Six slides worth $200 trillion, Moore's Law on steroids, crypto IPOs, digital Treasuries, The Long (AI) March, and more inside scoop...

There is something about Mary

The most coveted annual PowerPoint presentation in the VC-backed world from 1995 to 2019 was Mary Meeker’s Internet Trends Report. Now, after a reprieve, Ms. Mary is back with her BOND colleagues with the AI Trends Report, and we are delighted to have hunted down the 340-page deck.😳

Trends – Artificial Intelligence (AI), published on May 30, 2025, by Mary Meeker / Jay Simons / Daegwon Chae / Alexander Krey of BOND.

Mary has been crafting these missives since she was a Managing Director at Morgan Stanley from 1991 to 2010, where she led the bank’s global technology research team. After being recruited as a partner at VC powerhouse Kleiner Perkins Caufield & Byers, where she sat from 2010 to 2018, she founded BOND.

We teased Mary back in 2019 when she published her last Internet report that ‘blockchain,’ ‘bitcoin,’ and ‘cryptocurrency’ were not mentioned ONCE. So, before we talk about our favorite slides from Mary's new AI deck, here is one of our own that shows we were not off on BTC and the blockchain and crypto business back in 2019.

Total VC investment in AI companies since 2015 has been $350–400 billion. The total VC investment in blockchain companies was $80–100 billion. The difference reflects AI's broader market appeal, its capital-intensive nature (e.g., training large language models), and consistent investor enthusiasm, in contrast to blockchain's volatility. Still wondering why Mary remains crickets on the blockchain/crypto side of the equation.🤔

Stablecoins are the tip of the spear in crypto right now. The market cap is approximately $230 billion and mostly backed 1:1 by U.S. Treasuries. They represent blockchain’s best shot at powering global financial rails, putting dollars into the hands of 5 billion smartphone users worldwide.

—Paul Veradittakit, Partner, Pantera Capital.

The crypto IPOs market is also reaching a new maturity, as we had predicted for this year. Since May, eToro’s Nasdaq debuted with a current market cap of $5.4 billion, followed by Circle’s IPO filing, with the stock settling in with a ~$45 billion market cap as of late.

“In 1998, Google set out to ‘organize the world’s information and make it universally accessible and useful.’ Nearly three decades later, AI is making access to that information and how we move it much faster. AI is an Internet compounder which allows for wicked-fast adoption of easy-to-use, broad-interest services.”

AI puts Moore’s Law on steroids

Skipping ahead, we are thrilled the BOND is bullish on the ensuing AI era and its inevitable transformation of almost everything we do. It all adds up to more support for our Web3 = $200 trillion in new wealth over the next 20 years prediction, representing a 10x multiple over the Web2 era stats. At the very highest level, we are still betting on Moore’s Law, and at even greater rates of growth and efficiency than ever before.

Since 2016, exponential improvements in NVIDIA’s GPUs have led to a +225x increase in AI FLOPS performance, a +50,000x improvement in energy efficiency, and a +30,000x increase in theoretical token revenue for a $1B data.

The current chip power growth for AI applications significantly outpaces Moore’s Law. AI workloads, particularly for deep learning and large-scale models, demand specialized hardware (GPUs, TPUs, and NPUs) that are scaling performance at a faster rate than traditional CPU transistor counts.

Moore's Law reflects an empirical observation and prediction by Intel cofounder Gordon Moore in 1965. The Law states that the number of transistors on a microchip will double approximately every two years, while the cost of manufacturing remains constant or decreases. This leads to exponential improvements in computing power, performance, and efficiency over time.

Powering AI agents out on the edge

Exponential advancements in AI chip designs are enabling more powerful, accessible, and cost-efficient AI computation, which in turn enables the deployment of powerful AI apps and devices to the edge of resource-constrained devices.

AI players on the edge

Smartphones and Wearables: Real-time image processing (Google Lens, Apple’s Face ID), voice assistants (Siri, Google Assistant), on-device translation (Google Translate), and health monitoring.

IoT Devices (Smart Home/Appliances): Smart thermostats (Nest) that learn user preferences, AI-powered security cameras (Ring) with facial recognition, or voice-controlled smart speakers (Amazon Echo).

Autonomous Vehicles and Drones: Self-driving cars (Tesla’s Full Self-Driving) use AI for real-time object detection, path planning, and decision-making. Drones employ AI for navigation, obstacle avoidance, and aerial mapping.

Industrial IoT and Robotics: Manufacturing robots with AI for quality control (e.g., defect detection in production lines), predictive maintenance sensors in factories, or agricultural drones for crop monitoring.

Healthcare Devices: Portable diagnostic tools (e.g., AI-powered ultrasound devices), wearables for detecting arrhythmias, or glucose monitors with predictive analytics.

Retail and Consumer Devices: Smart checkout systems (Amazon Go’s cashierless stores), AI-powered vending machines, or augmented reality (AR) devices for personalized shopping experiences.

AI agents can reason, act, and complete multi-step tasks on your behalf. They don’t just answer questions –they execute: booking meetings, submitting reports, logging into tools, or orchestrating workflows across platforms, often using natural language as their command layer. This is where all the big money is going to be made.

A mad adoption rate

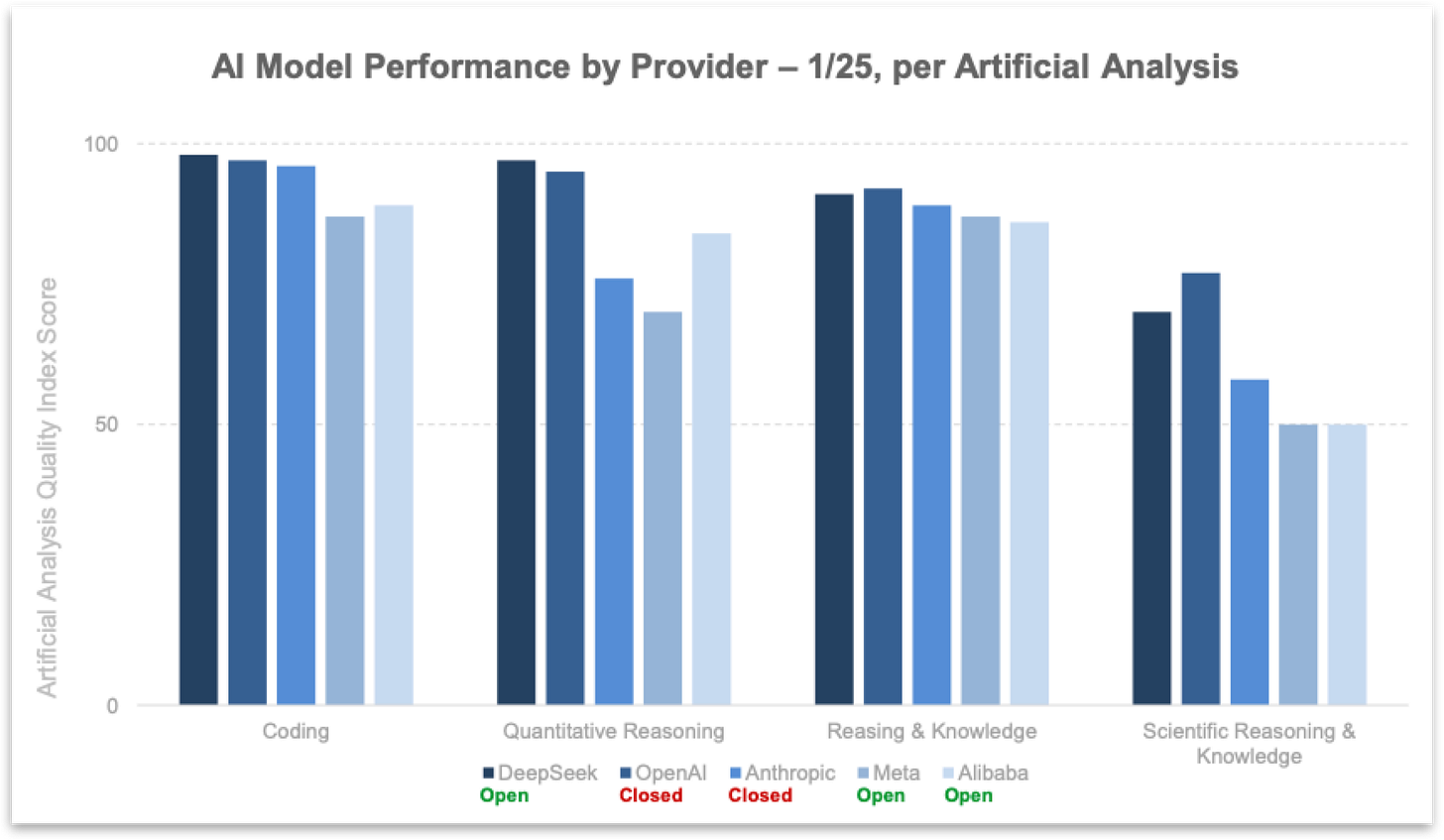

The chart below tells half the story. The other half is that most users have only an inkling of how AI apps and devices can and will transform their work and playtime. As the BOND report effused, OpenAI’s ChatGPT as ‘history’s biggest overnight success.’ FACTS. But its always good to remember that Google was the 15th notable Internet search engine on the scene, so OpenAI still needs to watch its back, especially with its current ‘closed AI’ model versus open source AI models like DeepSeek’s. (More on that below.)

Here is what Gen Z uses GenAI for today in order: Research, writing, brainstorming, exploring personal interests, organizing tasks, and seeking personal and professional input and advice. When the voice assistants like Siri give you the power to command your army of AI bots for almost anything you need, that’s when the game truly changes. We will be talking to Siri all day.

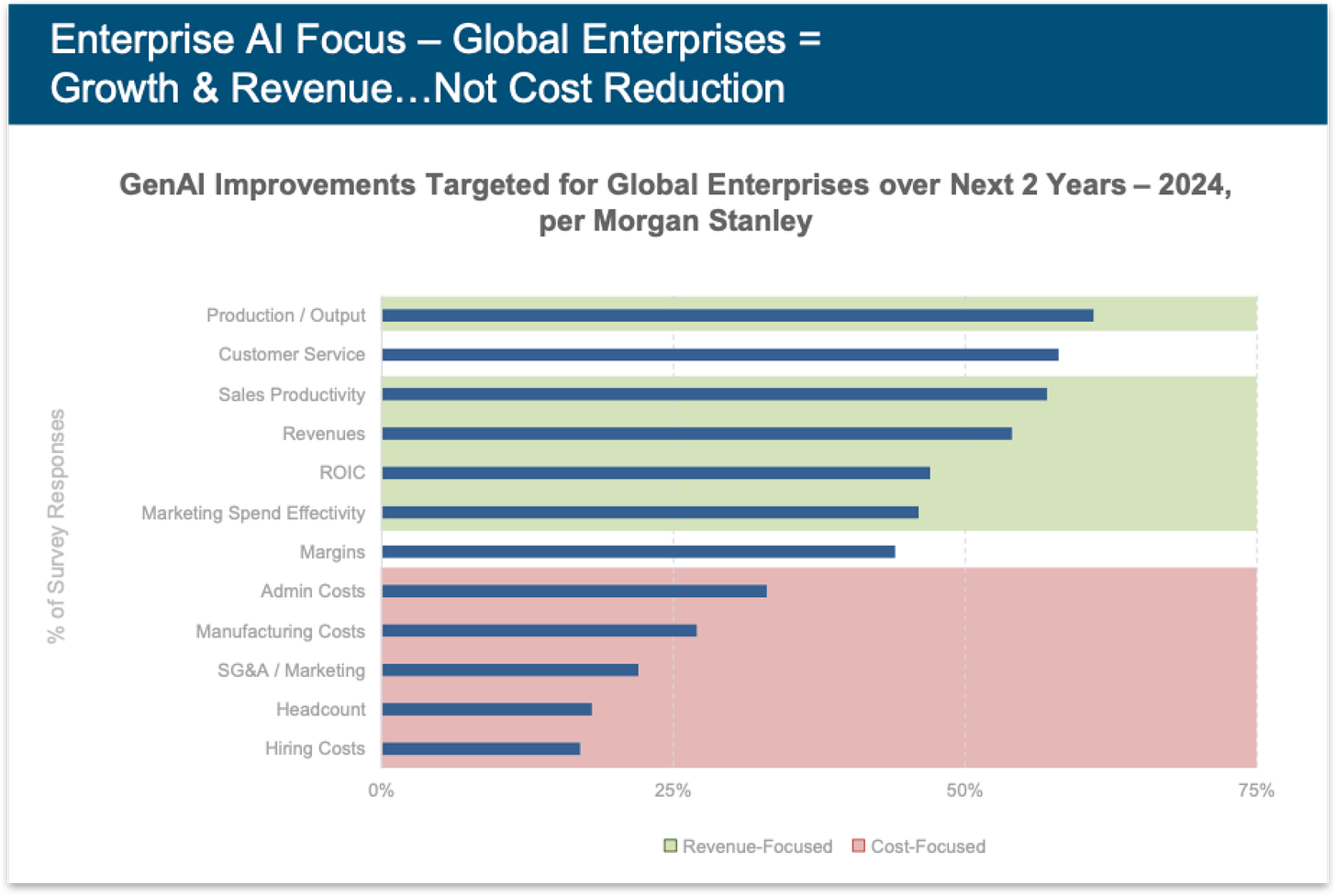

More about pumping sales than slashing costs

In the Morgan Stanley survey of 427 global enterprises, 75% indicated a focus on improving revenues through GenAI, and 50% emphasized enhancing customer service. Overall, corporate GenAI initiatives over the next two years are predominantly focused on revenue expansion rather than cost reduction, with higher response percentages in revenue-related areas compared to cost-focused ones.

“Every job will be affected by AI. Some jobs will be lost, some jobs will be created, but every job will be affected. It’s immediately and unquestionably clear, you're not going to lose a job to AI, you will lose your job to somebody who uses AI.”

— Jensen Huang, NVIDIA CoFounder & CEO @ Milken Institute Global Conference 5/25.

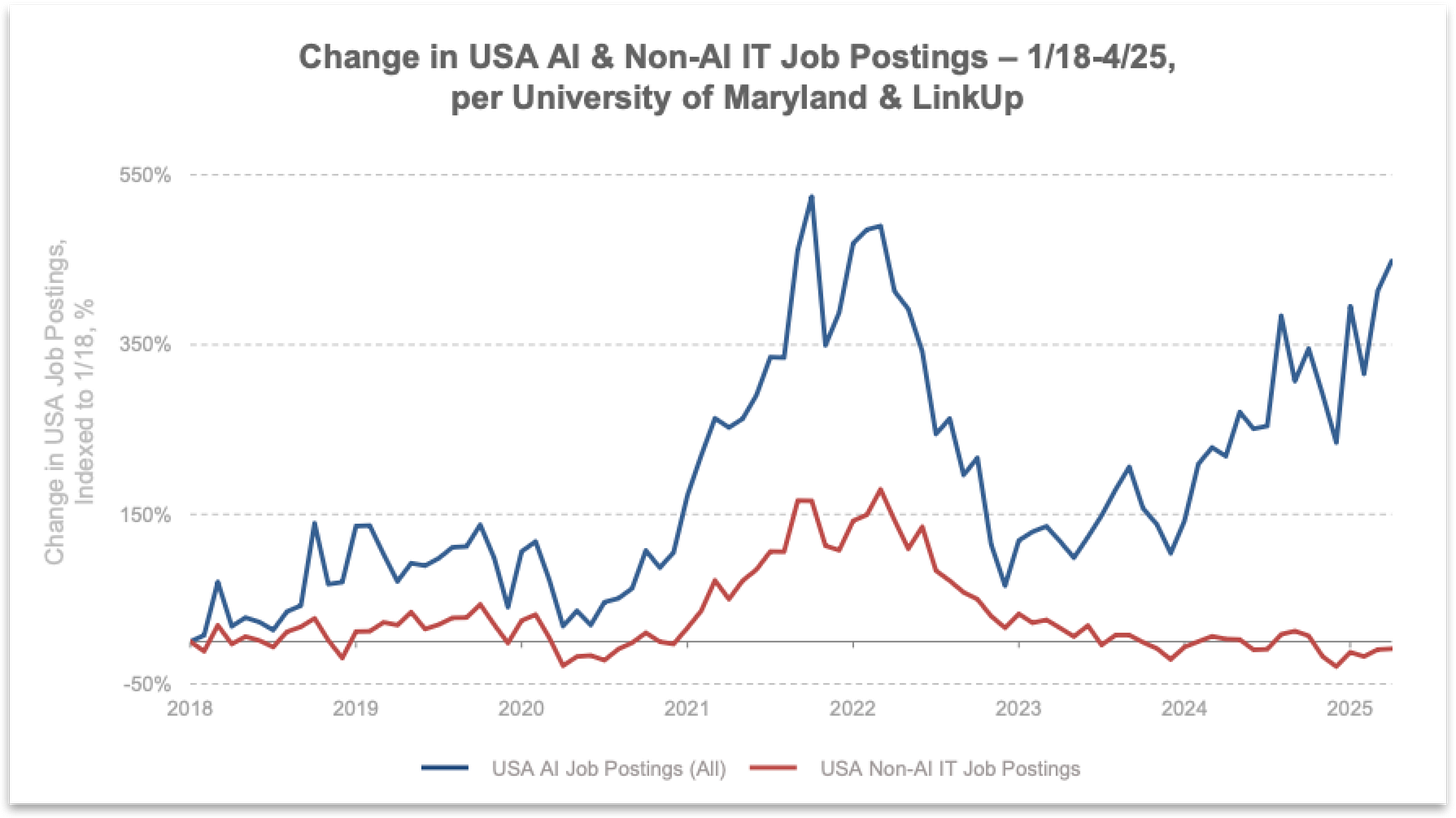

How to stay relevant in the AI era

The following two charts tell two stories. The first one is how those with AI apps and tools experience are well-positioned for growing opportunities. The second is the birth of yet another era of innovation eating itself.

Today, AI code is eating the software development process, making it more efficient and shifting focus from coding to oversight and creativity.

Show us the money!

This chart shows all the industries most ripe for AI remakes. The bigger the bubble, the greater the disruption in the given industry. This transition will require new 3rd-party solutions (e.g., Cryptonite 300 companies), and internal help and resources to make it happen (hence the boost in AI job postings and ‘revenue focused’ developments referenced above).

From small businesses to huge conglomerates, all companies will be AI companies, because AI will be the brains of every company, automating operations and tasks in ways we can’t even imagine. This future is not so far from here.

The free world’s greatest AI challenge

In April, Chairman Xi expressed to his fellow Politburo members, "Breakthroughs must be achieved in methodologies and tools to gain a first-mover advantage and secure China's competitive edge in AI."

Palantir cofounder and CEO Alex Karp is well-informed about what's happening inside the U.S. Department of Defense and throughout our intelligence agencies, particularly regarding our AI innovation and counterintelligence status compared to that of the Mighty Dragon from the East.

Mr. Karp bluntly told CNBC recently, 'My general bias on AI is it is dangerous. There are positive and negative consequences.’ In the AI arms race, Alex says only one country will emerge as the winner. 'Either we win that race or China will,' he says. ‘So we need to run harder, run faster in an all-country effort to develop more advanced AI models.' The race is on!

DeepSeek, the Chinese AI startup founded in May of 2023 by hedge fund manager Liang Wenfeng, rocked the AI world (and temporarily knocked a trillion in market cap out of tech stocks) at the beginning of the year. DeepSeek remains a shining example of China's growing capabilities in AI, and how the open source AI approach of coding at a higher performance, lower cost approach threatens the closed source AI players such as OpenAI and Anthropic.

"I personally think we have been on the wrong side of history here and need to figure out a different open source strategy; not everyone at OpenAI shares this view, and it's also not our current highest priority. But OpenAI will follow DeepSeek's approach. We are gonna show a much more helpful and detailed version of this soon. Credit to [DeepSeek’s] R1 for updating us.’😳

—Sam Altman, CEO of OpenAI, on a Reddit broadcast

Conclusion…

We highly recommend that all our readers review the entire report. The BOND folks go deep into AI model compute costs, performance trajectories, developer ecosystems, AI monetization strategies from chips to GenAI, and all the current Internet stats.

It's edited for the sophisticated tech investors in public and later-stage AI companies. We would have loved to see more coverage of the private companies and emerging sectors, which were a part of the Internet Reports.

Trends – Artificial Intelligence (AI), published on May 30, 2025, by Mary Meeker / Jay Simons / Daegwon Chae / Alexander Krey of BOND.

While reviewing the 2025 AI Trends report, we became certain, after the authors’ extensive praise of OpenAI’s ChatGPT as ‘history’s biggest overnight success’ and the company's market dominance, that BOND was an investor in OpenAI. But lo and behold, we can find no evidence that BOND has invested a penny in the GenAI pioneer.

Come hang out with the New Captains of Industry at Silicon Valley '25

Serendipity awaits!—33%-ticket discount until July 31st!

Cryptonite cordially invites our readers to the first annual Silicon Valley '25 (SV'25). SV'25 is an invitation-only gathering of 600 CEOs and founders from the Cryptonite 300 top Web3 private companies, their venture capital backers, as well as distinguished members of the business press, bloggers, analyst communities, and other industry thought leaders.

At the glorious Presidio Park Theatre

—September 16th & 17th (Tues. & Wed.)

—The Presidio Theatre Performing Arts Center (on the grounds of San Francisco’s Presidio National Park)—99 Moraga Ave., San Francisco, CA

—Tickets include breakfast, lunch, and two outdoor cocktail receptions.

—Only 600 exclusive member tickets are available, so act now!

Come join the conversation

The SV'25 program centers on conversations between entrepreneurial thought leaders and risk capitalists about how Web3 innovation can create new efficiencies, opportunities, and wealth and further decentralize power away from institutions we no longer trust.

Three Cryptonite 100 top Founders/CEOs and two VCs will present and participate in an interactive conversation on topics hosted by top members of the technology business press.

How quantum computing ignites breakthroughs in AI, materials science, cryptography, drug discovery, and secure communications. More from Gok3.

The Bitcoin Metaphor and the downsizing of Wall Street. Where DeFi and TradFi meet. More from Grok

The tokenization of real-world assets, including real estate, public stocks and bonds, fine art, and VC equity investments. More from Grok3

Should we create a digital USD to compete with China’s digital yuan (e-CN¥)? What role do stablecoins play, and are they viable over the long run? More from Grok3

Can Hollywood and corporate media survive the Creator Economy, the artist-to-fan token model, and AI-powered creativity? More from Grok3

Farm-to-fork certified organic food for all, with sustainable water, forest, and agricultural management along the way. More from Grok3

How AI, armies of bots, and predictive analytics will remake the modern corporation. More from Grok3

How professional service firms survive AI automation—or not. More from Grok3

AI-powered drugs, therapy, and diagnostics will create exceptional patient service and health outcomes. More from Grok3

How AI and autonomous AI-powered robots, killing drones, and robotaxis - Oh my! More from Grok3

Do we have nothing to fear but fear itself? Mass job elimination and self-annihilation? More from Grok3

We would be honored if you could join us at Silicon Valley ‘25 and participate in the ultimate insider event. There is no other event on the planet that will illustrate where global Silicon Valley innovation is taking the world. There are only 600 tickets available, so act now!

Tokenization of assets? BlackRock’s Larry Fink is all in!

Larry Fink, the CEO of BlackRock, the world’s biggest money manager, said in a recent letter to investors, ‘Every stock, every bond, every fund—every asset—can be tokenized.’ This is and will happen, of course, because it is by far the superior way to do the same things we already do today. Unlike traditional paper certificates signifying financial ownership, tokens live securely on a blockchain, enabling instant buying, selling, and transfers without exchanging paperwork. As Mr. Fink says, ‘much like a digital deed.’

Tokenization also enables 24-hour markets, with more inclusivity, and turns settlement time into seconds. This model also dramatically increases the velocity of transactions, allowing billions of dollars to be reinvested immediately back into the economy. What’s not to like?

It’s huge to have such an gigantic Wall Street money salesman on the team!

A great illustration of this trend is publicly traded Digital Asset Treasury companies. Crypto VC Pantera Capital has been at the forefront with investments in the first US-listed Solana treasury company, DeFi Development Corp (DFDV, fkaJNVR), Twenty One Capital (dba Cantor Equity Partners or CEP), the Bitcoin treasury company started by Tether, Softbank, and Cantor. CEP is now the second-largest digital asset treasury company behind MicroStrategy, now known as Strategy (MSTR).

‘On the conference circuit, the chatter was all about how the new IPOs signal crypto’s integration into mainstream finance. The IPO pipeline is heating up, offering liquidity, more consumer protection, and drawing institutional capital,’ observes Pantera partner, Paul Veradittakit.

By 2030, it's projected that the total value of tokenized real-world assets will reach anywhere from $10 trillion (Roland Berger) to $16 trillion (JPMorgan & Boston Consulting Group). You can take that to the bank.