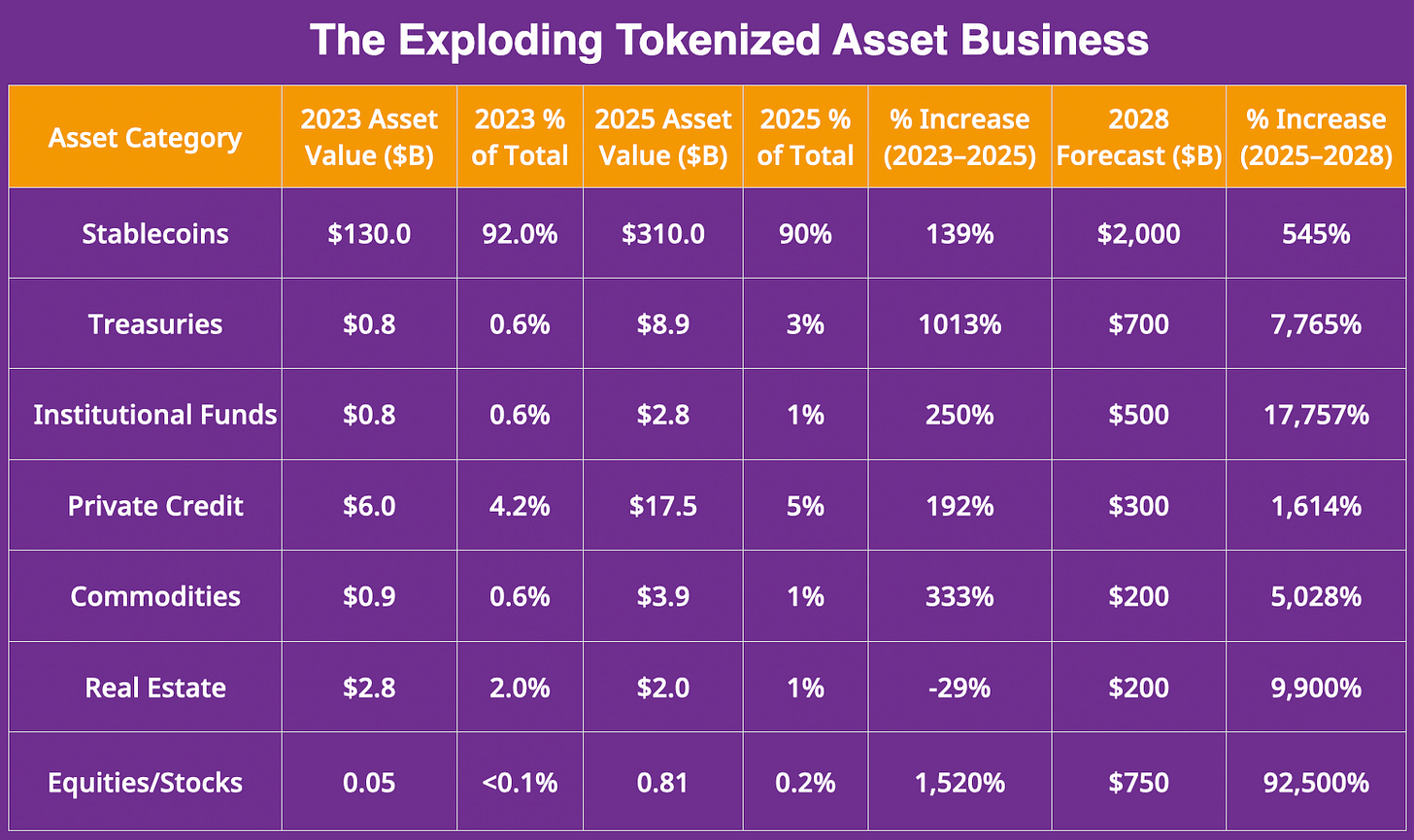

Stablecoin Explosion — Stablecoin market cap will start rapidly accelerating in 2026, with forecasts that it will more than double from $200 billion today to $500 billion by 2026, and reach $1.2 trillion by 2028, with a path to $2 trillion. This growth, in turn, creates more on-chain liquidity, which fuels DeFi, payments, and altcoin growth.

ETF Expansion and Inflows — 2025 saw ~$32 billion in total crypto ETF inflows (Bitcoin ~$21 billion, dominant); forecasts for 2026 range from $40 billion to $50 billion+ as altcoin/staking ETFs mature and advisors allocate more.

Macro Liquidity and Rate Cuts — As noted above, we predict that top White House economic adviser, Kevin Hassett, will be the new Fed Chair and will aggressively cut interest rates in 2026 amid cooling inflation and global liquidity waves.

Digital Wallet Explosion: In 2025, roughly 28% of US adults (70 million) owned active digital wallets, up from 21% in 2023. Crypto transaction volume surged ~50% from Jan-Jul 2024 to the same period in 2025, exceeding $1 trillion.

But…Mass crypto wreckage in 2026 as well

All these groovy forecasts aside, we will also see a brutal crypto blood-letting on the horizon in 2026. In each major asset and protocol class, only one or two players will win. Everyone else gets acquired or left behind. Bubble company shakeouts historically translate into lots of retail trader losses, but they are cleansing and healthy for the markets’ long-term health.

AI Revolutionizes On-Chain Security—We agree!

‘AI security and blockchain development tools are getting scary good. In 2026, picture bigger shifts toward on-chain intelligence with deterministic, verifiable rules taking over smart contract-based governance. The application will scan code in near real-time, spot logic bugs and exploits instantly, and give immediate debugging feedback. Real-time fraud detection, 95% accurate Bitcoin transaction labeling, and instant smart-contract debugging are here, detecting millions of blockchain vulnerabilities. Investment bet: The next big unicorn will be an innovative on-chain security firm that will 100x the safety game.’

The tokenization of Real World Assets (RWAs) continues…

Given all the market conditions and projections above, we forecast a ridiculous explosion in the tokenization of real-world assets (RWAs), reaching almost $4 trillion in asset value by 2028. As of January 11, 2026, tokenized RWAs, including stablecoins, represent approximately 10% of the total on-chain cryptocurrency market cap. By 2028, this share is projected to rise to upwards of 30%+.

Of particular note, 2026 is often referred to as the ‘Year of Tokenized Equities’, as the category is anticipated to accelerate dramatically, particularly when the ‘Innovation Exemption’ under the SEC’s ‘Project Crypto’ debuts this year. By 2028, tokenized equities should rank as the third-largest tokenized asset class, after Stablecoins and Treasuries. By 2030, we believe that RWA will represent over 50% of on-chain assets.

¡Viva Latinoamérica! The next startup frontier

In 2026, Latin America’s startup ecosystem will continue to experience robust growth in new company creation and venture capital funding. In 2025, Latin American innovation entrepreneurs raised $4.1 billion in VC funding, up 14.3% from $3.6 billion in 2024, with early-stage deals surging 31.9% to nearly $2 billion.

Brazil (São Paulo) led as the top LatAm hub, with $2.1 billion in VC funding (up 10.5%), while Mexico saw a 53% jump to $1.1 billion. Emerging spots like Medellín (Colombia), Lima (Peru), Santiago (Chile), and Montevideo (Uruguay) are also growing rapidly due to tech-friendly policies and high talent density.

Marcelo Claure, a Bolivian-American entrepreneur, stands out as one of the most prominent Latin American VCs investing in AI. Mr. Claure leads Bicycle Capital, Latin America’s leading growth equity fund, and previously spearheaded SoftBank’s $8 billion Latin America Fund—the region’s largest VC fund—which backed major AI-integrated tech companies like Nubank and Rappi, as well as top US companies such as OpenAI, Anthropic, and Databricks.

Emerging startup sectors include fintech, which captured over 50% of early-stage capital and remains dominant with innovations in payments, digital banking, and credit, followed by 55 AI deals and enterprise software in under-digitized areas like logistics, healthcare, and manufacturing. Cleantech and solar energy also gained traction with sizable rounds amid sustainability pushes.

This synergy positions Latin America for a booming 2026, with VC inflows potentially doubling historical highs.

We are also betting on a successful political transition in Venezuela that will, indeed, contribute to the 2026 LatAm boom, primarily by bolstering regional stability and investor confidence amid a shift toward market-friendly policies.

President Trump’s push for American oil companies to invest billions in reviving Venezuela’s deteriorated oil infrastructure has already sparked optimism among investors for broader Latin American reforms, which will unlock new capital flows into high-growth sectors like fintech and AI.

The Maduro regime change will alleviate migration pressures on neighboring startup hubs like Colombia and Brazil, as many of the 8 million Venezuelans who left the country in the largest migration in history under the Chávez/Maduro totalitarian regimes will be happily coming back home to roll up their sleeves and prosper in a free economy.

‘The EU has fined the tech companies more than $30 billion over the last 10 or 20 years. Under Biden and in the name of ‘on content moderation’ (e.g., suppressing Hunter Biden laptop stories and differing opinions on COVID vaccinations), the US government actually led the censorship attack against US companies first, and the EU just followed our government’s lead.’

—Mark Zuckerberg on the Joe Rogan Experience podcast, aired January 10, 2025)

‘The European Commission offered X an illegal secret deal: if we quietly censored speech without telling anyone, they would not fine us. The other platforms accepted that deal. X did not. After, the EU fined X $140 million for ‘transparency violations’, which is total bullshit. The EU should be abolished, and sovereignty returned to individual countries, so that governments can better represent their people.’

—Elon Musk, posted on X in July 2024

The European Union ends discriminatory censorship and billion-dollar fines targeting US tech (or else…)

The First Amendment of the US Constitution provides near-absolute protection for speech, including political expression, satire, parody, and even offensive content, unless it poses a ‘clear and present danger’ (e.g., incitement to imminent violence). Free speech within EU Member States, on the other hand, carries vague ‘duties and responsibilities’ that limit such expressions as Holocaust denial, blasphemy, or ‘insults’ to public figures.😳

In December, the U.S. State Department imposed visa bans on former EU Commissioner Thierry Breton (2019–2024), the key architect of the DSA, and four other Europeans: Amran Ahmed (Center for Countering Digital Hate), Clare Melford (Global Disinformation Index), German activists Josephine Ballon and Anna-Lena von Hodenberg (HateAid). All are accused of leading efforts to censor and fine US tech companies and suppress American viewpoints. French President Emmanuel Macron, quite ironically, condemned the move as ‘coercion,’ ‘intimidation,’ and an attack on European regulatory autonomy.🤔

The EU’s Digital Services Act exemplifies this divide, and disproportionately targets American companies (e.g., 83% of GDPR fines) like Apple, Meta, Google, Amazon, and X, who have been forced to pay over $16 billion for not managing ‘systemic risks’ like disinformation, hate speech, and illegal content over the last decade. These figures exclude compliance costs (~$2.2 billion annually) and potential revenue losses (~$32.9 billion) in 2024 alone.

These EU penalties and regulations are clearly discriminatory, censorship,’ harassment, and a threat to US innovation and national security. Our bet is that the Trump administration will respond in 2026 with retaliatory measures such as tariffs, fees, or market restrictions on European firms, and that this could escalate into a full-blown transatlantic trade conflict. The US Trade Representative has already warned that the US will use ‘every tool at its disposal’ to counter these EU fines, and has specifically named European companies such as Spotify, Mistral AI, SAP, and Accenture as potential targets for US fees or restrictions. Ultimately, we are betting the EU will back down to avoid harming its own economy.

Celebrities out, niche, expert-influencers are in

In 2026, the tide is turning decisively against global celebrity influencers, as public backlash intensifies over tone-deaf displays of extravagance and scandals that dominated 2025. This fatigue, amplified by constant exposure on social media, has eroded the mystique and trust in celebrity influencers, leading audiences to seek more substance and authenticity.

Large and small brands will continue pivoting to niche, expert-influencers (1,000-10,000 followers) and micro-influencers (10,000-100,000), who boast engagement rates by 3-6%—topping the 1-2% of celebrities—and offering a 2-5x better ROI. Niche-influencer support also builds more loyalty and genuine trust in targeted demographics at much lower collaboration costs.

Emerging decentralized social networks like Cryptonite (see below) will increasingly enable more peer-to-peer knowledge exchange, supported by crypto token rewards. AI matchmaking will also enable brands to find the best experts in their niche and automate their marketing content pipelines while maintaining a personal feel.

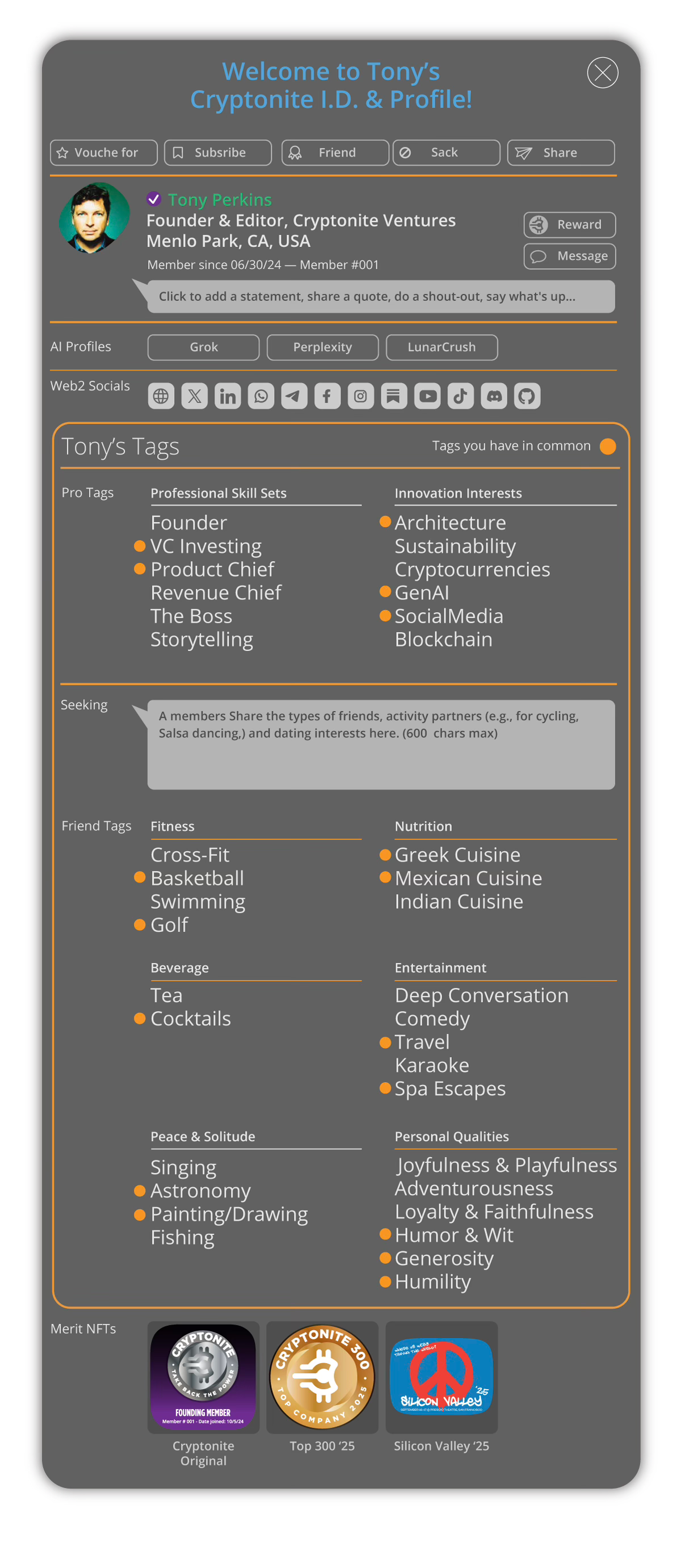

Cryptonite—The first fully web3 social network

Pardon our immodesty, but our final prediction for 2026 is that Cryptonite will launch the first Web3 social network to truly empower innovators with decentralization, ownership, privacy, and real economic alignment through our native

True ownership & zero exploitation — Decentralized control of member data, content, and connections on Solana — no Big Tech selling your info, or de-platforming risks, just full sovereignty in a purpose-built network for ambitious professionals

Daily tokenized rewards & economic alignment — Active members earn $CPRO bonuses every day for top contributions (following the 80/20 social network rule), and subscribe to Wizards and experts, tip via encrypted chats, stake for yields, enjoy discounts, and turn their expertise and influence into real, on-chain wealth

Instant AI-powered profiles & CVs — Grok and Perplexity integrations auto-generate stunning, real-time professional resumes, tags, and bios for you, your company, or investors — enabling members to stand out instantly in the most powerful global innovator network

Absolute privacy with on-device Personal AI Search — Members enjoy an exclusive, fully local LLM assistant running entirely on their own phone (offline-capable, unlimited queries, zero data leaks) for secure brainstorming on business modeling, fundraising, crypto strategies, or anything sensitive — no Big Tech servers, no spying

AI-driven matchmaking & expert connections — Smart algorithms filter and connect members to Wizards, investors, collaborators, and opportunities based on profile, professional connections, and network power — turning serendipity into high-value deals and partnerships

Military-grade privacy meets Web3 transparency — End-to-end encrypted XMTP messaging, multisig Squads treasuries, audited on-chain vesting/staking, and fully verifiable $CPRO distributions with the goal to build unbreakable trust while keeping personal AI and queries 100% private

Our promise is that Cryptonite will help ambitious professionals stay relevant in 2026 and beyond by combining Web3 utility with real social utility fueled by $CPRO, the currency of innovative expertise, and connections. 🚀

Be a Cryptonite Original !

Join the team producing the world’s first true Web3 professional + friend social network. We invite our most loyal Cryptonite Rap readers to join us in this historic journey. Become a Cryptonite Original!

Exclusive & strictly limited offer!

Buy CPRO at $0.01 — the absolute lowest price ever.

→ Doubles to $0.02 at early 2026 launch

→ $0.025 at full V1 rollout (Q2 2026)Be one of the first 5,000 Cryptonite Originals.

Claim your tokens + exclusive ‘Original” NFT badge now before this $0.01 window closes forever.