Are the VCs funding the noose with which China will hang us?

Under pressure from the top dogs in Washington and Beijing, VC power couple Sequoia Capital and Sequoia China broke up. It's now official—The AI Race is on and so is an emerging Cold War with China.

The Separation of East and West

On June 6th, the venerable Silicon Valley VC fund Sequoia Capital confirmed it was severing all connections with its hugely successful partner Sequoia Capital China. Founded by Neil Shen Nanpeng in 2005, Sequoia China, like its Silicon Valley partner, is the most dominant and successful VC fund in its country. Mr. Shen and the 42 managing directors, partners, and senior executives listed on the Sequoia China site have invested in over 400 projects in China since 2019, including 19 this year in a depressed VC environment. Last year, Sequoia China raised $8.5 billion of fresh capital to pour into tech startups in the Chinese Communist Party (CCP)-controlled country.

Also left on Sequoia's cutting room floor was Sequoia's Indian and Southeast Asian business, led by Shailendra Singh. This severance with India seems more like a case of collateral damage than geopolitics, as Seqoia's partnership with the China fund is what's on the US government's mind. Either way, by March 2024, all three entities will no longer share investors, profits, and back-office operations. The break-up also ends a practice of Sequoia regional partners investing in each other's deals. The Chinese fund has been rebranded as HongShan ("redwood" in Mandarin), while India and Southeast Asia fund is now called Peak XV Partners.

"The Beijing Academy of Artificial Intelligence [established by China's Ministry of Science and Technology in 2018] is far ahead of all AI competitors except for Open AI and Google. The gap is almost always measured in months, not years. We should absolutely assume, and even expect, that certain nation-states will use AI to launch increasingly powerful and disruptive cyberattacks and other harmful cyber influence operations."

—Brad Smith, Vice Chair and President, Microsoft

Sequoia’s monumental decoupling announcement signals a break between US VCs and China and a new era of competition between the US and China at the highest levels. The AI race has begun, and a Cold War mentality is rising. On the VC front, it also begs the question of whether or not the US investors have been blinded by their pursuit of profits and wealth and failed to consider that, unlike US companies, Chinese-owned companies are required by the CCP to support the People’s Liberation Army. This is incredibly daunting given that these Chinese companies are developing AI tools, semiconductors, drones, robots, and biometric tracking platforms, e.g., TikTok, that serve as weapons in the CCP’s pursuit of world domination.

When the break-ups were announced, Silicon Valley insiders were buzzing about what was up, mainly about the China fund, which has been very successful, and whether Sequoia was running scared. Mr. Shen is too good to kiss goodbye, as his ROI has been just as good, probably better than the home team. Mr. Shen bet early on some of China's most successful technology companies, including Alibaba, TikTok parent ByteDance, Meituan, a delivery super-app, and Pinduoduo, an e-commerce giant. His successes made him a billionaire while handsomely enriching Sequoia's US partners and investors.

Mr. Shen, for example, brought Sequoia’s global growth fund early into the Pinduoduo deal, where filings show U.S. partner Doug Leone has already personally cashed out 8 million of Pinduoduo shares worth over $600 million at today’s market price.

In an interview with Financial Times, Sequoia Capital boss Roelof Botha obliquely explained, “When I joined Sequoia in 2003, these businesses in China did not exist. They are now flourishing businesses in their categories. The number of years that have elapsed since we embarked on this is the same as that between World War I and World War II.” Mr. Botha says that Sequoia is now pursuing a “local first” strategy in a world that has become “increasingly complex to run a decentralized global investment business.” He also cited the pitfalls of a centralized back office for a decentralized set of funds.

Mr. Shen agreed with his former partner in the Financial Times article that the different Sequoia funds have much less in common now and that conversations about splitting the businesses are mutual and have been evolving over the last two to three years.

Under the covers, there is a lot more to this story than Mr. Botha's and Mr. Shen's talking points. When you observe the notoriously ego-driven cowboy capitalists from the world's most successful venture capital empire publicly concede they don't have the smarts or wherewithal to successfully navigate the challenges of investing across the world's two biggest markets outside the US, it doesn’t quite seem to add up. Nor that Sequoia would easily walk away from such gigantic cash returns orchestrated by the obviously brilliant and highly networked Mr. Shen. Status in Silicon Valley is measured in the billions, after all, and China was keeping the Menlo Park boys on top of the Forbes 400 list of wealthiest people in the U.S.

If you have any inside scoop on the deal, send a confidential message to our editors here.

The China Dragon continues to rear its ugly head

Before we dig further, let’s talk about the current state and antics of CCP and why they continue to be the world’s greatest threat. There is no more extreme example of centralized power than the CCP’s seven-man Politburo Standing Committee, with one clear supreme master—the current General Secretary Xi Jinping—the most powerful CCP leader since Mao Zedong.

The totalitarian regime’s primary offensive moves to supplant the U.S. as the world’s preeminent power have been quite clear for some time and include:

Surreptitiously tracking its people, gathering and storing personal data at home and abroad, including biometric data, assigning each a ‘social score’ according to their ‘loyalty,’ and handing out punishments and rewards based on their allegiance to the CCP.

Maintaining a relentless campaign to steal the world’s most valuable intellectual property, government secrets, and academic information through any means they can.

Planting functionaries throughout transnational organizations, such as the World Trade and World Health Organizations.

Bullying and waging a commercial war against Asian democracies such as Japan, South Korea, India, and Australia.

Beefing up its military, planting island bases in international waters, and gaining control over the world’s commercial chokepoints from the Suez to the Panama Canal.

Compromising strategically important nations via multi-trillion dollar investments in over 70 countries' infrastructures through its neo-colonial and imperialist Belt and Road Initiative.

The Belt and Road Initiative is considered the centerpiece of Communist Party Chief President Xi Jinping’s foreign policy, which initially announced the strategy as the ‘Silk Road Economic Belt’ on a visit to Kazakhstan in September 2013.

Palantir co-founder Peter Thiel warned in his New York Times editorial, ‘In 2017 Xi Jinping added the principle of ‘civil-military fusion’ to the CCP’s constitution,’ which mandates that all research and intellectual property in China be shared with the People’s Liberation Army to do with what they wish. In other words, all roads lead back to the Pigs running the farm.

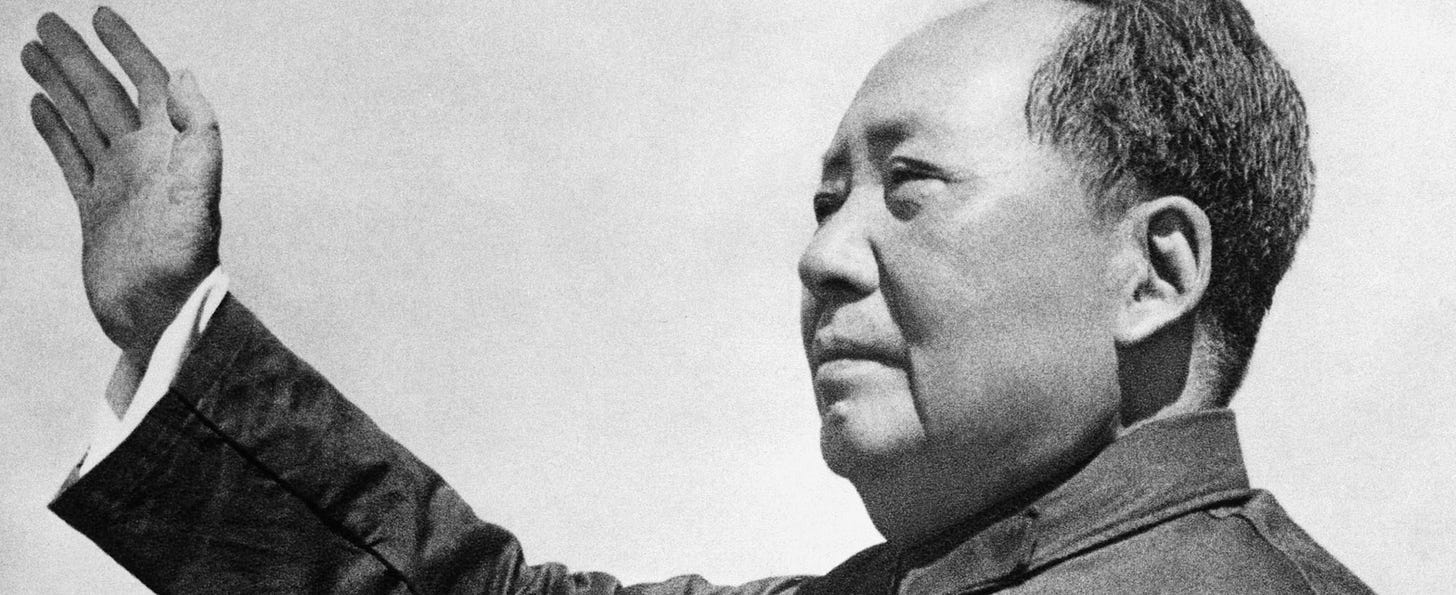

Mao Zedong and the Founding of the Chinese Communist Party (CCP)

Following Japan's defeat in World War II, the Chinese Civil War resumed. The CCP, under Mao Zedong's leadership, gradually gained the upper hand over the Nationalist Party, or Kuomintang (KMT). On October 1st, 1949, Mao proclaimed the establishment of the People's Republic of China. KMT leader Chiang Kai-shek and the remaining forces retreated to Taiwan. Mao's 'Great Leap Forward,' policies that followed resulted in widespread famine and economic difficulties, and his "Cultural Revolution, which lasted until Mao died in 1976, led to widespread chaos, political purges, and the suppression of intellectuals. In the end Mao’s intitiatives were resposnible for killing 80 million Chinese people.

Most tragically, the CCP is engaged in a sweeping genocidal campaign to curb its Muslim population by cutting Uyghur births with IUDs, abortion, and sterilization. Even the Uyghur diaspora lives in fear of the Chinese state.

The CCP’s treatment of the Uyghurs should inform our China policy as it demonstrates they are still in step with the Communist manifesto under which the former Chairman of the CCP, Mao Zedong (in power from 1943 – 1976), was responsible for murdering an estimated 80 million his people through forced starvation, persecution, prison labor, and mass executions.

“Silicon Valley tech leaders are acting with some combination of wishful thinking and blind profit motivation. They have become useful idiots — the Chinese Communist Party's fifth-column collaborators. If you think of it regarding human rights and what they are doing to the Uyghurs, it's profoundly racist. It's like saying they don't have the same rights because they look different. There is something super wrong going on here.”

—Palantir cofounder Peter Thiel, April 7th, 2021, @ Seminar On China

The bottom line is this is what we are dealing with, and when you look at how the Chinese government is treating its citizens, you can only imagine what the CCP would do for us if they could.

Note to readers: Our critique in this post is entirely focused on the policies and practices of the CCP and its National People’s Congress (NPC) party leaders and not the Chinese people in general, who clearly have no power or control over their government. At the end of 2021, CCP membership was 96.7 million, representing about 6.9 percent of the Chinese population, the NPC has 2,980 deputies, and China’s population is close to 1.5 billion.

Why Sequoia's capitalist dance with China is done

A myriad of overlapping geopolitical pressures and internal circumstances drove the decoupling of the mighty Sequoias. Here is a summary of corporate media reports and Silicon Valley insiders’ speculation regarding the Sequoia split.

Over the last six months, Washington has finally become fully enlightened that the AI arms race with China is rapidly accelerating; and part of the reason is that US VCs like Sequoia Capital have been funding the Chinese competition. Sequoia China has therefore faced increased political scrutiny in the US for its investments in Chinese companies that Washington alleges pose a national security. Sequoia investments with that profile include the sanctioned drone maker DJI and AI startup DeepGlint, accused of facilitating surveillance of Uyghurs in Xinjiang.

Beijing is also increasingly suspicious of US money invested in sensitive sectors and digital infrastructure. Like the US, the Chinese government considers investment and research in particular projects as national security matters.

Sequoia China's backing of ByteDance (producer of TikTok) is also a concern. The US has threatened to ban its video clip-driven social networking app because TikTok maps its global users' biometric data and relationships and sends this confidential data back to China.

By every metric you can imagine, Sequoia is an amazing story of American innovation and capitalism Many of its companies are doing amazing things and are even helping the Pentagon to develop and to apply cutting-edge technologies. But—and this is a very big “but”—some of its investments are also in companies that are helping the Chinese military to develop and to field technologies that will directly threaten U.S. personnel and interests. 4Paradigm is one such company.

4Paradigm is one of China’s leading artificial intelligence (AI) companies and specializes in applying AI across large enterprises. The company is currently helping the Chinese military deploy its Sage HyperCycle capability, a “automatic decision-making machine learning platform.” The Chinese navy, as just one example, is thought to be using this platform for combat tasking and “intelligent loss management.” Put simply: If the United States were to go to war with China, this software suite would likely be used by the Chinese to kill our sailors and to defeat our ships. Sequoia is the company’s largest foreign investor, and this is only one of their problematic investments.”

—Klon Kitchen, Senior Fellow, American Enterprise Institute

Insiders say Sequoia has faced much US government pressure about its China business, which the VC fund has yet to comment on. A senior cybersecurity source told THE TIMES, "There are definitely conversations around, 'How do we punish Sequoia?" The Sequoia break-up is viewed by many in DC as a win for the Biden administration.

The Biden administration is expected to sign an executive order soon to limit the ability of US firms to bankroll critical technologies in China, including semiconductors and AI. The measure targets the practices that helped Sequoia generate billions in profits overseas for over 15 years.

According to a Bloomberg report, when government concerns over TikTok started heating up, Sequoia sought out more help on the Hill. It began to look like Sequoia was trying too hard to influence US policy, and they found themselves in Washington's crosshairs. Sequoia has been contending they do not control every decision Sequoia China makes, but it's obvious they a reaping huge profits from the China affiliate.

Representative Mike Gallagher, a Wisconsin Republican and the Chairman of the House Select Committee on Competition with China, stated that Sequoia's decision to split operations does not resolve his concerns "You can rebrand and restructure all you want, but American capital should not fund PLA military modernization or the CCP's techno-totalitarian surveillance state. Period," he said. "We need strong outbound investment restrictions to ensure we aren't funding our destruction."

Lucky for the Sequoia partners and longtime LPs, including the University of Michigan endowment, the University of California regents, and a Massachusetts Institute of Technology retirement plan, the new bill's latest version is not retroactive. That means the fund and its LPs can still retain their shares in hundreds of startups they've been bankrolling for years by investing in Sequoia China.

In the US, Mr. Shen is a trustee at the Asia Society, an influential non-profit organization, and was named chairman of the Yale School of Management Board of Advisers in 2021. In China, he was the only venture capital industry representative appointed to the Chinese People's Political Consultative Conference, serving as the top political advisory body for the Chinese government from 2018 to 2022. However, Shen's advantage in working on both sides has become under scrutiny as the animosity between Beijing and Washington intensifies.

Internally there were growing cracks in the relationship between Sequoia East and West. While the partnership helped make Mr. Shen a billionaire, China's outsized contributions to the profit-sharing pool started agitating Mr. Shen over the last few years

The break-up also allows Mr. Shen to move more freely and invest in deals without worrying about political pressure from Sequoia or the US government. With billions of dollars from US investors in his pocket, Mr. Shen has had to balance the pressure to invest in Beijing's priority areas, such as semiconductors and artificial intelligence, while staying on the right side of Washington's push to control exporting sensitive technologies to China.

In 2022, when Doug Leone handed the Sequoia leadership baton over to Roelof Botha, insiders speculate that the firm's investment pendulum began to swing away from China. Mr. Leone has been a leading proponent of a close relationship, while Mr. Botha is on record as saying, “local first.” Like VC fund managers, it's also possible that Sequoia’s LPs are scaling back their China exposure amid geopolitical tensions and putting pressure on them to do the same.

China will remain the top threat to US technological competitiveness as Beijing targets key sectors and proprietary commercial and military technology from US and allied companies and institutions. Beijing uses a variety of tools, from public investment to espionage, to advance its technological capabilities. Beijing's willingness to use espionage, subsidies, and trade policy to give its firms a competitive advantage represents an ongoing challenge for the US economy and its workers and advances Beijing's ability to assume leadership of the world's technological advancement and standards.

—Jake Sullivan, national security advisor to President Joe Biden.

The Sequoia partners have switched to a defensive posture to protect themselves from any allegations from the Department of Justice or SEC. Sequoia’s following reported activities all point to a team bolstering their defense.

Sequoia has reportedly contracted Beacon Global Strategies, a national security advisory firm, to help screen deals for national security risk and help the fund navigate an increasingly hardline approach by the Biden administration.

On June 15th, Sequoia Capital announced it had led a $5.7 million seed round investment in US defense startup Mach Industries. Partners Shaun Maguire and Stephanie Zhan led the investment for Sequoia. Mr. Maguire and Mach promoted the deal as Sequoia's 'first-ever defense tech investment." Interesting timing and PR framing, to say the least.

All over Twitter is chatter about Mr. Leone's political donations and with the assumption it's an attempt to bolster Sequoia's influence in D.C. One filing record reprint on tweet shows that between 2021 and 2023, Mr. Leone has donated $1.9 million to the [Republican] Senate Leadership Fund, $1.4 million to the [Kevin] McCarthy Victory Fund, and $217,400 to the [Republican] Congressional Leadership Fund. Despite these big donation numbers, Mr. Leone has been a longtime donor to the Republican Party, so these contributions fit his pattern. He was also one of Donal Trump's best friends and donors in Silicon Valley until he publicly denounced the former President after the January 6th debacle.

Sequoia has remained largely off the record with corporate media and positioned the decoupling from China more about operational issues and other complexities involved in transacting internationally rather than any real mention of geopolitics or government pressure.

Another conspiracy floating around the Internet by tech insiders is whether or not the '"deep state" is working with heavily Sequoia-backed TikTok to distribute misinformation to manipulate the upcoming US presidential election. This suggestion would have seemed laughable a few years back, but with the release of the 'Twitter Files' that showed dozens of FBI agents offered Twitter executives top secret info to guide 2020 election censorship, who knows what is going on anymore?

However these relationships sort out, and how the government reacts over time is anyone's guess. We can be sure that Sequoia will maintain a very low profile, especially as we move into the 2024 presidential election cycle.

The China Gold Rush Is Over For US VCs

When China joined the World Trade Organization in 2001, and its middle class began to boom along with its consumer buying power, a growing set of US VCs began to see the market opportunities in mainland China. By 2005, China’s nascent Internet industry was crying out for venture capital funding. Sequoia Capital was among the first to see this opportunity and has been the most aggressive American investor in the Chinese tech scene. Since 2019, Sequoia and a superset of Asia-friendly US VCs have invested over a trillion dollars into Chinese companies. But as the table below shows, US venture capital funding for China startups has come to a halt.

All U.S.-based investors in China have significantly slowed their investment pace in the region in recent years, according to Crunchbase.

GGV Capital from Menlo Park is the US VC that has invested in the most deals in China since 2019, with 133 company bets. After making 24 investments last year, GGV has made two in Chinese companies so far this year, per Crunchbase data.

Another Menlo Park firm, BlueRun Ventures — formerly Nokia VC — has made 71 investments since 2019, with 19 last year and none this year.

San Francisco-based sports tech and online gaming-focused firm GL Ventures have made 62 deals in China since 2020 but only 11 in the past 16 months.

Palo Alto, California-based GSR Ventures, which focuses on early-stage technology companies developing AI-enabled tech, has completed 60 deals in China since 2019 but only 13 in the past 16 months.

SOSV and OrbiMed announced more than 40 deals each in the past four-plus years, but only one deal combined this calendar year.

Founded in 1996, with offices in Menlo Park, Beijing, and Tokyo, DCM Ventures has invested in Chinese companies longer than any other US VC fund. Their sites show almost 100 active investments in Chinese companies.

Everything started to change when COVID hit; the media and Americans, in general, became more suspicious of whether or not China was reporting the truth about where the virus came from and how long they knew about it. “The COVID virus led to a drying up of foreign capital, as LPs started to change their perspective about investing in China,’ observes Hurst Lin, general partner and head of DCM’s China office since 2006.

Mr. Lin also acknowledges that Chinese regulations around tech companies and the growing difficulties for China startups to go public on foreign exchanges also affected investor interest. With shrinking access to foreign exchanges, the Hong Kong exchanges have tried to fill the gap. Given the mistrust for TikTok in the US, its parent company ByteDance is said to be planning an initial public offering on the Hong Kong exchange, as an example.

In addition to external events, such as COVID and the growing awareness of AI’s accelerating capabilities, Sequoia’s move is perceived as a harbinger of the VC world. One thing seems clear: funds with China ambitions are seriously rethinking their strategies.

The Cryptonite Take

Even our dizzy president, whom many suspect might be comprised by a family whose done business in China for years, is calling it like it is. Joe Biden called President Xi Jinping a dictator at a June 21st fundraising event in California, a day after US Secretary of State Antony Blinken met Mr. Xi in Beijing with the aim of easing tensions. "Xi Jinping got very upset when I shot down that balloon with two box cars full of spy equipment because he didn't know it was there!" He bragged to his donors. "That's a great embarrassment for dictators. When they didn't know what happened.'

We are dealing with a single man leading a totalitarian regime dead-set on running the world at almost any cost. We must not be naive or afraid to talk about this. As Russian author Aleksandr Solzhenitsyn expressed in his book, The Gulag Archipelago, written while imprisoned in a Soviet gulag, "In keeping silent about evil, in burying it so deep within us that no sign of it appears on the surface, we are implanting it, and it will rise up a thousand-fold in the future."

Global Silicon Valley entrepreneurs and investors must be on the watch for innovations that bad actors could leverage to improve their ability to track and even kill innocent people. AI represents the most significant change to war since the internal combustion engine and will be integrated across most all new applications. Nuclear weapons and precision-guided munitions capable of delivering them represent our two greatest fears. AI is the third.

Let’s also not be too cynical about the past, however. Entrepreneurs, by nature, are driven to create a better world, and most are true patriots. Noone seeks to harm our country. Sequoia didn’t set out to support evil regimes; they went East to make more money for their investors and themselves. But whether out of naivety or willful blindness, Sequoia and other US VCs who have invested in Chinese startups helped accelerate the power and development of the Communist military technological apparatus and, by doing so, compromised the security of our nation.

"I was the first Silicon Valley VC to invest in China… and the first one to get out of there. I loved working with Chinese startups until Xi took over. All of a sudden, my companies were getting strong-armed by the CCP. He is ruining the lives of 1.4 billion people. So I got out. Weak leaders feel the need to control everyone and tell us what to do. Great leaders trust their people and set them free.

The US is not exactly a perfect model here, either. Our bureaucrats are regulating by enforcement and sucking all the air out of the innovation room. The Cold War is just another way for our governments to control us and maim our economies. Great leaders can grow their economies at 8-10%. Weak leaders wonder why their economies go flat line. This is not the Chinese vs. the Americans. This is two weak leaders sucking billions of people into subservience."

—Tim Draper, Managing Director Draper Associates, Headmaster, Draper University

In Silicon Valley, we are allergic to Washington, DC; it’s not a coincidence that we choose to work as far away from our Capitol as possible. Big government is our nemesis, the farthest thing from our minds. Therefore, the most efficient and palatable way to handle the national security challenge would be for entrepreneurs and their investors to be more informed about what to watch out for and proactive about policing themselves. For investors, this should include recruiting a qualified independent thinking advisory group of security experts who you bring in early in the due diligence process and participate later in a final investment review.

Silicon Valley’s relationship with the government should not just be about compliance but also include proactive collaboration. The job of pioneering entrepreneurs is to drive innovation and solve old problems by making the things we do cheaper, faster, and less painful. In Silicon Valley, we have a lot to offer our governments in terms of helping our officials understand emerging technology and consumer trends and how new innovations might be subverted for evil purposes. We all know our politicians are always several steps behind Silicon Valley, and if we bridge that gap, we all win.

Finally, there are also many ways for Silicon Valley entrepreneurs and investors to play offense against the Mighty Dragon and other bad actors. As the CCP seeks to centralize all data under its control, the Web3 movement is dead-set on decentralizing data and keeping it out of the hands of centralized agencies. As described above, the CCP is actively gathering and stealing sensitive information on everything and everyone, including biometric data via apps such as TikTok, to control their citizens and, ultimately, the world. At this very moment, noble entrepreneurs throughout the global Silicon Valley are developing thousands of blockchain apps, often powered by AI-driven smart contracts, with the goal of keeping online data in the control of the content creator. It's not a complete solution, but it’s an indelible fact that whoever controls the data has the power.

The good news for the VCs is they don't have to invest in China to keep moving up the Forbes 400 list. The Web3 boom happening here and within all free countries represents a $200 trillion opportunity, so there is plenty of money to be made playing ball on the home court.

To the global Silicon Valley community: Be sober-minded; be watchful. Our adversaries prowl around like a roaring dragon, seeking someone to devour.

Further Recommended Reading

How top Silicon Valley investor Sequoia bankrolls China’s tech

Out-of-bounds Investments: How Some American Investors Are Helping the Chinese Military

Exclusive: Sequoia makes first defense tech investment in Mach Industries

Sequoia’s Split Sends Warning to US Companies Doing Business in China

Who are the Uyghurs, and why is China being accused of genocide?

China getting bolder and better in cyberspace, spy chiefs warn

Chinese Investment in U.S. startups under scrutiny for Espionage

Chinese VCs Lived the Silicon Valley High Life. Now the Party’s Over

Looking forward to hearing anyone from our amazing subscriber base what we might be missing, or if we have been unfair in any way. This is obviously a very complex subject with lots of moving parts.

Commentors should idenify themselves accurately to maintain the integrity of the discussions.