U.S. PRESENCE :: CRYPTO REGULATION VS. INTERNET REGULATION

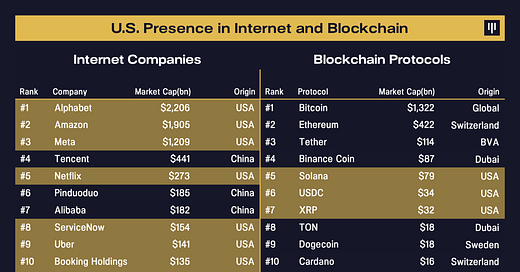

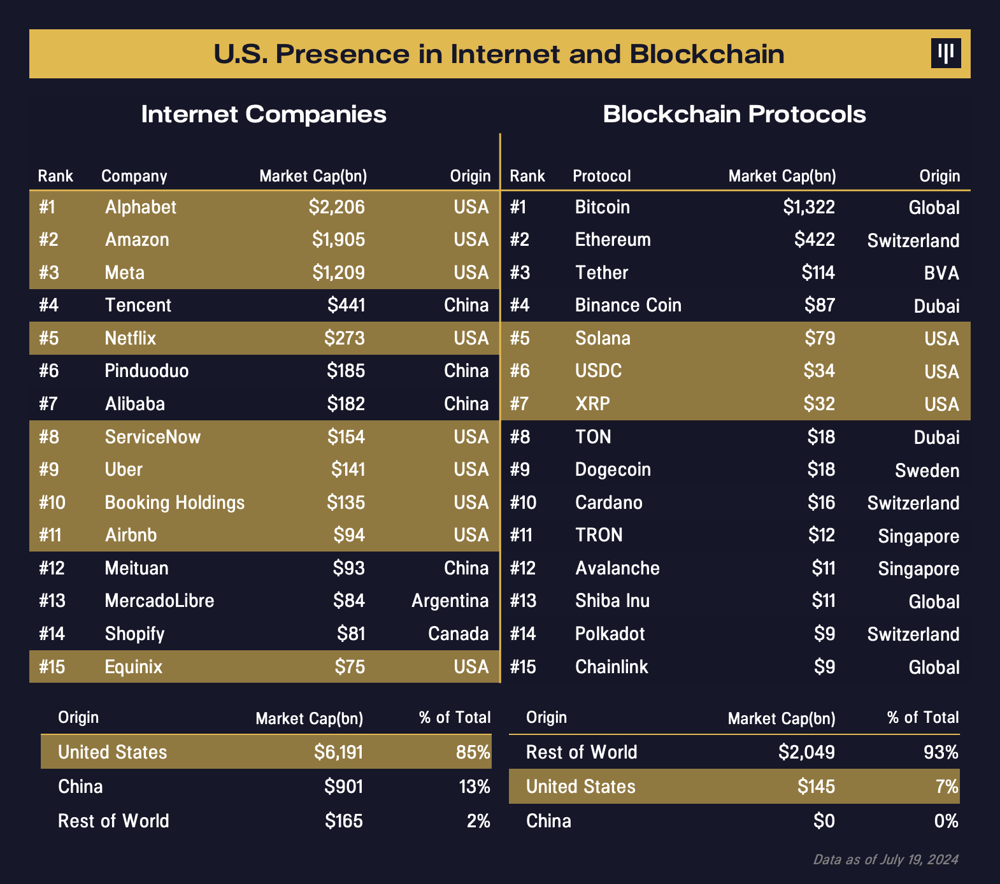

The prior stance of crypto-asset regulation is the polar opposite of the rest of the internet.

The U.S. government literally built the internet (ARPANET, which celebrated the 50th anniversary of TCP/IP last year). The U.S. government then empowered early internet companies with a myriad of Congressional advantages. In particular, the U.S. gave them safe harbor against regulation and provided an 8.25% discount versus their brick-and-mortar competitors via no sales tax. The result is that all of the largest internet companies in the world are in the United States (or essentially Chinese copies of them).

So far in the blockchain era, the U.S.’ regulatory approach has had the opposite effect. It scared 95% of blockchain trading to move offshore to the Bahamas and opaque firms like FTX instead of being regulated in the US. Similarly, 93% of the market cap of blockchain protocols are in projects domiciled outside of the United States.

ALIGNMENT OF INTEREST

I love this bit. Literally the next words from his mouth from the mid-sentence quotation above was:

“The other thing is, I did things like NFTs and, you know, stuff. And I noticed that 80% of the money was paid in crypto. It was incredible. So, NFTs are, you know, I did the — very successful. We had one year to sell it out and it sold out in one day. The whole thing sold out: 45,000 of the cards. And I did it three times [and] I’m going to do another one, because the people want me to do another one. It’s unbelievable spirit. Beautiful. But the thing I really noticed was everything was paid in — I would say almost all of it was paid in crypto, in this new currency. And it opened my eyes.

“So we have a good foundation. It’s a baby. It’s an infant right now. But I don’t want to be responsible for allowing another country to take over this sphere. And so I think we’re going to be good. Also, I’ve gotten to know people in the industry, they’re top-flight people. And you ask Jamie Dimon, Jamie Dimon was, you know, very negative and now all of a sudden he’s changed his tune a little bit.”

– The Donald Trump Interview, Bloomberg Businessweek, July 16, 2024

Headline

Speaking of toppling totalitarian regimes

—Anthony Perkins, founder & editor Cryptonite

Did you know?

(Overheard on the streets of the global Silicon Valley. Got any hot insider tips? Email us editor@cryptoniteventures.com)

Billionaire Boys & Girls Club

Tesla CEO Elon Musk zinged Dallas Mavericks …

UnSocial Networking

Start typing here…

VC Whispers

Early-stage VC deal value jumped by 56.9% QoQ, notching $16B in Q2—but the figure may be buoyed by select outsized deals.

The pace of dealmaking remains sluggish, suggesting a flattening of deal activity.

2024 has a mere total of 35 public listings so far, and the lack of exits continues to weigh on LP liquidity constraints.

Fundraising activity remains diminished, with established firms commanding an advantage when securing LP commitments.

Silicon Valley '24—Coming live this summer!

Join us at Silicon Valley ‘24 this summer in Silicon Valley and broadcast around the world. The dates and location are to be announced soon. Sponsored by Draper Associates & Draper University and produced by Cryptonite Ventures.

AI Tracker

AI is coming for the centuries-old legal profession, an area once written off by venture capitalists as uninvestable.

Legal-tech startups offer software, platforms and services intended to help law firms with research and operations.

But the legal profession is entrenched in old habits, making it a hard group to sell to. Laws and regulations also vary widely among jurisdictions, compounding the challenge of making a product at scale. But perhaps the biggest hurdle has been a perceived threat that technology poses to the legal industry’s revenue model of billable hours, as simplifying processes may curb profits.

All of this appears to be changing, though, as the rise of generative AI drives an unprecedented flow of capital into legal tech.

“It feels like for the first time we’re the popular kids,” said Zach Posner, co-founder and managing director at The LegalTech Fund, which, according to PitchBook data, is a top investor in legal-related startups.

Now some of the venture industry’s biggest players are making sizable bets. Harvey, the developer of an all-encompassing AI platform for researching and drafting legal documents, just raised a $100 million Series C led by GV at a $1.5 billion valuation, with additional backing from investors including OpenAI, Sequoia and Elad Gil.

Also on Tuesday, Canadian legal-tech company Clio raised a $900 million Series F, valuing the company at $3 billion. NEA led the deal.

After slow, mostly static growth, investments in legal-tech startups have taken off as advances in AI give the vertical a shot in the arm. This year, deal value had already hit nearly $1 billion prior to the Harvey and Clio deals, surpassing last year’s annual sum of roughly $960 million. In Q2 alone, investors committed $354.4 million to 55 deals.

Pointing to a flood of companies chasing the opportunity, Posner estimated nearly 100% growth in new legal-tech companies being founded compared to last year. At the same time, he said, more high-profile venture firms are contacting his team for help in their efforts to tackle the legal-tech market.

“It feels like everyone looked at legal before and said, ‘Why would you do that?’” Posner said. “Now it’s like, ‘Oh my God these are hot companies.’”

But in a field where precision and accuracy are paramount and the risks of AI-created errors are very real, what’s driving the excitement and growth?

For one thing, some VCs and startups are taking an approach that’s more measured—and less hype-focused.

By emphasizing AI’s fallibility up front and taking a hybrid approach to applying the new technology to existing services, some founders and their backers aim to keep their pitches more rooted. Posner said the slow and steady approach of easing into AI is one of the key reasons startups are finding traction with legal firms and attracting investor interest.

“The way I look at it is, do you want to experiment with an entire company or do you want to experiment with a product that is tried and true with a little bit of [a large language model] on top?” Posner said. “You can’t rely on this right now 100%.”

Hammers, not gavels

As investors look for startups addressing specific needs, legal tech has provided an answer for many them.

“When these large language models first came out, it was like everyone was running around trying to use these transformative models like a hammer,” said Kory Jeffrey, an investor at Inovia Capital, which led a $20 million Series A in January for Spellbook, an AI legal-tech startup focused on reviewing and drafting contracts. “Everything looks like a nail and you end up hitting things that aren’t nails.”

Jeffrey said that one of the promising aspects of AI legal tech is the opportunity the technology brings to open up more services to people. Given the sky-high costs of legal services, startups that can create documents like wills and leases could lower costs and allow more people to access service.

“This idea of democratizing services to people who are typically underserved, that excites me,” Jeffrey said. “The more distribution of this technology, the better outcomes for everyday people.”

Artificial versus intelligence

For Max Junestrand, CEO and co-founder of legal AI startup Leya, the calls from investors didn’t stop after closing their seed round—they accelerated. Based in Stockholm, Leya offers an AI assistant for lawyers that analyzes documents and generates briefs. In May, Leya raised $10.5 million in seed funding led by Benchmark and backed by SV Angel, Y Combinator and Hummingbird.

Just two months later, in mid-July, the startup secured a $25 million Series A led by Redpoint Ventures and joined by backers including Benchmark. The amount of investor outreach, according to Junestrand, only picked up after Leya’s seed round.

Junestrand said Leya is gaining traction because its software was built directly in tandem with law offices. He said that making central the needs of lawyers and promising actual utility was key in company growth and attracting investors. He also emphasized that every step of the way managing expectations has been crucial to nabbing clients and getting backers on board.

“The market has been over promised before and it didn’t deliver,” Junestrand said. “The last AI wave was more artificial than intelligent.”

OnHollywood

As Shari Redstone decides…

The Science of Life

Start typing here…

Going Green

Bill Gates-backed climate VC Breakthrough Energy Ventures has gathered $839 million in its effort to raise the firm’s third flagship fund, according to a regulatory filing, making it the largest climate fund raised so far this year.

Kirkland, Wash.-based Breakthrough launched its BEV III fund in July 2023, having closed its 2021 vintage second fund at $1 billion.

The final target amount for the fund close is unclear. Breakthrough didn’t respond to a request for comment.

LPs have indicated a bullish stance on early-stage climate funds even as they have simultaneously retreated from other sectors in venture. In the first half of 2024, climate dedicated funds attracted nearly 5% of all LP capital commitments globally, according to PitchBook’s 2024 Climate Tech Funds Report.

But early stage climate investing comes with significant risks, notably the long time horizon for exits and the significant capital required to scale novel hardware technologies.

Founded in 2015 by Gates, Breakthrough was one of the first VC funds dedicated solely to climate bets. That unique approach, and Gates’ connections in the climate world, catapulted Breakthrough into the ranks of leading early-stage investors just as climate dealmaking took off in 2020.

Breakthrough has made early bets on several now-prominent climate startups. It led Boston Metal‘s Series A at a $55 million valuation (last valued in 2023 at $860 million), Redwood Materials’ Series B at a $217 million valuation (last valued in 2023 at $5.25 billion) and Pivot Bio‘s Series B at a $200 million valuation (last valued in 2021 at $1.7 billion).

Best on the Block

Start typing here…

Follow the Crypto

Visa-backed crypto project to launch ‘fair’ token…

Space Shots

China and India scored moon landings…

Robots on the March

Mytra, a robotics company for warehouse automation, launched from stealth Tuesday with $78 million raised across three rounds, including a $50 million Series B led by Greenoaks. The company declined to disclose a valuation.

The logistics business, which is revenue-generating, was incubated by Eclipse Ventures, a VC firm focused on investments in physical industries. Its 3D robotics system automates moving and storing materials in warehouses.

Mytra joins a rapidly growing group of startups developing AI-enabled robotics, an emerging technology that is bolstering an otherwise slow dealmaking landscape for warehouse and supply chain technology. In the first half of 2024, warehousing-tech startups raised $298 million—compared to $451.6 million in the first half of 2023, according to PitchBook data.

But even as VCs retreat from the supply chain, AI-enabled robotics for warehouses remains hot, seen as a viable, practical application for generative AI technology in the physical world. Covariant, co-founded by OpenAI research veterans, has raised more than $220 million in total capital for its warehouse robotics picking technology. Earlier this month, Standard Bots, a developer of robotic arms for manufacturing, raised a $63 million Series B led by General Catalyst.

The idea for Mytra originated on co-founder Chris Walti’s notepad in early 2022, according to Seth Winterroth, a partner at Eclipse, which led the company’s seed and Series A rounds.

Walti then worked out of Eclipse’s offices throughout the summer of 2022 to develop his idea for the startup through customer conversations, an incubation model that Eclipse has replicated with roughly a dozen of its portfolio companies.

Walti previously led Tesla‘s Optimus project, which is developing a humanoid robot. Mytra co-founder Ahmad Baitalmal most recently headed up factory software at Rivian.

Mytra’s production system is in market with its first customers and has a “massive backlog of business that we’re ready to fulfill over the next two or three years,” Winterroth said.

The next stage of Mytra’s growth will involve reducing the company’s cost structure and working toward unit economics, he added: “We want to get to this place where the merits of the business are underwritten purely by looking at the financials alone.” Winterroth declined to share details on the company’s revenue growth.

In the Chips

Tesla robot ATTACKS an engineer…

Straight outta Silicon Valley

Start typing here…

Know Thy Enemy

Since its foundation in 1948, North Korea…

Chaos & Complexity

Start typing here…

Gen Z

Start typing here…

What the Math Says

Start typing here…

Pura Vida (pure life)

We are honored to feature…

Current Wisdom

Start typing here…