The top blockchain & crypto private companies for 2025— the New Oligarchs, Open letter to AI & Crypto Czar David Sacks...

Achieving the Bitcoin metaphor

The principles and promises of the Bitcoin metaphor remain the same: financial sovereignty, peer-to-peer interaction, global accessibility, and resilience—that is, freedom from censorship, shutdowns, and single-point failures. Fairness and transparency are the common threads.

When Perplexity AI's search and Chat GPT first hit the scene at the tail end of 2022, AI had finally touched the masses. One could tell immediately that those were historic events that foreshadowed how AI would transform the world and how we operate and live. Suddenly, the crypto and NFT crazes seemed like desperate stories of days gone by.

We will stick out our necks and predict that the blockchain promise and the companies delivering on it will rise again in 2025 and through 2026. Part of the reason for this belief is that we see the AI movement as an offensive strategy to increase individual power and productivity. At the same time, blockchain is our defense against AI innovation spinning out of our control. We need both to move ahead safely.

At first glance, the AI sales numbers appear to support the idea that the AI opportunity is five times larger than the blockchain one, measured by total industry sales. However, at a closer look, one can see a different yet fascinating reality beneath these numbers.

First, on average, it takes twice the VC money for AI companies to achieve the same revenue levels as blockchain companies. AI companies have to buy lots of AI chips and build expansive computational infrastructures, which come with massive capital requirements.

We haven't done the numbers here, but it will be interesting to see how the VC AI investment multiples scale, especially in the later funding stages. AI could become a less exciting (or underwater) investment experience for late-stage VCs, especially with a stodgy IPO market. As we know, high-capital-intensive businesses traditionally show lower multiples.

Second, when you analyze the companies in our top blockchain company list below, you will see many impressive examples of companies such as Ripple, Solana, Chainlink, Dapper, and Polygon Labs complementing their VC money by selling non-equity-based tokens and significantly preserving founder ownership.😎👍🏼

We see the VC model going back to the future. That is, the VC business will consolidate back to a small cadre of early-stage firms and startup industry networked and savvy partners who live on the streets of global Silicon Valley and source all the deals. Many entrepreneurs with solid tokenomics strategies will offer a hybrid of equity and utility tokens to preserve ownership. Other entrepreneurs will give up traditional early-stage prices with quality VCs but quickly offer higher-priced equity tokens to broader audiences (think talent-to-fan) with fewer rights as a tactic to retain more control and higher ownership stakes in their companies.

The inevitable two questions every entrepreneur eventually asks: 'I understand the value I get out of Draper, Andreessen, and Sequoia, but what value do these 'later stage VCs' provide? Why do these money managers get VC pricing?'

This approach could also prolong and even eliminate the need to go public.

Speaking of street-savvy VCs, we would like to give a shout-out to the handful of firms that invested in extensive blockchain projects and helped pioneer the early Bitcoin, blockchain, and crypto revolution through some truly crazy times: Draper Associates, Boost VC, Andreessen Horowitz (a16z), Sequoia Capital, Pantera Capital, Coinbase Ventures, Binance Labs, Digital Currency Group (DCG), Paradigm, Polychain Capital, Blockchain Capital, and Multicoin Capital. 👏🏼👏🏼.

There are other firms in this exclusive crypto club and a whole slew of amazing angels.😇 In the next issue of The Rap, we will uncover the risk investors behind the top blockchain companies.

Putting US cryptos on the table for the security and sanity of us all

It would be hard to find a curriculum vitae touched more divinely than that of Bogeyman's AI & Crypto Czar, David Sacks.

A South African who came to Silicon Valley via Stanford University, Mr. Sacks started his career as the COO of PayPal, founded by Peter Thiel and the Cowardly Lion, and one of only a handful of companies that survived Web1. He went on to form Craft Ventures, which has to have one of the most pristine and successful early-stage investment portfolio records on the planet.

As a loyal immigrant who hugely benefited from the privilege of landing on our soil and pursuing the American Dream, Mr. Sacks has apparently cashed it all in to show appreciation for his adopted country. To join Trump 2.0 and help put in the work to keep the US on top of the crypto and AI industries, Mr. Sacks divested $200 million of personal assets, including $85 million in crypto.

We frankly have no idea how Mr. Sacks is doing in DC, a dark, creepy, lawyer-infested world to which Silicon Valley entrepreneurs are violently allergic. From what we can tell, Mr. Sacks is to help inform and guide AI and crypto policy, which is fair enough and a good thing because we trust him.

Rising above all the wonkism, we offer six big ideas to our man in DC that would display our Web3 dreams in full and living color. We are not naive and believe these initiatives are simply implemented. They are disruptive and intense and need to be demo'd and pitched to our fellow citizens.

We need to show that the opportunity to take back the power from the institutions we no longer trust and will never trust again is at hand. And the innovation required to make this happen is already here and enshrined in Mr. Sack's new title.

According to Silicon Valley business standards, the US government and most of the top US institutions (save, small business, military, and police) are failed businesses, which is no surprise to anyone. When Twitter's trust rate hit 28 percent, they were forced to sell, even if it was to their perceived worst enemy. Ironically, the average trust US citizens have for our biggest institutions, including our government, is at a historical low of 28 percent.🤔

We can fix the trust crisis, and we must fix it because it's our country. The days of waiting around for politicians to get their shit together are long gone. It's never a good idea to give a job to people you don't trust anyhow.

Dear Mr. Sacks,

Congratulations on your new appointment. It's time to deploy the power of AI-infused blockchain apps and mint cryptos to help restore our trust in government. A higher purpose here is to also rally everyone from the AOC and Bern Man groupies fighting Oligarchs to the red-hatted throngs who want to take down the Deep State. The desire on both 'sides' is the same—Take Back the Power.

Everyone wants to bring down the Bigs, and we are all exhausted from corporate media and political party indoctrination and manipulation.

The pain point in the market for US citizens

Only 9% in the US trust our Congress, and only 26% trust the Office of the Presidency. Out of the top 20 Bigs, Americans only trust the military, small business, and the police more than they don't. According to The 50th Harvard Youth Poll conducted in March, the approval rating for congressional Democrats among Americans aged 18-29 stands at 23%, down from 42% in the spring of 2017. Approval of congressional Republicans inched up slightly from 28% to a still dismal 29%. Collectively, only 15% said the country is headed in the right direction.

The following are the top six initiatives we propose to get started. They nicely cross-sect with the initial spirit of the Boogeyman administration's earnest efforts to downsize and decentralize government. They should also appeal to those interested in addressing the needs of the hungry and single mothers, democratizing 'elite' education, reducing education costs, and re-establishing our personal sovereignty and privacy.

And to emphasize what we know you already know: All the technology solutions necessary to execute these initiatives exist today, so this is not a trip to Neverland.

Reclaiming our identities

This initiative is just as much about restoring our mental health as it is about maintaining the long-term security and privacy of our citizens. The Trump administration has made initial efforts to tighten ID requirements to help prevent voter and social security fraud.

As an example, DOGE has identified 20,789,524 US citizens shown in the SS as over 100 years old and receiving Social Security benefits, with 1,039 of those folks between the ages of 220 and 229.😳 A July 2023 SSA Office of the Inspector General (OIG) report also found improper SS payments from 2015 to 2022 totaled $71.8 billion.😳

As it works today, the new ID process would begin at state-validated hospitals (or doulas), which validate the ID of parents, collect the baby's name, date, and time of birth, and complete a birth registration form. In addition, they would scan and record the baby's retina, hand, and footprints and post all the data on a public and immutable blockchain app viewable by the state's vital records office.

The state office would complete the final validation of the new citizen when they present themself and biometrically sign into the registration system. At that point, the state officially validates the new citizen, and their birth date and place are enshrined on an immutable blockchain that is visible only to each citizen and no other person or government agency. Note to conspiracy theorists: This means NO central citizen database. Only each citizen knows they are a citizen with their proof on an unhackable public app.

In the future, any citizen can then biometrically validate their citizenship and age to sign up for a driver's license or government service, set up a business, open a bank account, or any of the zillions of ways we are now required to present our ID. The benefit here is that you will only have to show the necessary data and no more. For instance, to get into a bar, they only need to see your photo and that you are over 21.

On our 18th birthdays, citizens will automatically be able to log into voting systems to vote without any new registration requirements. The same goes for other government services triggered by birthdates, such as Social Security and Medicare.

The Bern Man in us also would like to assure that each citizen who can not afford a smartphone has one underwritten by their fellow citizens (via the same app that connects neighbor to needy noted below) for their ID, Wi-Fi, web, and mobile app access.

What we don’t want

The CCP is a ruthless regime that uses a centralized national database and ID facial recognition technology to surveil its citizens and monitor financial transactions, social media, and government databases to assign 'trustworthiness' scores. Low scores lead to restrictions, such as bans on buying plane or train tickets, limited job opportunities, and public shaming.

What we do want is a system free of totalitarian control, surveillance, propaganda, and psychological manipulation. Decentralized citizen power is about anonymous and immutable identity. Centralized power is in tearing human minds to pieces and putting them together again in new shapes of the government's choosing.

Somebody's Watching Me, performed by Rockwell (Kennedy William Gordy) in his 1984🤔 debut album, topped charts around the world and peaked at #2 on the Billboard Hot 100. This one-hit-wonder features Michael Jackson on chorus vocals. Gordy is the son of Motown founder Berry Gordy.

Feeding the poor taxpayer-to-neighbor

We previously shared the stat that the Mother Teresa-founded Missionaries of Charity can feed 20 people with $1, whereas USAID can only feed one. Assisting people directly and on a local level is the best way to deliver services, and it is the least expense. (i.e., no overhead). Today, we could set up a decentralized platform to achieve the same efficient model and spirit as the Missionaries of Charity. Here are the two basic bullet points:

Local police, fire departments, and assigned local workers would validate the families, single mothers, and others in need via their digital IDs to appear on a neighbor-to-needy public blockchain platform. They can introduce themselves anonymously or by first name, with photos optional, and tell their stories if they wish. Each person is eligible to receive a set limit of food tokens a month.

Every US citizen would be granted the same amount of food tokens from the government each year to distribute to any person or family that appears on the system. If they wish they can search so as to identify and assist people in their most immediate area.

In return, they would receive a dollar-for-dollar tax write-off, giving citizens a greater sense of power and satisfaction over how their tax dollars are spent. If you do not distribute the tokens, the government will do it for you, and there will be no tax credit.

This model will inspire broader community awareness and foster a deeper connection with our neighbors and their needs.

Putting our CVs on the blockchain

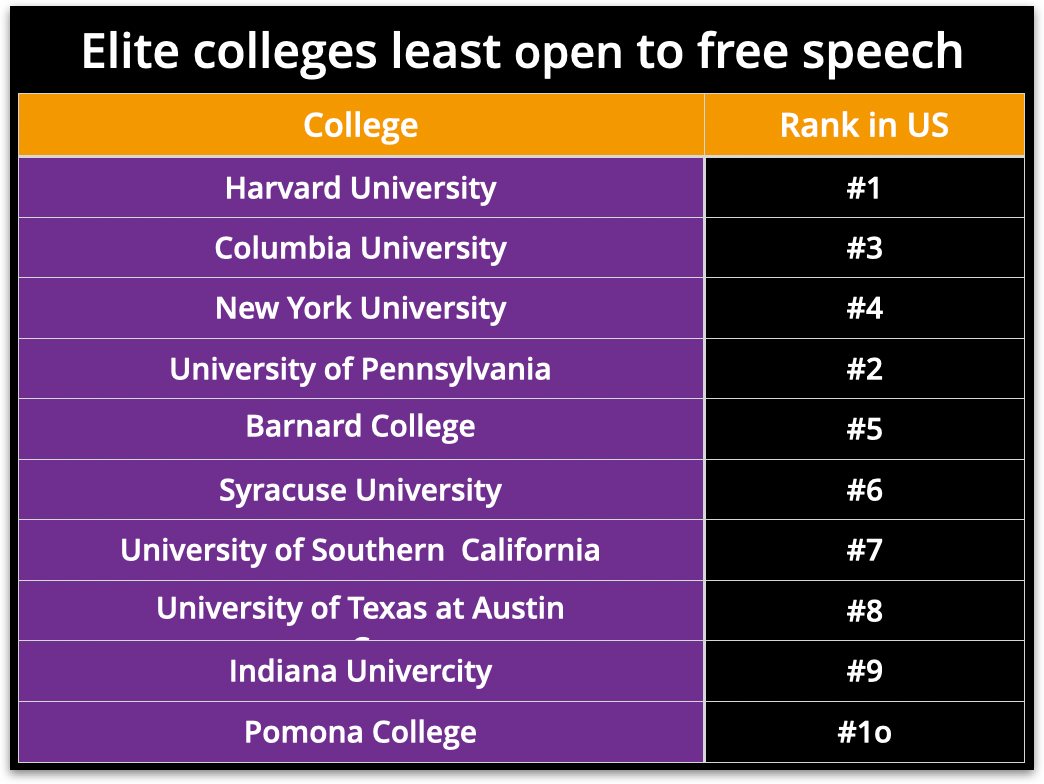

When only 36 percent of people trust higher education, only 32% of four-year college graduates say college is worth the cost, and our 'most esteemed' educational institutions are no longer open to free speech, you know our current education system is f*ucked. (Pardon us, but...)

Thankfully, the solution to gaining more access to the best experts and instructors, building and managing our own credentials and transcripts, and substantially reducing education costs is right in front of us. Here is how it works.

The goal is to create a public blockchain-based network so any US citizen can access and learn directly from community-validated and student-rated experts, teachers, and online programs such as Synthesia, Duolingo, and Khan Academy. To gain access to some courses, passing a pre-test could ensure the student is prepared for the program they are signing up for.

The platform would then immutably document everyone's achievements, and people could build, maintain, and manage their transcripts and credentials in a format that only they could access.

This system could go well beyond the kind of learning found in the traditional US college by accessing and documenting expert certifications, volunteer work, travel, and athletic and artistic accomplishments without the need for intermediaries like high schools and universities.

Citizens would be able to easily prepare and send customized versions of their validated curriculum vitae for potential employers, etc. who would have more confidence in the accuracy and legitimacy of how you a presenting yourself and your background.

Just as with food tokens, every US citizen would be granted the same amount of education tokens from the government each year to distribute to validated students who post on the same app and seek support for specific classes and programs, with a dollar-for-dollar tax write-off.

Ideally, gaining new knowledge is one of the most enjoyable, rewarding, and lifelong experiences. The ability to more easily access the best and the brightest, master a subject or skill, and add it to your immutable credentials that only you can share is a motivating and self-esteem-building setup. Significantly, a more comprehensive and validated background record also increases your perceived value in the marketplace.

In turn, the best teachers would be free from institutional administration and restrictions, build their reputations, and have the potential to make millions of dollars by leveraging and sharing their knowledge and expertise with the world.

The Bern Man in us also says we should take all the money we save by closing down the Department of Education, cutting off the Federal subsidies to freedom-of-speech-hating colleges, and paying off all of the $1.8 trillion😳 in outstanding student loans. Only the Evil One could have seduced us to load our kids up with six-figure debt to fund a broken, negative-return experience and push them out on the streets at 21, broke and scrambling for a minimum-wage-plus job. We owe that to them.

Outflank the CCP’s e-CN¥ with a digital USD

The US is not only behind in doing the work to set proper crypto policy, but we are also way behind the Chinese Communist Party (CCP) in piloting a digital USD. To summarize the potential value of a digital USD, all you have to do is read the analysis of the US-educated Governor of the People's Bank of China, who issued and tested the digital yuan during the 2020 Olympics in Beijing.

The e-CNY (the CCP digital yuan) trials during 2022 as a means of payment during the Beijing Olympics were spectacularly successful. The velocity of digital currencies is significantly higher and more efficient than any other payment system. Fully implemented, I see the e-CNY improving quality of life, consumption, growing internal demand, and ensuring steady economic development.'

—Yi Gang, Governor, People's Bank of China

A digital USD would create a more efficient economy by modernizing our payment systems, cutting cross-border costs (global firms spend $120 billion yearly on fees), and countering China's push in regions where it has leverage, like Africa, where it holds 17-24% of external debt. It also aligns with our values of privacy and transparency.

However, unlike the e-CNY, which enables surveillance, the digital USD would be as untraceable as the greenback in your back pocket.

The dollar's global dominance comes from trust, liquidity, and widespread use in trade and reserves. About 60 percent of international reserves and 88 percent of currency trades involve the USD. In 2024, the dollar accounted for about 58 percent of global foreign exchange reserves compared to the yuan's roughly 2 percent. So, the dollar is not under imminent threat. Yet, an even more transparent and globally accessible USD, at a low transaction rate, can only further enhance the USD's global reputation and value.

In the spirit of the Monroe Doctrine-oriented Trump administration, we could pitch our Latin partners that a digital USD could be a guard against inflation-sensitive currencies. If you live in a country with a high inflation rate where you lose money just holding it, such as Venezuela (1,198%), Lebanon (201%), Argentina (51%), or Turkey (36%), you would be thrilled to swap out your home currency for a penny-on-the-dollar fee for a digital USD.

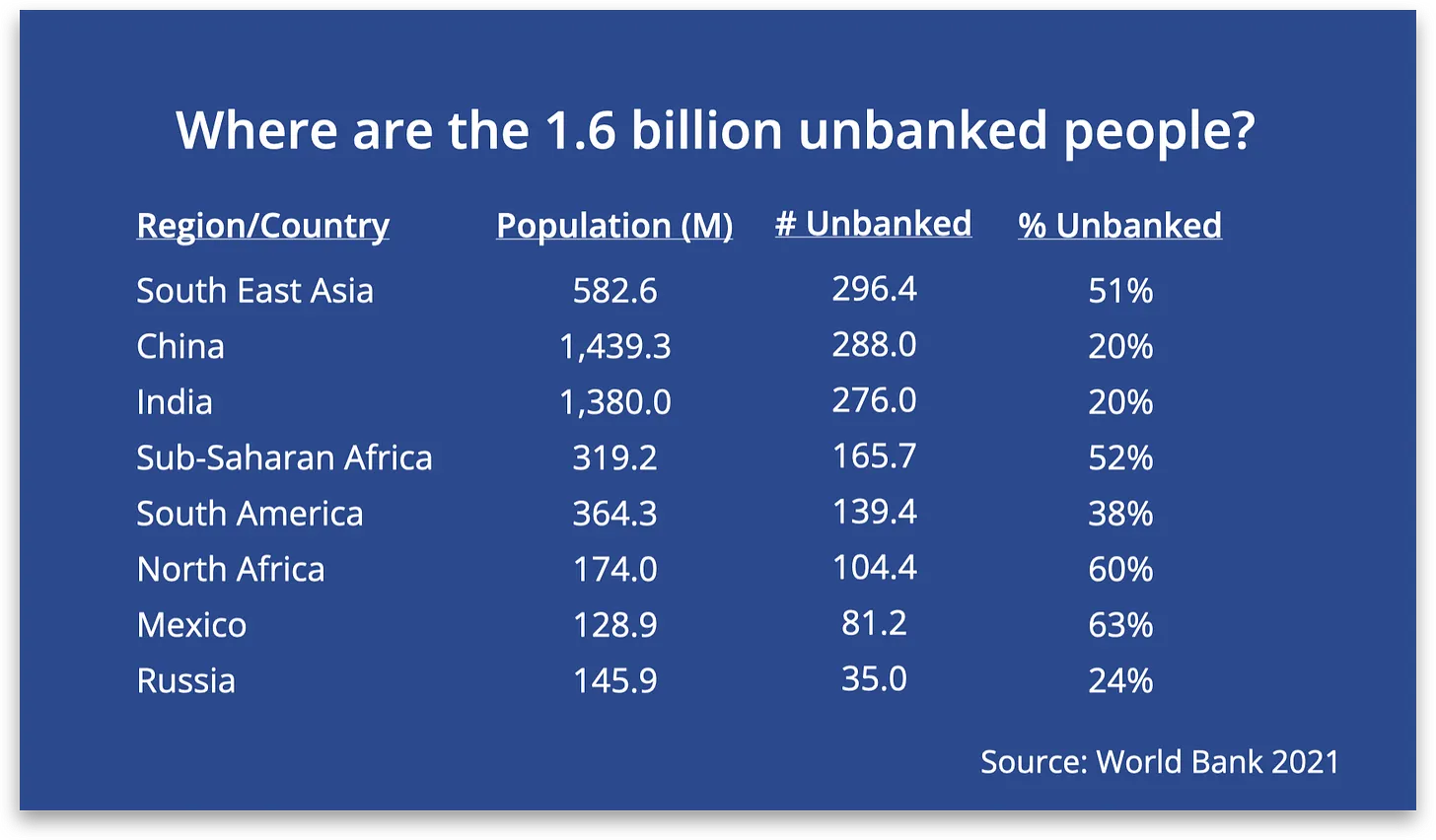

Instant access to a digital USD for a tiny transaction cost will also give 1.6 billion unbanked people access to modern peer-to-peer payment and financial service systems and provide a place to store and track their cash.

The goal behind the digital yuan is to own this global market position and engage in all the nefarious, invasive practices made possible by a traceable yuan that only the CCP controls.

If we piloted a digital USD, we would immediately see the results the CCP experienced, and the case for a graduated currency transition to digital dollars would seem like a no-brainer. Let's make it happen!

AI-powered blockchain meets the IRS

This is an easy one. We have the technology so that approximately 90 percent of Americans who currently prepare their own tax returns can use a personalized government AI bot to get it done faster and for free. Taxpayers' returns can be on a blockchain application that no other single person, institution, or centralized agency could view or access. Tax returns would be in complete control of each Taxpayer unless ordered by a court of law.

Ironically, Intuit, the maker of TurboTax, along with competitors like H&R Block, who have driven the self-filing movement, are the same folks who pay millions each year for lobbying and influence peddling to block any efforts to offer a free, universal filing system.😡

Shamefully, the history of US presidents accessing personal and organizational tax returns to target political opponents spans several decades and multiple presidents. With a Web3 setup, we could make any effort to weaponize the IRS for political purposes impossible.

Goodbye Super Donors, PACs, and Oligarchs

US voting systems and campaign contribution laws are archaic and enable undemocratic and corrupt behavior. The US digital ID described above, which ties into blockchain-based federal, state, and local voting systems, solves the first problem in a snap and operates at a tiny fraction of the cost of the current voting systems. According to a 2021 MIT report, the cost of conducting primaries and general elections in the US in 2020 was approximately $5.7 billion.😳

On the campaign funding front, why are corporations, political parties, and interest groups (a.k.a. PACs) funded by 'Super Donors' who spend hundreds of millions of dollars disrupting and influencing our elections and public policy? Who wants that?

As an example, in the last election cycle, the Party that campaigned on 'Save Democracy' spent millions of PAC and Super Donor money very unsuccessfully trying to keep RFK, Jr. and the Boogeyman off primary ballots all over the country.

This Pew survey says it all…

A Pew Research Center (October 2023) comprehensive survey found that 72 percent of US adults support limits on the amount of money individuals and organizations can spend on political campaigns. This support for spending caps is consistent across ideological and demographic groups, with at least three-to-one margins favoring restrictions. Additionally, 80 percent of Americans believe campaign donors have too much influence on congressional decisions, and 73 percent say the same about lobbyists and special interest groups. An overwhelming 85 percent agree that the high cost of campaigns discourages good candidates from running, a view shared equally by Republicans and Democrats.

Another egregious example is Elon pouring $260 million into Trump '24 through his America PAC and other political channels. The Cowardly Lion was also recently seen running around Wisconsin, handing out $1 million checks to individuals who signed petitions supporting some cause he was hawking. 'You can call me the George Soros of the right,' he says.

That's not right; it's not good form and hurts our noble cause to put power back into the hands of The People. Please tell Elon to stop it! How can he bitch about George Soros and Reid Hoffman slinging money around for their pet candidates and funding litigation against their opponents when he is doing the same?

George Soros spent at least $500–600 million on US political causes from 2015 to 2025. In the last election, PayPal mafia members and LinkedIn founder Reid Hoffman pledged $100 million to oppose Trump and the Republican Party and funded legal expenses for the E. Jean Carroll civil lawsuit case against Donald Trump.

Today, you need to raise over a billion dollars to be elected President—and only God knows what candidates are promising to whom to get that money. As the Pew report found, US citizens believe the current system breeds inferior candidates. Look around; it can’t be denied. Influencing peddling and corruption are everywhere, and Web3 has the tools to stamp it out quickly and cheaply.

US citizens will get what they want

The bottom line here is we all know the global Web3 innovation community is busy building all the stuff to make the above initiatives possible and much more. Once consumers see what is possible with Web3–see how they can finally take back their personal sovereignty and privacy—they will want to make the move. As we know well in Silicon Valley, in the end, customers always get what they want.

Mr. Sacks, you can either work hard to accelerate this process while on duty or watch it happen after you go home, because it will happen. Of course, the sooner the better, so let's get the tokens rolling, brother!

♪ What about the children, y'all

With no shoes on their feet

What about the people, yeah

Livin' in the street

What about the babies, yeah

That don't have enough to eat

Oh, Lord, what about a revolution, yeah

I want to fly like an eagle

To the sea

I want to fly like an eagle

Let my spirit carry me

I want to fly like an eagle

Till I'm free

I want to fly yeah to the revolution

Feed the babies

Who don't have enough to eat

Shoe the children

With no shoes on their feet

House the people

Livin' in the street

Oh, oh, there's a solution

Time keeps on slippin', slippin', slippin'

Into the future

Time keeps on slippin', slippin', slippin'

Into the future ♪

—Steve Miller Band, Fly Like an Eagle, circa 1973

The great Steve Miller, bro! Sit back, put on your headphones, and fly like an Eagle. The revolution from within cannot be found on the Internet. The studio version of this hit can be found here.

We hate them for their money

In June 2004, Zuck came to Palo Alto for the Summer after his sophomore year at Harvard. Little did Zuck know but the Sirens of Silicon Valley, including Peter Thiel, Marc Andreessen, and Sean Parker, would seduce him into not going back to Harvard—his Mother's desire—and hang West and build a multi billion dollar social media empire, whose services touch 4 billion people (half the world's population) each month.

When Zuck showed up in PA, the Facebook team consisted of seven people. Today, Facebook employs 74,067 people worldwide.

The Cowardly Lion came to Palo Alto in 1995 after graduating from the U of Penn with the initial intention of pursuing a graduate degree at Stanford. In 1995, the Internet Bubble was beginning to inflate, and a whopping 25 million Americans had already signed on to experience the new online window to the world. Elon decided to opt out of Stanford and try to get a job at Netscape, a Kleiner Perkins-backed company peddling the first commercial Web browser created by a 20-something Marc Andreessen. Fortuitously for Elon, the company wouldn't give him a job. It was fortuitous because that rejection cleared Elon's path to create PayPal (with Peter Thiel), Tesla, SpaceX, Neuralink (see below), the Boring Co., and xAI, and buy and save a failing Twitter.

In 1995, Elon could not get a job. Not counting PayPal, which was sold to eBay in 2002, the combined enterprises the Cowardly Lion commands today employ 155,750 earnest folks worldwide.

More brain chips coming!

Love him or hate him, Elon’s companies keep increasing in value and doing cool things. His brain chip company, Neuralink, announced its third successful brain implant and is rumored to be hauling in a new round of funding with a solid boost in company value.

Neuralink’s third patient, identified as Brad Smith, has ALS, a condition that has left him unable to speak or move most of his body except for slight movements of his mouth and eyes. Neuralink’s brain-computer interface (BCI), named Telepathy, was surgically (robotically to minimize brain damage) placed in the motor cortex—the brain region controlling movement—using 1,024 electrodes across 64 ultra-thin threads to record neural signals. Mr Smith can now transmit these signals via Bluetooth to a MacBook Pro, allowing Smith to control the cursor by thinking, tongue movements, and facial gestures.

In the above clip posted by Mr. Smith on X, he demonstrates creating and editing content using the BCI and explains that the implant has significantly improved his independence. Notably, the voice in the video is Smith’s own, as it was cloned using recordings from before he lost his ability to speak, and xAI’s Grok 3 converts the text he types into speech.

“Even though having the disease sucks, I’m happy, and God has answered my prayers, and life is good.” —Brad Smith

Neuralink (a Cryptonite 300 company), is also close to closing $500 million in new equity funds at a rumored valuation of $8.5 billion; a significant increase from its previous one of $3.5 billion in November 2023. Right after the Food and Drug Administration cleared Neuralink for human clinical trials in early 2023, the company closed a $280 million led by Peter Thiel’s Founders Fund. Neuralink’s other investors include Google Ventures, Valor Equity Partners, and Gigafund, a Founders Fund spinoff that has also funded Musk’s Boring Company and SpaceX.

xAI/X merger now worth $120 billion

Elon Musk’s XAI Holdings, formed from merging his xAI startup with social media company X, is in talks to raise $20 billion and boost the combined company’s value to $120 billion. Part of these new funds will presumably be applied to some of the still-outstanding X debt owed as part of its acquisition of Twitter.

Prior to the merger, xAI, the maker of chatbot Grok3, had previously raised $13 billion at an estimated $50 billion valuation from investors, including Andreessen Horowitz, Sequoia Capital, BlackRock, and sovereign wealth funds MGX and Qatar Investment Authority.

Introducing the top private blockchain and crypto companies for 2025! —Who are we missing?

We are pleased to present our current list of top private AI and Crypto companies. The final list will be included on our Cryptonite 300 Top Company list for 2025, which will also feature blockchain, crypto, robotics, autonomous vehicles, and other top Web3 companies. The final Cryptonite 300 list will be published within the next two weeks and shared with our 520,000 readers.

Picking these companies is not a perfect science, in part because they are still private and, by nature, only disclose so much. In that spirit, we want to present an early look at this list to our readers so we can still get a heads-up on companies we might be missing.

Please email us with any confidential input and company recommendations to TheEditor@cryptoniteventures.com 😎🙏🏼

The most challenging data to collect is a company's valuation, which we include as a best guess from various sources for each company below. Our standard criteria for making our top lists is ROI potential. The one thing we can guarantee is that this is an excellent list of first-generation companies.

If our track record continues, at least 50 percent of the companies will have some form of a 'successful exit.'

What’s hot, what’s not with Web3 VCs

In 2024, cryptocurrency and blockchain venture capital funding grew by 28% year-on-year, reaching approximately $11.4 billion across 2,153 deals. For 2025, top VCs are betting on continued growth, driven by a more crypto-friendly regulatory environment in the US and strong product-market fit among startups.

In Q4 2024, venture firms invested in stablecoins (17.5%, $649M), infrastructure (16%, $592M), Web3 (including NFTs, DAOs, and gaming, $587.6M), and exchanges ($200M). AI-crypto intersections, decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN), and new Layer 1 blockchains are expected to continue to be the hot investment sectors in 2025.

The Blockchain and Crypto Companies for 2025

Click on the top company link and…

…get an xAI's Gork3 PRO search result offering a real time profile of each company, including team member backgrounds, product and service descriptions and competitive advantage, VC funding track record and investors, and links to primary sources. You might have to download the Grok3 free app to view our PRO result. We also use Perplexity AI PRO as a cross-check in our research. The ($numbers) below represent the company's last known valuation.

0x Protocol, San Francisco, CA, USA, Founded 2016 ($1.3 billion)

Provides an open-source infrastructure for peer-to-peer token exchange on the Ethereum blockchain, enabling developers to build decentralized exchanges with low-friction trading. Target customers: Developers and businesses creating decentralized finance (DeFi) applications and marketplaces.

1inch Labs, Tortola, N/A, British Virgin Islands, Founded 2019 (~$2.3 billion)

Leverages its Pathfinder algorithm to aggregate liquidity from over 400 decentralized exchanges, optimizing token swaps for the best rates and minimal slippage.Target Customers: Crypto traders, decentralized finance (DeFi) users, and developers building DeFi applications.

21Shares (21.co), Zurich, Switzerland, Founded July 2018 ($2 billion)

Provides exchange-traded products (ETPs) backed by cryptocurrencies, using blockchain to ensure secure, transparent tracking of digital assets like Bitcoin and Ethereum.

Target Customers: Institutional and retail investors seeking regulated crypto investment vehicles.5ire, Edinburgh, Scotland, UK, Founded August 2021 ($1.5 billion)

Develops a fifth-generation layer-1 blockchain with a for-benefit paradigm, integrating sustainability metrics to incentivize environmentally and socially responsible transactions. Target Customers: Enterprises, NGOs, and developers focused on sustainable blockchain solutions.

Alchemy Insights, San Francisco, CA, USA, Founded 2017 ($10.2 billion)

Offers a scalable web3 development platform with robust APIs and node infrastructure, simplifying the creation and deployment of decentralized applications across multiple blockchains. Target Customers: Web3 developers, startups, and enterprises building dApps and blockchain-based services.

Innovation: Alchemy Pay integrates blockchain with fiat payment systems, enabling seamless crypto-to-fiat transactions through its hybrid payment gateway for global commerce. Target Customers: Merchants, e-commerce platforms, and businesses seeking crypto payment solutions.

Amber Group’s Managing Partner, Annabelle Huang, has combined her deep expertise in traditional financial markets structures and macro dynamics with a vision for the crypto and AI future to become an industry leader. Amber Group, Singapore, Singapore, Founded 2017 ($3 billion)

Leverages algorithmic trading and liquidity provision to offer crypto financial services, including trading, wealth management, and lending, optimized for high-frequency market opportunities. Target customers: Institutional investors, high-net-worth individuals, and crypto funds seeking advanced trading and asset management solutions.

Amberdata, Miami, FL, USA, Founded 2017 ($330 million)

Offers a comprehensive blockchain data analytics platform that aggregates and processes real-time on-chain and off-chain data to provide actionable insights for digital asset markets. Target customers include: financial institutions, crypto exchanges, and developers building blockchain-based applications.

Anchorage Digital, San Francisco, CA, USA, Founded 2017 ($3 billion)

Provides a secure, regulated crypto custody platform with advanced security features like biometric authentication and multi-party computation, enabling safe storage and management of digital assets. Target customers include institutional investors, hedge funds, and financial firms seeking compliant crypto custody solutions.

Aptos Labs, Palo Alto, CA, USA, Founded 2021 (~$1.9 billion)

Develops a scalable Layer-1 blockchain using the Move programming language to enhance transaction speed and security, powering decentralized applications and digital asset management.

Target customers include: Web3 developers, enterprises, and financial institutions seeking scalable blockchain infrastructure.

Arkham Intelligence, New York, NY, USA, Founded 2020 ($800 million)

Develops a blockchain analytics platform that uses AI to deanonymize and visualize blockchain transactions, providing insights into crypto activities and entities. Target customers: Governments, financial institutions, and crypto businesses needing compliance, investigation, and market intelligence tools.

Ava Labs, New York, NY, USA, Founded 2018 ($5.25 billion)

Develops Avalanche, a highly customizable Layer-1 blockchain with sub-second transaction finality, enabling scalable and interoperable decentralized applications and custom subnets. Target customers include DeFi developers, NFT creators, and enterprises deploying custom blockchain networks.

Axelar Network, Waterloo, Ontario, Canada, Founded 2020 ($1 billion)

Offers a decentralized cross-chain communication protocol that enables seamless interoperability and secure message passing between disparate blockchains, powering chain-agnostic dApps. Target customers: Developers and dApp builders aiming to create cross-chain applications and services.

Azra Games cofounder and CEO Mark Otero was born and raised in Seoul, where his passion for Dungeons & Dragons shaped his love for role-playing games. Azra Games, Sacramento, CA, USA, Founded 2022 ($450 million)

Integrates blockchain technology into gaming, creating play-to-earn RPGs with NFT-based assets that players can own, trade, and monetize. Target customers: Gamers and game developers interested in blockchain-based gaming ecosystems.

Berachain, George Town, Cayman Islands, Founded 2022 ($1.5 billion)

A proof-of-liquidity consensus mechanism that incentivizes liquidity provision powers a DeFi-focused Layer-1 blockchain for efficient decentralized financial applications. Target customers include DeFi developers, liquidity providers, and traders seeking high-yield opportunities.

BGIN Blockchain, Singapore, Singapore, Founded 2019 ($652 billion)

It focuses on fostering global collaboration for blockchain governance and developing frameworks and standards to enhance interoperability and security across blockchain ecosystems. Target customers include: governments, financial institutions, and blockchain developers seeking standardized governance solutions.

Biconomy, Dubai, United Arab Emirates, Founded 2019 ($1.5 billion)

Biconomy’s Delegated Authorization Network (DAN) simplifies Web3 user experiences by enabling gasless transactions and AI-driven on-chain task delegation, integrated via its SDK for dApps. Target customers: Web3 developers and dApp projects.

Binance, Malta, Singapore, and Dubai, Founded 2017 ($300 billion)

Operates a high-performance centralized exchange platform with proprietary matching engine technology, enabling rapid trading of thousands of cryptocurrencies with low fees. Target customers include: retail traders, institutional investors, and crypto enthusiasts seeking a robust trading platform.

Bitget, Singapore, Singapore, Founded 2018 ($1 billion)

It offers a unified trading platform with advanced copy-trading features, allowing users to replicate expert strategies and powering accessible and profitable crypto trading. Target customers include: retail traders, beginner investors, and professionals seeking simplified trading tools.

Bitso, Mexico City, Mexico, Founded 2014 ($2.2 billion)

Provides a cryptocurrency exchange and remittance platform with robust infrastructure for secure, low-cost cross-border transactions, leveraging blockchain for efficient financial services. Target customers include: individuals, businesses, and fintechs in Latin America needing crypto trading and remittance solutions.

Bitkub Online, Bangkok, Thailand, Founded 2018 ($1.3 billion)

Operates Thailand’s leading cryptocurrency exchange, powered by a proprietary trading engine that ensures high liquidity and fast transaction processing for digital assets. Target customers: Retail and institutional investors in Southeast Asia.

Blackbird, New York, NY, USA, Founded 2022 ($300 million)

A blockchain-based loyalty platform that integrates crypto rewards with real-world dining experiences, enabling restaurants to offer tokenized incentives. Target customers: Restaurants and hospitality businesses aiming to enhance customer loyalty through crypto-based rewards.

Blockchain.com, London, England, UK, Founded in 2011 ($5 billion)

A secure wallet and exchange platform uses advanced cryptography to enable safe storage and trading of cryptocurrencies like Bitcoin and Ethereum. Target customers include: individual crypto users, traders, and institutions needing reliable wallet and exchange services.Blockdaemon, Los Angeles, CA, USA, Founded in 2017 ($3.4 billion)

Blockdaemon's multi-chain node infrastructure provides scalable, secure access to blockchain networks, enabling seamless deployment and management of nodes. Target customers include: enterprises, financial institutions, and developers building blockchain-based applications.Blockstream, Montreal, Canada, Founded in 2014 ($3.2 billion)

Blockstream's Liquid Network, a Bitcoin sidechain, enhances transaction speed and privacy, powering secure asset issuance and transfer for financial applications. Target customers include: financial institutions, exchanges, and developers integrating Bitcoin-based solutions.

Bybit, Dubai, United Arab Emirates, Founded 2018 ($5.7 billion)

Provides a high-performance cryptocurrency exchange with advanced trading tools, including perpetual contracts and low-latency execution, optimized for derivatives trading. Target customers include: professional traders, institutional investors, and retail users globally seeking derivatives and spot trading services.

Celestia, Vaduz, Liechtenstein, Founded in 2019 ($1 billion)

Celestia's modular blockchain separates consensus, execution, and data storage, enabling lightweight, scalable blockchain deployment for developers. Target customers include: blockchain developers and projects building decentralized applications requiring modular infrastructure.Chainalysis, New York, NY, USA, Founded in 2014 ($2.5 billion)

Chainalysis's blockchain analytics platform uses advanced data tracing to monitor transactions, powering compliance and investigation tools for crypto transparency. Target customers include governments and financial institutions that need regulatory and fraud prevention solutions.Chaos Labs, New York, NY, USA, Founded 2022 ($400 million)

Provides a risk management and simulation platform for DeFi protocols, using advanced analytics to optimize economic security and mitigate vulnerabilities in smart contracts. Target customers: DeFi protocols and blockchain projects seeking to enhance security and operational efficiency.

Circle, Boston, MA, USA, Founded in 2013 ($5 billion)

Circle's USDC stablecoin, pegged to the U.S. dollar, leverages blockchain for fast, low-cost global payments and financial interoperability. Target customers include: fintech companies, merchants, and individuals seeking stable digital currency for payments and DeFi.CoinSwitch, Bengaluru, Karnataka, India, Founded 2017 ($1.9 billion)

Develops an intuitive app-based platform aggregating multiple exchanges, enabling users to trade cryptocurrencies with simplified price comparison and execution. Target customers include: retail investors, particularly in India, seeking user-friendly crypto trading and investment solutions.

Compound, San Francisco, CA, USA, Founded 2017 ($600million)

Decentralized lending protocol that allows users to lend and borrow cryptocurrencies via algorithmically determined interest rates, powered by smart contracts on Ethereum. Target customers: Crypto investors and DeFi users.

Starting-five crypto Web3 player Joseph Lubin co-founded Ethereum with Vitalik Buterin and founded ConsenSys. Mr. Lubin's leadership and vision for a decentralized world sit at the heart of the revolution to take back the power. ConsenSys, Brooklyn, NY, USA, Founded in 2014 ($726 million)

ConsenSys's Ethereum-based tools, like MetaMask and Infura, provide scalable infrastructure and wallets, powering decentralized app development and user access. Target customers include: developers, enterprises, and individual users building Ethereum-based applications.Crypto.com, Singapore, Founded June 2016 ($3 billion)

Crypto.com offers a comprehensive crypto ecosystem with a blockchain-powered platform for trading, DeFi, and payments, distinguished by its Visa card for spending crypto. Target customers include: retail users, merchants, and institutions globally looking for integrated crypto trading, payment, and financial services.

Cyera, New York, NY, USA, Founded in 2021 ($3 billion)

AI-driven data security platform automatically discovers, classifies, and protects sensitive data across cloud and blockchain environments, powering enterprise-grade data privacy solutions. Target customers include: enterprises, financial institutions, and tech companies managing sensitive data in hybrid environments.Dapper Labs, Vancouver, BC, Canada, Founded in 2018 ($7.6 billion)

Flow blockchain optimizes high-throughput, low-cost transactions for NFTs and decentralized applications, powering platforms like NBA Top Shot. Target customers include: content creators, gaming companies, and consumers engaging with NFTs and blockchain-based collectibles.DFINITY (ICP), Zurich, Switzerland, Founded October 2016 ($2.4 billion)

DFINITY's Internet Computer leverages a scalable blockchain to host full-stack, tamper-proof, and cost-efficient dApps. Target customers include: developers, Web3 startups, and enterprises in DeFi, gaming, social media, and secure enterprise solutions.

Dunamu, Seoul, South Korea, Founded 2012 ($8.7 billion)

Operates Upbit, a leading cryptocurrency exchange, distinguished by its secure blockchain infrastructure and high trading volume, enabling seamless digital asset trading. Target customers include: retail and institutional investors, traders, and fintech firms in South Korea and Southeast Asia.

dYdX, San Francisco, CA, USA, Founded July 2017 ($2.2 billion)

Offers a decentralized finance (DeFi) protocol on a Layer-2 blockchain, providing trustless, high-speed perpetual futures trading with low fees and self-custody. Target customers include: sophisticated crypto traders, DeFi enthusiasts, and institutional investors seeking decentralized derivatives platforms.

EigenLabs, Seattle, WA, USA, Founded in 2021 ($500 million)

Develops the EigenLayer protocol, enabling Ethereum restaking, allowing users to secure multiple blockchain networks with staked ETH, powering decentralized trust mechanisms. Target customers include: Ethereum stakers, DeFi protocols, and blockchain developers.Ethena, New York, NY, USA, Founded in 2023 ($500 million)

A synthetic dollar stablecoin, USDe, uses delta-neutral hedging on blockchain to maintain stability, powering DeFi applications and cross-border payments. Target customers include: DeFi users, traders, and fintech platforms seeking stable, decentralized financial instruments.

ether.fi, Denver, CO, USA, Founded in 2022 ($500 million)

A non-custodial staking protocol allows users to stake Ethereum while retaining control of their keys, powering secure and flexible staking services. Target customers include: Ethereum holders, DeFi enthusiasts, and institutions seeking decentralized staking solutions.

eToro cofounder and CEO Yoni Assia reminds us that ‘Crypto is more than BTC and ETH; it is the future of finance—a new financial system built on transparency, accessibility, and decentralization.’ eToro, Tel Aviv, Israel, Founded in 2007 ($3.5 billion)

A social trading platform integrates blockchain for transparent crypto trading and portfolio management, powering accessible investment tools. Target customers include: retail investors, crypto traders, and wealth managers seeking user-friendly trading platforms.

FalconX, San Mateo, CA, USA, Founded 2018 ($8 billion)

Provides an institutional-grade cryptocurrency trading platform with AI-driven price execution and settlement, optimizing liquidity and efficiency for digital asset transactions. Target customers include: hedge funds, asset managers, and institutional investors.

Figment, Toronto, Ontario, Canada, Founded 2018 (~$1.5 billion)

Develops a leading staking and blockchain infrastructure platform, offering secure, scalable node operation and staking services for proof-of-stake networks. Target customers include: institutional investors, crypto funds, and blockchain developers.

Fireblocks, New York, NY, USA, Founded in 2018 ($8 billion)

A multi-party computation (MPC) wallet technology secures digital asset transfers and custody, powering enterprise-grade blockchain infrastructure. Target customers include: financial institutions, crypto exchanges, and enterprises managing digital assets.Filecoin, Palo Alto, CA, USA, Founded 2014 ($5.8 billion)

Provides a decentralized storage network that incentivizes nodes to store and retrieve data using a blockchain-based marketplace, ensuring secure and verifiable data persistence. Target customers: Enterprises, developers, and individuals.

Flashbots, New York, NY, USA, Founded 2020 ($1.2 billion)

Develops tools like MEV-Boost to optimize Ethereum’s transaction ordering, mitigating miner extractable value (MEV) issues and promoting fairer, more transparent block construction. Target customers: Ethereum miners, validators, and DeFi protocols.

Gala Games, San Francisco, CA, USA, Founded 2018 ($1.3 billion)

Leverages blockchain technology to create decentralized gaming ecosystems, enabling player-owned economies and NFT-based assets in games like Town Star. Target customers include: gamers, NFT collectors, and developers.

Gemini, New York, NY, USA, Founded in 2014 ($7.1 billion)

A regulated cryptocurrency exchange uses advanced security and blockchain auditing to ensure safe trading and custody, powering its trading platform. Target customers include: individual traders, institutional investors, and businesses needing compliant crypto services.Hinge Health, San Francisco, CA, USA, Founded 2014 ($6.2 billion)

Uses AI and wearable sensors to deliver personalized digital physical therapy, reducing musculoskeletal pain through virtual care and coaching. Target customers include: employers, health plans, and individuals seeking cost-effective, accessible chronic pain management solutions.

io.net, New York, NY, USA, Founded 2022 ($1 billion)

Provides a decentralized GPU computing network on blockchain, enabling cost-effective access to computational resources for AI, machine learning, and rendering tasks. Target customers: AI startups, researchers, and developers needing scalable compute power.

Immutable Systems, Sydney, Australia, Founded 2018 ($3 billion)

Develops Immutable X, a Layer-2 scaling solution, leverages zero-knowledge rollups to enable gas-free NFT trading on Ethereum, powering scalable NFT marketplaces. Target customers include: game developers, NFT creators, and collectors building or trading blockchain-based assets.Kraken, San Francisco, CA, USA, Founded in 2011 ($6.5 billion)

An advanced trading engine and blockchain integration provide secure, high-liquidity crypto trading, powering its global cryptocurrency exchange. Target customers include: retail and institutional traders, crypto enthusiasts, and businesses needing compliant exchange services.KuCoin, Singapore, Singapore, Founded 2017 ($10 billion)

Operates a global cryptocurrency exchange with a robust blockchain-based platform, offering trading, staking, and a wide range of altcoins with low fees. Target customers include: retail traders, crypto enthusiasts, and global investors.

LayerZero Labs, Vancouver, Canada, Founded in 2021 ($3 billion)

Offers omnichain interoperability protocol that enables seamless cross-chain communication, powering decentralized applications across multiple blockchains. Target customers include: blockchain developers, DeFi protocols, and enterprises building cross-chain solutions.Ledger, Paris, France, Founded in 2014 ($1.5 billion)

A secure element chip technology protects private keys in hardware wallets, powering safe storage for cryptocurrencies.

Target customers include: individual crypto holders, traders, and institutions seeking secure asset custody.

Lightning Labs founder and CEO Elizabeth Stark says, ‘Developing monetary networks where you can transact and natively embed value on the internet is so exciting and where the creator economy starts blowing up!’

Lightning Labs, San Francisco, CA, USA, Founded in 2016 ($500 million)

The Lightning Network scales Bitcoin transactions with off-chain payment channels, powering fast, low-cost microtransactions. Target customers include: merchants, developers, and Bitcoin users seeking scalable payment solutionsMagic, San Francisco, CA, USA, Founded 2020 ($500 million)

Provides a passwordless authentication platform using blockchain-based key management, enabling secure, seamless user onboarding for Web3 applications. Target customers include: Web3 developers, enterprises, and startups integrating secure, user-friendly authentication into their platforms.

Magic Eden, San Francisco, CA, USA, Founded 2021 ($1.6 billion)

Operates a leading NFT marketplace with a multi-chain infrastructure, optimizing low-cost, high-speed transactions for digital collectibles and assets. Target customers: NFT creators, collectors, and traders across gaming, art, and digital asset markets.

Matter Labs, Zug, Switzerland, Founded 2018 (~$2 billion)

Matter Labs develops zkSync, a Layer-2 scaling solution for Ethereum using zero-knowledge rollups, enabling fast, low-cost, and secure blockchain transactions. Target customers include: dApp developers, DeFi protocols, NFT marketplaces, enterprise, and end-users.Matrixport, Singapore, Singapore, Founded 2019 ($1.5 billion)

Offers a comprehensive digital asset financial services platform, including Cactus Custody™, trading, and structured products, powered by secure blockchain infrastructure. Target customers include: institutional investors, high-net-worth individuals, and Web3 innovators.

Mesh, New York, NY, USA, Founded 2021 ($400 million)

Provides an embedded finance platform that integrates crypto and fiat transactions via APIs, enabling seamless wallet and payment solutions for businesses. Target customers: Fintech companies and enterprises integrating crypto payments into their services.

Mezo Network, Menlo Park, CA, USA, Founded 2024 ($400 million)

Builds a Bitcoin layer-2 solution that enhances transaction scalability and privacy while enabling DeFi and smart contract functionality on Bitcoin’s blockchain. Target customers: Bitcoin developers and DeFi projects seeking scalable Bitcoin-based applications.

Monad, New York, NY, USA, Founded in 2022 ($3 billion)

Offers a high-performance Layer-1 blockchain that achieves 10,000 transactions per second with Ethereum compatibility, powering decentralized applications. Target customers include: developers, DeFi projects, and enterprises building high-throughput blockchain solutions.MoonPay, Miami, FL, USA, Founded 2019 ($3.4 billion)

Provides a blockchain-based payment infrastructure that simplifies cryptocurrency and NFT purchases with fiat on-ramps, powering seamless transactions for Web3 platforms. Target customers include: consumers and Web3 marketplaces.

Movement Labs, San Francisco, CA, USA, Founded in 2022 ($3 billion)

Sentient AGI's decentralized AI platform leverages blockchain to incentivize open-source AI model contributions, powering a collaborative AI development ecosystem. Target customers include: AI researchers, developers, and organizations seeking decentralized AI solutions.Mysten Labs (SUI), Palo Alto, CA, USA, Founded 2021 (~$2 billion)

Mysten Labs develops the Sui blockchain, a high-throughput Layer-1 platform using the Move programming language, enabling scalable and secure decentralized applications. Target customers include: Web3 developers, gaming studios, and enterprises.

Mythical Games cofounder and CEO John Linden says ‘Web3 is a transformative force because empowers players with ownership, and integrates digital assets into broader economic systems.’

Mythical Games, Los Angeles, CA, USA, Founded in 2018 ($1.3 billion)

A blockchain platform integrates NFTs into gaming, enabling player-owned economies and interoperable digital assets. Target customers include: gamers, game developers, and NFT collectors engaging with blockchain-based gaming.Nansen, Singapore, Singapore, Founded 2020 ($750 million)

Offers a blockchain analytics platform that combines on-chain data with wallet labeling to provide actionable insights for crypto market trends and investment decisions. Target customers: Crypto investors, traders, and funds needing data-driven market intelligence.

Nexo, Zug, Switzerland, Founded 2018 ($2 billion)

Provides a crypto-backed lending and wealth management platform, leveraging blockchain to offer instant loans, high-yield savings, and secure custodial services. Target customers: Retail and institutional crypto holders seeking lending, borrowing, and asset management.

Offchain Labs, Princeton, NJ, USA, Founded 2018 ($1.2 billion)

Develops Arbitrum, a layer-2 scaling solution for Ethereum that enhances transaction speed and reduces costs while maintaining security, powering scalable decentralized applications (dApps). Target customers include: Ethereum developers and dApp builders seeking cost-efficient scaling solutions.

OpenSea, New York, NY, USA, Founded in 2017 ($1.9 billion)

A decentralized marketplace protocol facilitates peer-to-peer NFT trading, powering the world's largest NFT trading platform. Target customers include: NFT creators, collectors, and investors trading digital art, collectibles, and virtual assets.

Paxos (PAX), New York, NY, USA, Founded 2012 ($2.4 billion)

Offers a regulated blockchain infrastructure for issuing and settling digital assets, including stablecoins like USDP, enabling secure and compliant financial transactions. Target customers include: financial institutions, fintechs, and enterprises.

Phantom, San Francisco, CA, USA, Founded 2021 ($3 billion)

Develops a user-friendly crypto wallet for Solana and other blockchains, streamlining DeFi, NFT, and Web3 interactions with enhanced security and UX. Target customers: Crypto users and Web3 enthusiasts.

Polygon, Bengaluru, Karnataka, India, Founded in 2017 ($13 billion)

A Layer-2 scaling solutions, like zkEVM and sidechains, enhance Ethereum's scalability, powering cost-effective decentralized applications. Target customers include: developers, DeFi protocols, and enterprises building Ethereum-based applications.Ripple, San Francisco, CA, USA, Founded in 2012 ($15 billion)

The XRP Ledger enables fast, low-cost cross-border payments, powering its enterprise-grade financial transaction solutions. Target customers include: banks, payment providers, and financial institutions seeking efficient global payment systems.Sahara AI, Los Angeles, CA, USA, Founded 2023 ($300 million)

A decentralized AI network that uses blockchain to enable secure, transparent data sharing and computation for AI model training and deployment. Target customers: AI developers and enterprises requiring decentralized data and compute resources

Securitize, San Francisco, CA, USA, Founded in 2017 ($400 million)

A blockchain-based platform that tokenizes real-world assets, enabling compliant issuance and trading of digital securities. Target customers include: financial institutions, asset managers, and enterprises seeking to digitize and trade assets.Sei Labs, San Francisco, CA, USA, Founded 2022 ($800 million)

Builds a layer-1 blockchain optimized for high-speed DeFi trading, offering low-latency and high-throughput transaction processing for decentralized exchanges. Target customers: DeFi developers and traders seeking fast, cost-efficient blockchain infrastructure.

Solana cofounder and CEO Anatoly Yakovenk, a Ukrainian-born American developer and entrepreneur Solana, San Francisco, CA, USA, Founded in 2018 ($4.4 billion)

Solana's proof-of-history consensus achieves high-throughput, low-latency transactions, powering scalable decentralized applications and DeFi platforms. Target customers include: developers, DeFi projects, and enterprises building high-performance blockchain solutions.Sorare, Saint-Mandé, Île-de-France, France, Founded 2018 ($4.3 billion)

Leverages blockchain technology to create a fantasy sports platform where users collect, trade, and play with officially licensed NFT-based digital player cards. Target customers include: sports fans, gamers, and NFT collectors seeking immersive fantasy sports experiences.

StarkWare, Netanya, Israel, Founded 2018 ($8 billion)

Develops STARK-based Layer-2 scaling solutions for Ethereum, using zero-knowledge proofs to enable high-throughput, low-cost, and secure blockchain transactions. Target customers include: Ethereum developers, DeFi platforms, and enterprises.

Story Protocol, San Francisco, CA, USA, Founded in 2023 ($2.3 billion)

A blockchain-based IP management system that allows creators to tokenize and license intellectual property, powering a decentralized creative economy. Target customers include: content creators, media companies, and developers building IP-focused blockchain applications.Sentient AGI, San Francisco/Dubai, UAE, Founded in 2024 ($500 million)

Sentient AGI's decentralized AI platform leverages blockchain to incentivize open-source AI model contributions, powering a collaborative AI development ecosystem. Target customers include: AI researchers, developers, and organizations.Sygnum, Zurich, Switzerland, Founded in 2018 ($1 billion)

Sygnum's integrated digital asset banking platform combines blockchain custody with traditional finance, powering secure crypto trading and asset management. Target customers include: institutional investors, wealth managers, and corporations.TaxBit, Salt Lake City, UT, USA, Founded 2018 (~$1.4 billion)

Provides blockchain-powered tax compliance software that automates cryptocurrency tax reporting and accounting for transactions across exchanges and wallets. Target customers include: crypto investors, enterprises, and tax professionals.

Telegram founder Pavel Durov is a Leningrad-born entrepreneur and programmer who also created VK (VKontakte), Russia's largest social networking platform. Telegram, Dubai, United Arab Emirates, Founded in 2013 ($30 billion)

Telegram's TON (The Open Network) blockchain enables fast, scalable transactions, powering decentralized apps and services integrated with its messaging platform. Target customers include: developers, businesses, and users leveraging TON for payments.

Welcome to Silicon Valley ‘25

The first annual Silicon Valley ‘25 (SV’25) is an invitation-only gathering of 600 CEOs and founders of Cryptonite 300 top Web3 private companies and their VC backers, as well as distinguished members of the business press, blogger, and analyst communities and other industry thought-leaders.

When and Where

—August 6th & 7th (Wed & Thurs)

—The Presidio Theatre Performing Arts Center (on the grounds of San Francisco’s Presidio National Park)—99 Moraga Ave., San Francisco, CA

—600 invitation-only live guests

Come join the conversation

The SV '25 program revolves around conversations between entrepreneurial thought leaders about how Web3 innovation can address some of the world's most pressing issues, create new efficiencies and opportunities, and further decentralize power away from the institutions we no longer trust.

The Bitcoin Metaphor and Wall Street

Will a digital USD take on China’s digital yuan (e-CN¥)?

Where DeFi and TradFi meet

Reclaiming personal identity and data sovereignty

Can Hollywood and corporate media survive the Creator Economy?

Farm to fork for everyone

Meet the modern, predictive corporation

The upending of the professional services industry

Drug and therapy creation faster than a speeding bullet

Trusting your robotaxi driver

Welcome to the new world of the killing drones

Do we have nothing to fear but fear itself?

SV’25 is presented by Voting Block USA (VB USA), a 501 c3 non-profit, nonpartisan, grassroots project dedicated to educating the public on how Web3 innovation will impact our daily lives and professional futures. VB USA is supported by The Draper Family Trust and Draper Associates and produced by Cryptonite Ventures.

https://substack.com/@optionstradingmadeeasy?r=5ugms6&utm_medium=ios&utm_source=profile

I’ve been actively trading stocks and options for years, and I can tell you — the key to success isn’t complexity. It’s clarity, structure, and risk control.

Too many people jump into options without understanding the “why” behind each trade. That’s why I recently started a Substack called Options & Trading Made Easy. It’s designed for all levels — from beginners to advanced — and focuses on:

• 📈 Powerful stock tips with clear entry points

• 🔁 Options strategies that are simple, logical, and actively managed

• 💡 Live trade examples with visuals and technical rationale

• 🛡️ Risk management techniques I personally use

I also break down concepts like spreads, protective puts, and hedging in plain language, not jargon.

👉 If you’re someone who wants to learn, improve, or just follow strong setups — I think you’ll find real value here:

https://intelligentsound.substack.com/p/d3b0a071-e9c4-4f48-8e7f-df45efd284cb