VeradiVerdict - Issue #290—April 4, 2024: At Pantera Capital, the investment team spends quite a bit of time learning and educating entrepreneurs on insightful strategies across a number of areas. General Partner Lauren Stephanian has created the most comprehensive report in the industry around how to optimize your token distribution so you can read it below and feel free to DM her if you have any comments or questions!

Two years ago, we released Optimizing Your Token Distribution, an analysis of token distribution patterns, to help founders better think through network allocation. Trends in this space shift quickly and, given the renewed market enthusiasm, more founders are starting to draft their token distribution models and launch tokens. This report incorporates the latest data along with updates to our analytical framework to serve as a useful resource to founders.

As a reminder, founders of protocols often raise capital with the intention of releasing tokens to both private investors and their community. These tokens typically involve governance rights, and allow holders - insiders, private investors, and community alike - to participate in a product, service or protocol. Often a protocol has a fixed supply of tokens and therefore teams have to be careful about how they allocate them, optimizing for the greatest set of recipients as well as considering inclusion of their users and partners. Teams will therefore allocate their supply accordingly and create a schema that contextualizes how tokens are earmarked for different user groups.

In the previous version of this exercise in 2022, we explored key trends in token distributions with data pulled from private pitch decks, public medium posts and blogs, and Github READMEs dating back to 2014. Now, two years later, we have been able to improve upon that data set and further explore the latest trends below.

Please note: This report was published as of March 2024 using publicly available information as well as aggregated and anonymized private data points. The authors of this report did not independently verify the accuracy of these distributions today.

Key Trends for Token Buckets

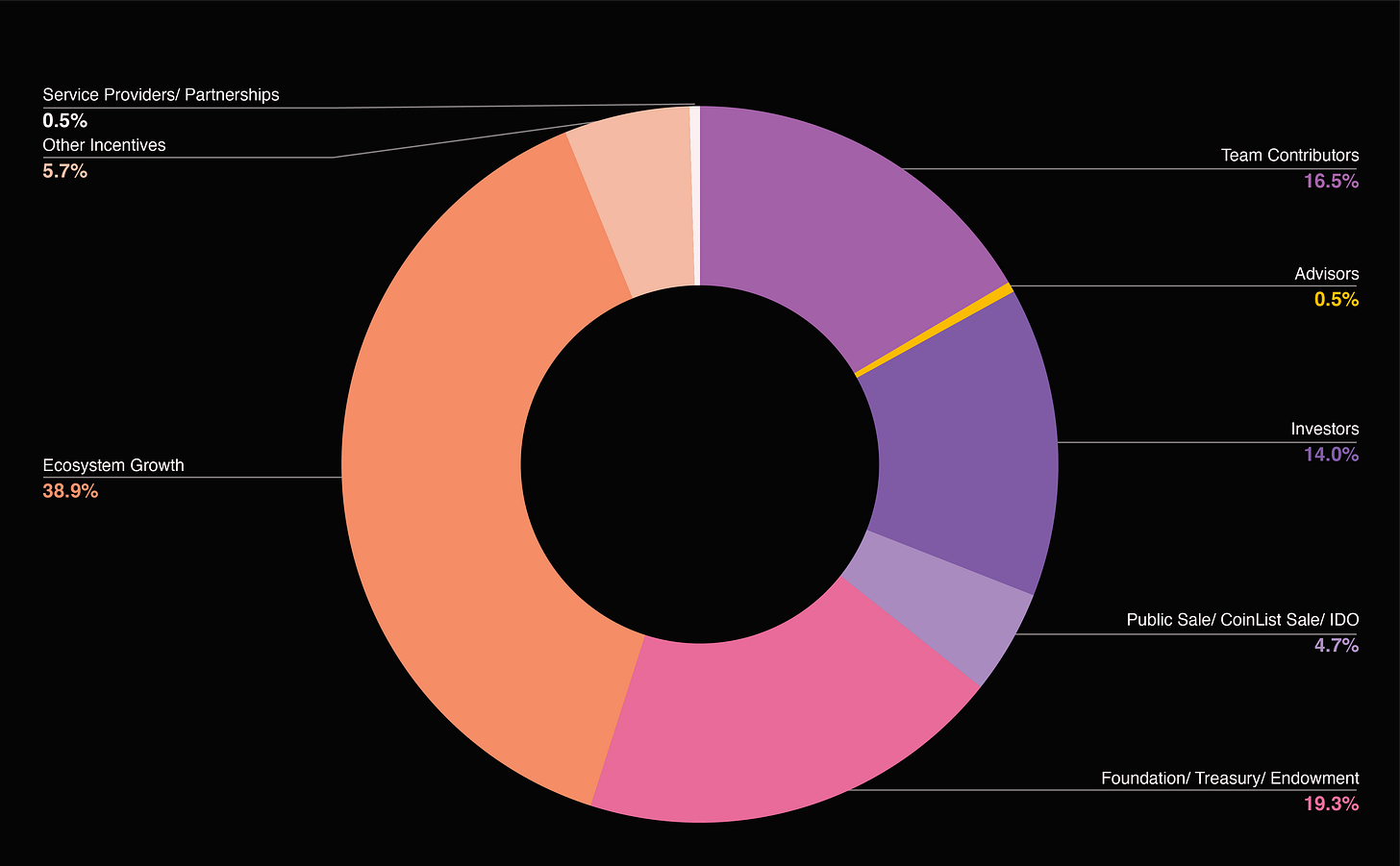

Token distributions can be broken down into 7 main segments:

Core Team

Private Investors

Community Treasury

Ecosystem Incentives

Airdrop

Public Sale

Partnerships and Vendors

We aggregated distributions across 150+ projects and protocols to create a comprehensive analysis of notable trends.

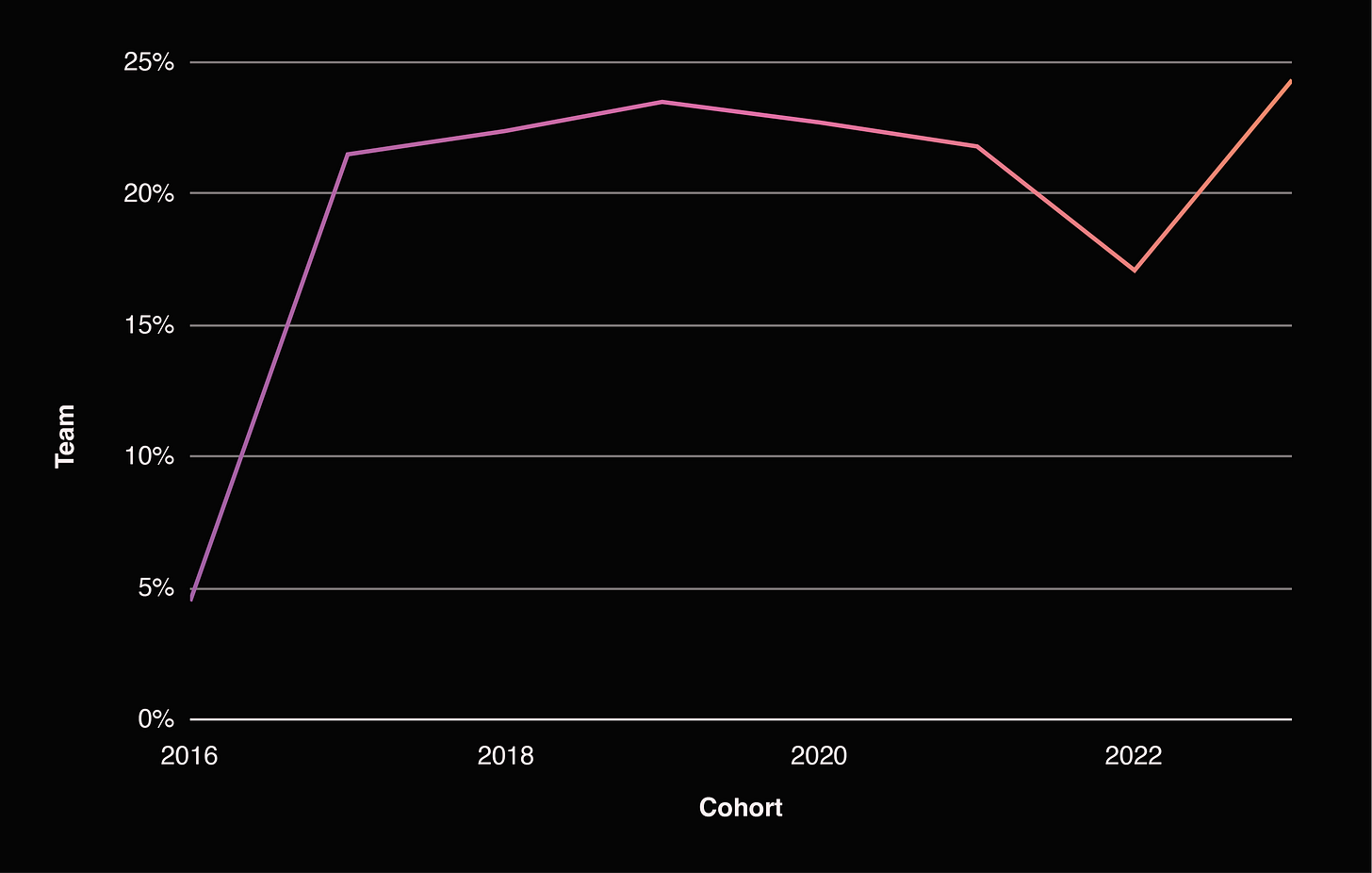

Team

This is the allocation reserved for founders, past and future employees as well as advisors. These tokens are often subject to the longest lockups, typically in line with their investors lockup schedules.

The chart above includes all team allocation, including core contributors, future contributor pools, and advisors. For a closer look at just core team, take a look at the chart below, indicating that core team allocation has actually never been higher.

It’s unsurprising - but still notable - that team allocation does seem to be somewhat correlated with where we are in a particular market cycle. When the aggregated crypto market cap is growing, allocation to team grows, while when market cap shrinks, the team allocation also shrinks.

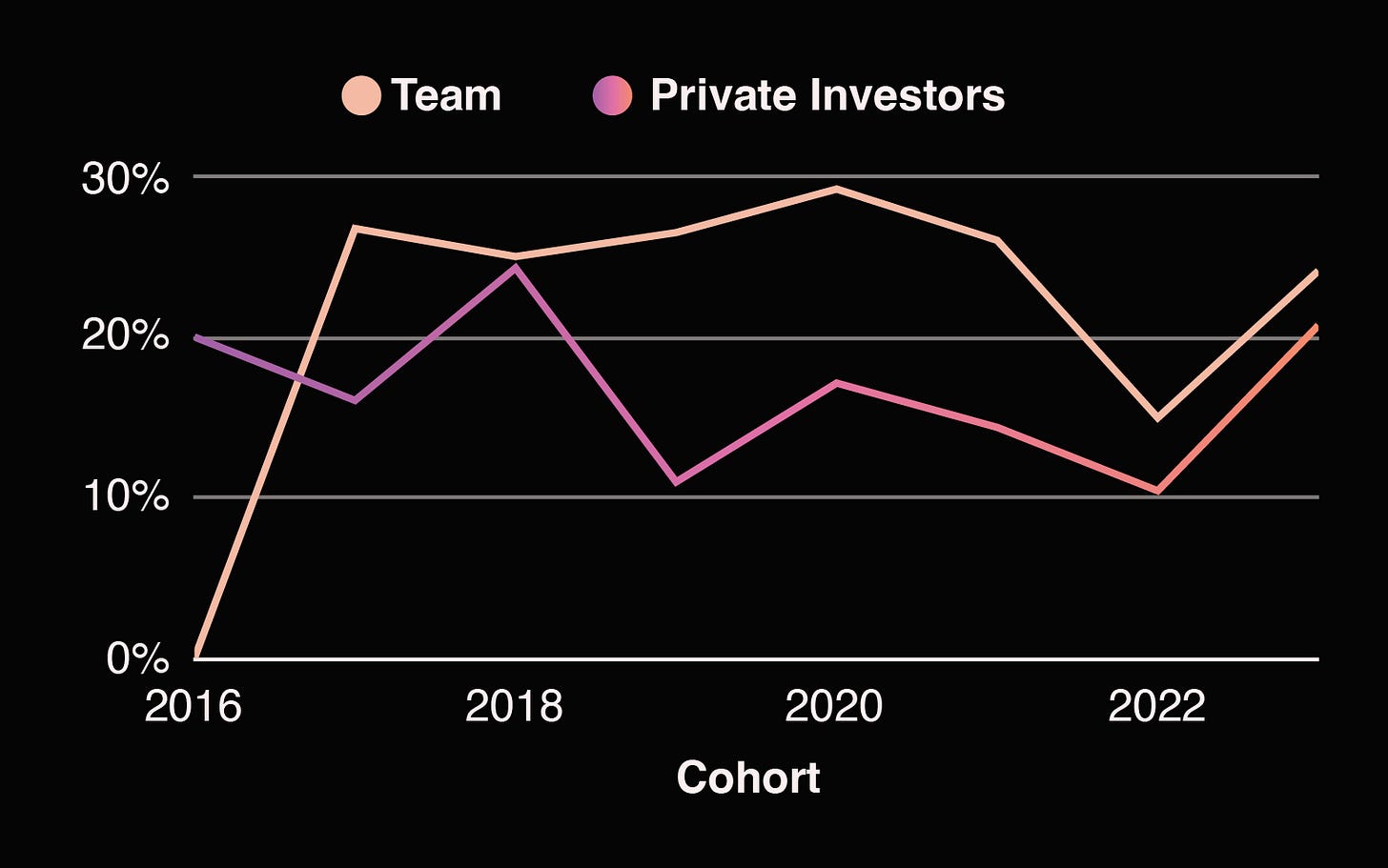

Private Investors

This is the percentage allocated to capital providers who have purchased rights to future tokens or equity that later converts to tokens. These tokens are also subject to lock-ups, generally in line with the core team

Interestingly, while we might have expected the investor allocation to be inversely correlated with team allocation, it’s actually also on the upswing over the past year. It now sits roughly at levels we last saw in 2018.

Initially I thought this could be related to the larger rounds being raised in late 2023 but taking a look at industry raise data this doesn't make as much sense given valuations increased more % wise than raise amounts.

This could be related to founders raising rounds they didn’t expect to need after waiting out this most recent bear market.

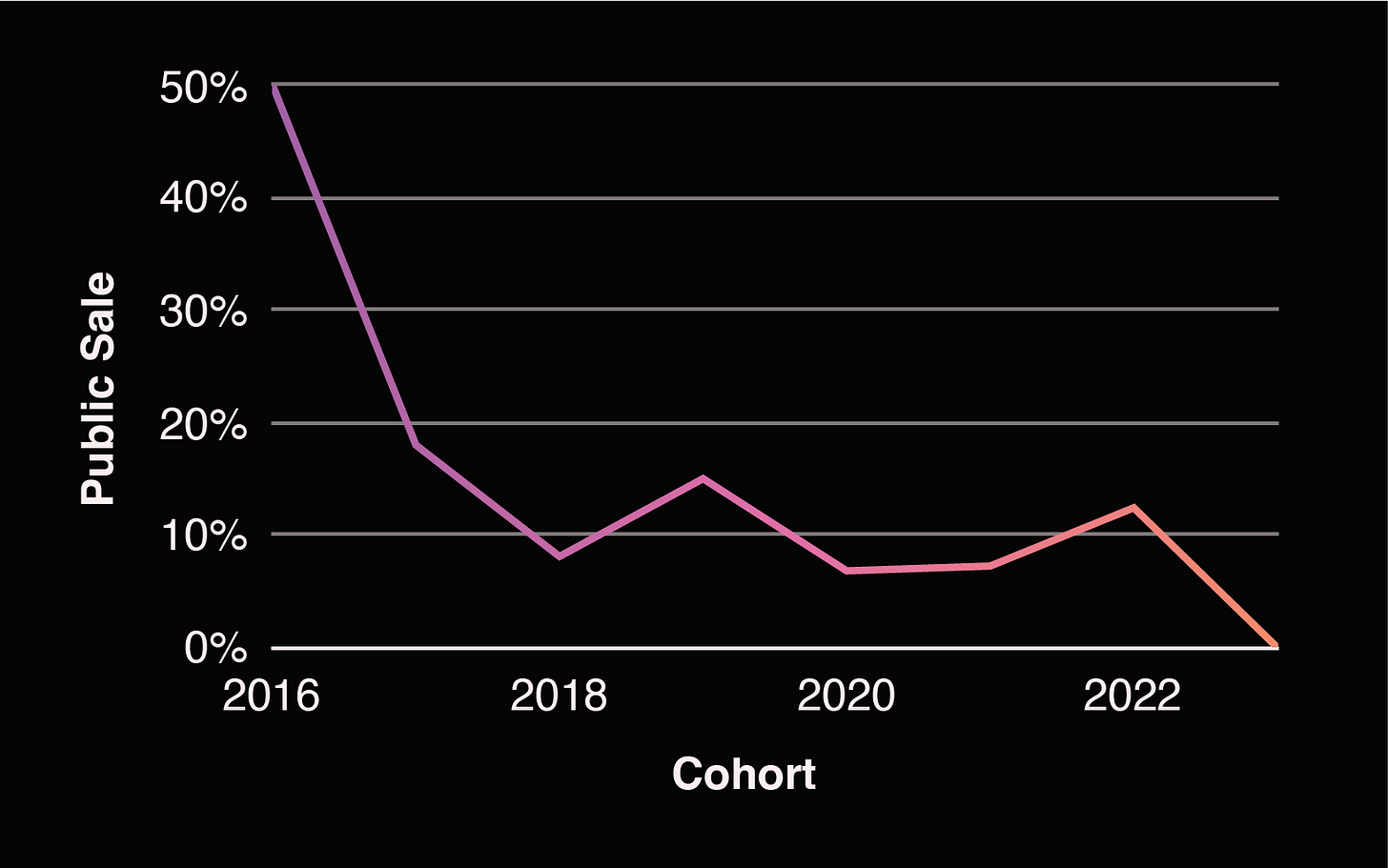

Public Investors

This is the allocation meant for sale to the general public. Formerly referred to as the “ICO” portion of the supply, Public Sale tokens are sold at launch, and liquid at inception.

Perhaps unsurprisingly, due to regulatory risk, public sales are trending to 0.

Airdrops

The absence of token sales to the public begs the question - how do you get tokens into the hands of your community? One potential way is through airdrops.

Treasury

These tokens are retained for future distribution through governance. Treasury tokens are often viewed as the project's “reserve pool” - allocated to different stakeholders through voting proposals.

Treasury allocations have fluctuated over time but peaked in 2022. Trending downwards, we’re likely seeing less allocation potentially due to increases across other categories.

Ecosystem Incentives

These are earmarked for growth programs at launch. Ecosystem Incentives are typically programmed at launch, allowing users to earn from a pre-designated pool of tokens. Incentives have emerged as an alternative to public sales, including growth programs, liquidity mining and yield farming.

Allocation to ecosystem incentives is on the decline but given airdrop percentages have increased so quickly, it’s quite likely that many founders view incentivization as an overall larger bucket, so you could take this decrease as being pretty closely tied to the massive increase in airdrops

Partnerships and Vendors

These include pools for payments for expenses such as legal, rent, third party marketing, etc. The reason for this decline might be simply due to these expenses being uncategorized and lumped together with treasury.

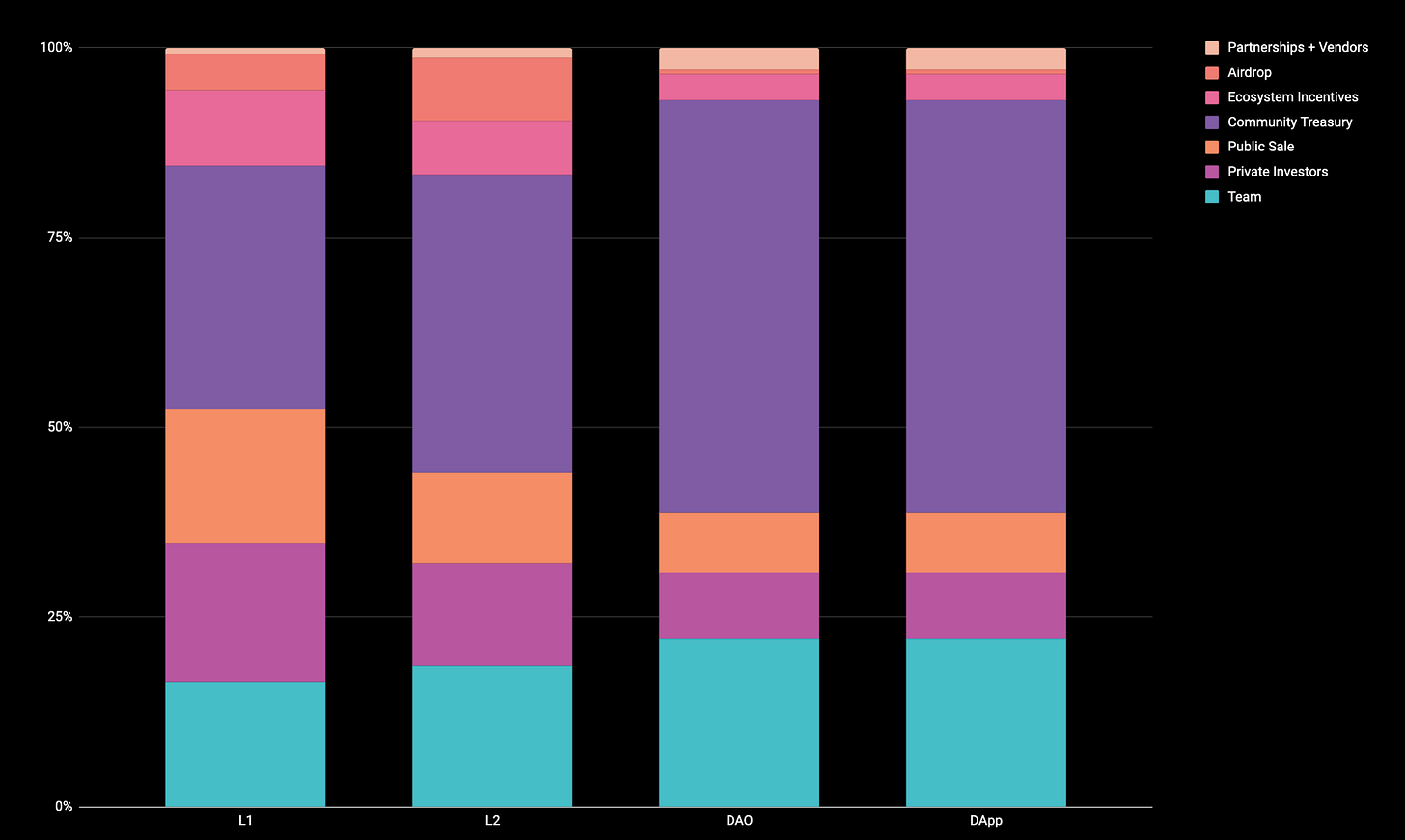

Token distribution by project type

Each type of project will have a unique distribution pattern.

Here’s how they stacked up across the board. Note that these are post-pandemic averages.

Unsurprisingly, DAOs tend to allocate more to their treasury / foundations, whereas L1s prioritize airdrops and - at least before 2023 - public sales. L2s tend to prioritize ecosystem growth incentives, which could have later been decided to be used for airdrops as well. DApps spent the most on their community engagement not necessarily via airdrops, but by other engagement farming such as liquidity incentives and yield farming.

Now, we’ll dive a bit deeper into the breakdowns within each category.

DAOs

Taking a closer look at DAOs by year, we can see some shifts over time distribution. Community treasury remained high throughout the years, while team allocation shrank and allocation to funds grew. Unfortunately we did not have enough data from 2023 to display averages.

DApps

Diving a bit deeper into DApp token distributions, we can see that team allocation has been decreasing slightly over time (after a big drop after 2014), while investor allocation and airdrop allocations have been increasing.

Infra: L1s and L2s

Because they are quite similar, this chart lumps L1 and L2 token distribution together. We can see that over time, public sale allocation dropped off. Community treasury has fluctuated a bit over the years, while investor and team allocation both increased in 2023. A significant portion of token distribution in 2023 is also going to airdrops.

Taking a closer look at the difference between the typical layer 1 and layer 2 token distribution, you can see that L2s tend to reserve less for unallocated ecosystem growth pools and more for public sales (though likely not anymore) and airdrops. L2 teams tended to take less allocation as well.

Interviews

Of course, all of the above charts indicate historical averages over time. This time around, it felt pertinent to share anecdotal data collected from some founders from earlier vintages of token raises to see what they might have regretted about their raises or what they were happy with.

Here’s what they had to say:

Livepeer

Livepeer was founded in 2017, long before DAO governance tools when crypto still very much felt in its infancy.

“I am generally happy with how [our token] was distributed, initially through an algorithmic, decentralized, and open-for-all mechanism we created called the Merklemine, and then on an ongoing basis through inflation that directs token to node operators on the network and other active participants. This has gotten tokens in the hands of those who are directly helping the network, while also allowing access to all and allowing tens of thousands of users to discover Livepeer along the way through the MerkleMine received token.

As to what I would change, if DAO based governance tools were more mature and available [6] years ago when the network launched, it would have been nice to take advantage of them to enable a community governed treasury. This would help with future ecosystem growth by being able to direct the token into the hands of video developers and others who aren't directly rewarded by the network. But at the time, these tools were so immature and complex to build, that it wasn't going to be a top priority - and we didn't want centralized control over the distribution so didn't reserve a large company governed treasury.” - Doug Petkanics, Founder of Livepeer

Well Known dApp Founded in 2018

“I think for [redacted token name], the token distributions themselves ended up working out well, I don't often wake up thinking: if only ... #facepalm

But if I could go back in time I would have placed a greater emphasis on raising from folks who 1) Can actively quant trade, 2) Are Vocal, 3) Are active in governance.

One thing that has played out well for us as founders is we didn't take up an exorbitant piece of the pie— this has allowed us to compensate employees with strong positions in the network and room to spare.” - founder of well known DeFi protocol founded in 2018

What is “Optimal”?

After publishing the previous 2022 version of this post, it was rightly pointed out that average isn’t always what’s optimal. Therefore it’d be interesting to reverse engineer some of the most notable and recent token launches across categories.

Reverse Engineering Top Token Launches

Layer 2

Taking a look at Optimism, they have a large fund specifically dedicated to RPGF, a new trend in incentivizing builders to engage with their platform. A typical amount was given to investors and core contributors, while airdrops were also a big part of the equation.

Layer 1

Celestia is a layer 1 protocol. They’ve dedicated a large portion of their token allocation to investors and a large portion dedicated to their R&D ecosystem. Incentivizations together also make up a very large portion of distribution.

dApp

GMX being a DeFi DApp has a more complex token breakdown, with a large portion going to requirements for the longevity of the DApp, especially as it pertains to keeping the product functioning well - i.e. liquidity reserves, etc.

Summary and Key takeaways

Dynamics in this space have drastically shifted over the past year with this recent bull run.

Teams

In 2023, on average teams were allocated 24% of the total distribution.

On average, team allocation is correlated with the timing of the market and in this market teams will have a lot more leverage.

Team and investor allocations are not necessarily inverse to one another and in fact, both are trending up in this market.

Private Investors

In 2023, on average private investors received 20% of the total distribution.

Community Treasury

In 2023, on average founders allocated 28% of the total distribution to their treasury.

Public Sale

In 2023, public sales saw next to nothing in distribution on average.

Ecosystem Incentives

In 2023, on average founders allocated 8% of the total distribution to ecosystem incentives.

Airdrop

In 2023, on average founders allocated 20% of the total distribution to airdrops.

Airdrops have become an important part of community building and airdrop strategy is important.

What makes a successful token drop involves allocating a large portion to community holders and future incentivization of the core team.

In a bull market, teams have the upper hand as VCs vie to get into the top deals. Founders took a cut in ownership in the last bear market but current ownership percentages are back up to where they were during the last bull market in 2021. One of the difficult problems founders in the crypto space needs to solve is striking the balance between incentivization and core team members semi-retiring upon first vest.

Separately, airdrop popularity has grown exponentially, which has spurred a flurry of engagement - both good and bad - from crypto users that have become more sophisticated with time: users will not only set up wallets on a protocol, but bridge to it, engage in transactions, generate pull requests on a protocol’s GitHub, and more - often to the dismay of builders.

On the Horizon

This space is ever-changing and we’re always seeing innovations in marketing, ecosystem growth, fundraises, and team compensation. Interestingly, it seems as though we’ve given into the reality of engagement farming, but the question is how to lengthen the time of engagement and get users familiar with using your platform.

One evolution of the airdrop framework involves points, which can be used to incentivize activity while providing the founding team with the benefit of full control. Maybe to the detriment of the community this allows founders to incentivize engagement without fully committing to dropping a token at all.

RPGF is also an up and coming topic, and a way to incentivize the building of utilities, i.e. tooling for an ecosystem which makes it easier to access or build. Utilities are extremely important Layer 1s and Layer 2s to have, but they’re typically not venture backable. RPGFs are used to incentivize the building of these utilities and enhance the ecosystem overall, - technically categorized under ecosystem growth. So far, over $300m has been granted to 1k+ entities.

Learn More or Contribute

After publishing the initial version of this post, the most frequent request I received was to open source the data. Unfortunately during the first go-round it was a mix of private and public data which for confidentiality reasons I felt I couldn’t share. However, we now have more than enough public data that we have begun building a repo. If you’d like to view (or contribute!) data, the Github repo is here.

Crypto Users Are Comparatively Impatient

VeradiVerdict - Issue #296

JUN 13

Crypto users want immediate gratification and this can be applied to airdrops, read below to find out more

Do Crypto Users Need an Intervention?

A study by Pantera Research Lab found that crypto users exhibit a high present bias and low discount factor, indicating a strong preference for immediate gratification.

The quasi-hyperbolic discounting model, characterized by parameters such as present bias (ꞵ) and the discount factor (𝛿), is useful for understanding the tendency of individuals to prefer immediate rewards over future gains, a behavior particularly pronounced in the volatile and speculative crypto market.

This research can be applied to optimize token distributions, such as airdrops which serve to reward early users, decentralize governance, and market new products.

Introduction

A classic story in Silicon Valley startup lore is Paypal’s decision to pay people $10 to use their product. The reasoning was that if you could pay people to join eventually the network value would be sufficiently high that new people would join for free, and you could stop paying. It certainly seemed to work, as PayPal was able to stop paying and continue growing, thereby bootstrapping its network effects.

In crypto, we have adopted and extended this approach with airdrops, paying people not just to join but typically to use our products for some period.

Quasi-Hyperbolic Discounting Model

Airdrops have become a multifaceted tool used to reward early users, decentralize protocol governance, and, frankly, to market something new. Formalizing the distribution criteria has become an art, particularly when determining who should be rewarded and the value attributed to their efforts. In this context, both the quantity of tokens distributed and the timing of their release, often through mechanisms like vesting or gradual release, play significant roles. These decisions should be grounded in systematic analysis rather than relying on guesswork, sentiment, or precedents. Using a more quantitative framework ensures fairness and strategic alignment with long-term objectives.

The quasi-hyperbolic discounting model provides a mathematical framework to explore how individuals make choices involving trade-offs between rewards at different times. Its application is particularly relevant in areas where impulsivity and inconsistency over time significantly influence decision-making, such as financial decisions and health-related behaviors

The model is driven by two population-specific parameters: present bias, ꞵ, and the discount factor, 𝛿.

Present Bias (ꞵ):

This parameter measures the tendency of individuals to prioritize immediate rewards over those that are further away disproportionately. It varies between 0 and 1, where a value of 1 indicates no present bias, reflecting a balanced, time-consistent evaluation of future rewards. As values approach 0, they signify an increasingly strong present bias, indicating a heightened preference for immediate rewards.

For instance, given the choice between 50 today or 100 in a year, a person with a high present bias (closer to 0) will prefer the $50 immediately rather than waiting for the larger sum.

Discount Factor (𝛿):

This parameter describes the rate at which the value of future rewards diminishes as the time until their realization increases, accounting for the natural decline in their perceived value with delay. The discount factor is more accurately quantified over longer, multi-year intervals. When assessing two options in the short term (less than one year), this factor exhibits considerable variability as immediate circumstances can disproportionately influence perception.

For generalized populations, studies show the discount rate is usually around 0.9. However, this value is often substantially lower among groups with gambling tendencies. Research indicates that habitual gamblers typically exhibit a mean discount factor slightly below 0.8, whereas problem gamblers tend to have a discount factor closer to 0.5.

Using the above terms, we can express the utility U of receiving a reward xat time t through the following formula:

U(t) = tU(x)

This model captures how the value of rewards varies depending on their timing: immediate rewards are evaluated at full utility, while future rewards are adjusted downward in value, factoring in both the present bias and the exponential decay.

The Experiment

Last year, Pantera Research Lab conducted a study to quantify the behavioral tendencies of crypto users. We surveyed participants with two straightforward questions designed to gauge their preference for immediate payment versus receiving some future value.

This approach helped us ascertain representative values for both ꞵ and 𝛿. Our findings revealed that the representative sample of crypto users exhibits a present bias just above 0.4 and a notably low discount factor.

The study revealed an above-average present bias and a low discount factor among crypto users, suggesting a tendency towards impatience and a preference for immediate gratification over future gains.

This can be attributed to several interconnected factors within the crypto landscape:

Cyclical Market Behavior: The crypto market is known for its volatility and cyclical nature, with tokens often experiencing rapid value fluctuations. This periodicity influences user behavior, as many are accustomed to navigating through these cycles rather than adopting the long-term investment strategies more common in traditional finance. The frequent ups and downs may lead users to discount future values more steeply, wary of potential downturns that could erase profits.

Stigma Around Tokens: The survey specifically asked about tokens and their perceived future value, which could have highlighted an ingrained stigma associated with token-specific trading. The stigma, tied to the periodic and often speculative nature of token valuations, reinforces a cautious approach to long-term investments in the crypto space. Additionally, suppose the survey had measured preferences using a fiat currency or another form of reward. In that case, the discount rates of crypto users might align more closely with global averages, suggesting that the nature of the reward could significantly influence the observed discounting behavior.

Speculative Nature of Crypto Applications: Today's crypto ecosystem is deeply rooted in speculation and trading, traits that are prevalent in its most successful applications. This tendency highlights that current users overwhelmingly favor speculative platforms, a preference reflected in the survey results, which show a strong inclination towards immediate financial gains.

While the study's results may diverge from typical human behavior norms, they reflect the characteristics and tendencies of the current crypto user base. This distinction is especially pertinent for projects designing airdrops and token distributions, as understanding these unique behaviors allows for more strategic planning and reward system structuring.

Take, for example, the approach by Drift, a perps DEX on Solana, which recently launched its native token, DRIFT. The Drift team included a time-delay mechanism in their token distribution strategy, offering to double the rewards for users who wait 6 hours after the token launch to claim their airdrop. The time delay was added to mitigate the congestion typically caused by bots at the outset of airdrops and potentially help stabilize the token's performance by reducing the initial surge of sellers.

In fact, only 7.5k, or 15% (at the time of writing), of potential claimers did not wait the 6 hours for their rewards to double. Based on our presented research, with a doubled value for the reward, Drift could have delayed a few months and statistically should have appeased most of their end users.

Stay up to date with the latest research from Pantera Research Lab by following our Head of Research, Matt Stephenson, and Research Engineer, Ally Zach.

- Paul Veradittaki

RISE OF TAP-TO-EARN

Crypto assets naturally excel in financial use cases, making web3 the goat of pioneering gamified monetization ways: be it rewarded quests involving the community, learning about, utilizing a project, and disseminating info about it or the massive boom of P2E—play-to-earn—gaming, the initial segment of what is known as GameFi today.

WHAT ARE TAP-TO-EARN GAMES?

In 2022, play-to-earn titles attracted over 1.5 million active users, reaching a combined valuation exceeding $3 billion at it’s peak.

So, setting yourself up for possible goodies with these games is super easy—no special skills or knowledge are required. Just use your phone, pop up Telegram—the messenger-turned-web3-playground—and give it several minutes once you can.

Once you collect a bunch of in-game points, you should be eligible for a share of crypto rewards available once the dev team decides to do an airdrop—to date, the most utilized approach to pay out tappers eventually.

Sometimes, to prevent players from straight selling off their gains, projects promise or imply that airdropped coins will gain value and utility in the future, as they are expected to represent products like a DEX (decentralized exchange) already in development.

NOTCOIN’S TRAILBLAZING JOURNEY

As we covered earlier, T2E games owe much of their viral growth potential to Telegram’s integration of the TON blockchain and crypto assets directly within its messaging app.

The Notcoin mini-app became the spark that unleashed the craze, leveraging this integration in a game where users tapped to earn in-game coins.

Players climbed global leaderboards and earned additional tokens by completing tasks like joining Telegram groups, launching advertised mini-apps, and subscribing to social media accounts—a significant revenue source for Notcoin.

FIRST OF ALL, WHY SUDDENLY TELEGRAM?

Source: Telegram X Account.

Crypto’s early focus was on niche tech that mainly served speculators and lacked real-world use. But with spot ETFs and firms like BlackRock embracing asset tokenization, the time for evolution has arrived.

Telegram is leading this change by merging its messaging app with almost a billion monthly users, the TON blockchain for crypto adoption, and a native wallet bot simply called Wallet. While many pitch decks dream of merging web2 and web3, Telegram is actually making it happen.

Telegram’s approach addresses three core issues that have held crypto back. In the view of many crypto enthusiasts, stablecoins are the best product crypto has delivered by far.

PRIMED FOR VIRALITY

KEY FEATURES OF TAP-TO-EARN

TOP TAP-TO-EARN PROJECTS

With the original game is no longer active, Notcoin introduced a staking mechanism and tiered $NOT rewards for users to try DeFi on the TON blockchain—Explore & Earn—to sustain the excitement and keep the token afloat.

TAP-TO-EARN THRIVES ON QUESTS & TASKS

It’s 2024 now, and, echoing that 2022 success, a fresh, seemingly mass adoption-fueling, and similarly named T2E—tap-to-earn—meta has been trending for several months so far.

What started as a novel idea with Notcoin has rapidly evolved into a booming market, capturing the attention of hundreds of millions of users worldwide, building new communities, and distributing crypto rewards.

Are T2E products a passing narrative, or does their business model have some solid fundamentals, allowing them to stick around and have a longer peak than the P2E frenzy did?

Let’s find out about this by looking into the blue wave of Telegram x TON ecosystem that T2E titles are riding, exploring their origins, how they work, their most popular examples, and where this phenomenon might be headed.

Telegram has been around since 2013.

With USDT native on TON since April, seamless P2P value transfer is now a reality—users can send crypto as easily as they send messages on WhatsApp. This user experience outpaces ‘neobanks’ like Revolut or Venmo and is far ahead of traditional banks.

The real opportunity to onboard hundreds of millions to crypto though lies in Telegram’s mini-apps.

WHAT ARE TELEGRAM MINI-APPS?

An open platform for businesses to build and deploy crypto-friendly apps, Telegram mini-apps are lightweight web apps built with standard widespread web technologies. They are embedded directly within Telegram, allowing users to launch and interact with them from a chat or bot without any downloads or installations.

Developers create these mini-apps by integrating them with Telegram’s API, enabling them to use features like authentication, notifications, and payments.

Plus, these apps can connect with the TON blockchain for secure transactions, digital asset management, and decentralized services.

Source: TON Website.

This seamless blend of web technology and blockchain within Telegram makes mini-apps both powerful and user-friendly, allowing web3 builders to reach non-crypto users, who won’t even realize they’re using a crypto product, whether it’s a mobile game or a DeFi protocol.

The leading tap-to-earn games run in Telegram mini-apps, so there’s no need to download any additional apps, which naturally extends their cross-platform reach.

Helped by that, they are rapidly becoming the go-to way for people to have a shot at earning relatively liquid digital assets when they have some spare time here and there.

By ‘relatively liquid digital assets’ here we mean anyone can now potentially earn on-chain tokens that can later be held, used, or sold outside the game itself—unlike illiquid in-game ‘currencies’ of traditional games—by engaging in simple screen tapping or more fun gaming activities that some products have evolved to offer.

This promise may sound eerily similar to that of play-to-earn products back in 2022, and it’s no secret that many of them went out of the market, lacking a clear financial model besides the initial hype wave.

Only a few stayed like the OG Axie Infinity, The Sandbox, and Gods Unchained, with several AAA titles like Star Atlas, Illuvium, and Star Heroes still in beta or development ever since the boom of P2E popularity.

CONVENIENT & PROMISING OPPORTUNITIES

Remember to always DYOR (do your own research) before buying the creator’s messaging about future token performance.

Still, the possibility of becoming a stakeholder in a web3 product after some taps is a big motivation that also contributes to this ongoing T2E bull-run.

Popular T2E titles include Blum, Hamster Kombat, TapSwap, Pixeltap, formerly Notcoin, and a variety of others.

With tap-to-earn all the rage these days, everyone involved is participating in a large-scale real-time test of a model that could prove superior and more resilient than early P2E games.

In early 2024, Notcoin introduced its own token, $NOT, on major exchanges like Binance, allowing players to turn their gaming achievements into real value.

FIRST MOVER ADVANTAGE AND CLEVER BRANDING

Notcoin’s rise to prominence can also be attributed to a combination of strategic branding and clever marketing that played on the growing influence of the TON ecosystem.

At the time of its launch, Notcoin capitalized on the initial success and increasing traction of TON in the web3 space. Notcoin’s upside-down logo, a reversed TON logo, was a bold move that caught the attention of crypto enthusiasts.

The team might have drawn their inspiration from a popular Solana memecoin at the time that, when read backwards, spelled, well, $ANALOS.

This added a shade of intrigue and speculation about its potential connection to Telegram and TON.

Later Notcoin started partnering with GameFi devs and integrating their creations in the mini-app’s Games tab, further evolving its business model.

Notcoin Explore & Earn

For example, Notcoin lent its platform and reach to Lost Dogs, a ‘social experiment’ game that began on August 1. Each day marks a new round, where outcomes are driven entirely by player decisions, with no reliance on luck.

In T2E games, players engage with tappable icons, manage energy bars, and earn rewards through referrals, tap bots, and daily tasks.

Boosters and upgrades add depth, while intuitive gameplay ensures these games are accessible to all, including crypto newcomers.

X Empire Tappable Character

Tappable Icon

The core element is the tappable icon that players interact with to earn rewards.

Each tap is governed by an energy bar that refills over time, improving retention and adding a layer of planning to the gameplay.

Blum Invite Frens Feature

Referral Programs

Many T2E titles feature referral schemes. Players earn a share of the points from users they invite and receive bonuses for milestones like inviting 100 friends.

This drives user growth and creates smaller and locally galvanized communities around the game, as they tap together toward a common achievement.

MemeFi Task List

Daily Tasks and Offers

Beyond tapping, players can complete in-game tasks and third-party offers, such as joining Telegram channels or following X accounts, to earn lump-sum rewards.

TapSwap Tap Bot

Tap Bots

Some games offer a tap bot—a feature that auto-taps even when the app is closed.

Such a feature allows players to earn passive rewards, which can be a game-changer for those looking to maximize their earnings without constant active play.

Hamster Kombat Boost Button

In T2E games, players engage with tappable icons, manage energy bars, and earn rewards through referrals, tap bots, and daily tasks.

Boosters and upgrades add depth, while intuitive gameplay ensures these games are accessible to all, including crypto newcomers.

BLUM

Co-founded by former Binance execs Gleb Kostarev and Vladimir Smerkis, Blum is building a DEX within a Telegram mini-app, offering access to over 30 blockchains without native token gas fees.

Game Mechanics and Rewards

Blum’s Drop game offers players to catch falling asterisks within a 30-second window, using Game Passes earned through daily check-ins. Points can also be accumulated via referrals and completing tasks. These points can later be converted into various rewards on the Blum app, with hints at future trading opportunities.

Collaborations and Future Plans

Blum has partnerships with major platforms like Binance, OKX, and Bitget. The team also plans to introduce a native blockchain and additional features like a launchpad for meme projects and perpetual trading.

With over 35 million users on its mini-app, Blum is currently one of the biggest bets of web3’s tapping community.

HAMSTER COMBAT

In Hamster Kombat, players take on the role of a hamster CEO in a fictional crypto exchange, growing their startup through strategic investments in marketing, licenses, and talent. With strategic gameplay and daily bonuses, the game has captured the attention of a staggering 300 million players since its launch.

Gameplay Overview

The game’s updated whitepaper outlines that 60% of the $HMSTR supply is allocated for airdrop

Core features include:

Daily Combo Promotion

Earn 5 million free in-game coins by investing in selected daily upgrades.

NFT Integration

Each hamster is a unique NFT, fully tradable and sellable in the marketplace.

Customization Options

Personalize your hamsters with a variety of outfits, accessories, and weapons.

Multiplayer Mode

Challenge friends or compete globally in online battles.

CONTROVERSY

Despite claiming no need for investors, the game has been reported to secretly take funds from the Russian fund AD.RU, promising but never delivering profits. Key members left due to broken promises and internal conflicts. Currently, the token’s pre-market price has dipped, raising concerns within the community about the value of the delayed airdrop this September.

TAPSWAP

Like the first two examples, TapSwap features extensive tapping, daily tasks, and earnings-boosting mechanics, all with the promise of future $TAPS tokens. Currently, the game has attracted over 60 million players, with nearly 5 million subscribers on its official YouTube channel.

TapSwap has gained attention following the success of Notcoin and Hamster Kombat, proving the ongoing popularity of tap-to-earn games.

TapSwap Daily Code

TapSwap’s Daily Secret Code challenge involves watching specific YouTube videos to find a hidden codeword.

Entering this code unlocks rewards ranging from 200,000 to 400,000 tokens, usable for boosters and premium upgrades.

These codes are valid for 24 hours.

X EMPIRE

X Empire, formerly known as Musk Empire, boasts over 16 million players since its July 4 launch and over 1 million X following, the game stands out for its engaging mechanics and playful use of a cartoon Elon Musk avatar, much like how Notcoin took liberties with the TON brand and, by extension, its founder, Pavel Durov.

Originally a simple tap game, it has been evolving into a financial strategy adventure.

Core features include:

Strategic Angle

The game now includes deals and negotiations, allowing players to upgrade their avatars' attributes, such as ethics and leadership, to boost passive income.

Players can engage in battles, trade, and invest in in-game stocks through the City tab.

Players can also choose from a variety of characters, including a cartoonish Elon Musk avatar.

Daily Engagement

Daily activities like the Daily Combo and Riddle of the Day offer extra bonuses, making the game more interactive.

X Empire has partnered with Notcoin to offer special missions for high-level players, temporarily rebranding as NOT Empire.

MEMEFI COIN

In MemeFi Coin, players tap the screen to defeat ghostly enemies, to earn in-game coins for each enemy defeated. Enemies vary in difficulty, each with specific health points, and each tap depletes the player’s energy, which regenerates over time. Power-ups and boosters can increase damage, energy limits, and recharge speed, enhancing gameplay.

Competitive Gameplay

Set in a meme-rich universe that blends pop culture with fantasy, MemeFi Coin encourages player competition through leaderboards and a clan system, where clans (Telegram channels) foster collaboration and competition for top rankings.

Clan creators, known as Memelords, earn rewards when their members defeat bosses, driving community growth and participation.

In-Game Economy The game introduces a unique economic dynamic with social keys and $PWR upgrades, enabling players to join clans, complete missions, and exchange performance-based rewards.

Blockchain Choice

Unlike most mini-app tap games, which typically choose the TON blockchain for its integration with Telegram, MemeFi Coin is building on Linea, an Ethereum layer-2 solution. However, there are reportedly plans for TON and Solana in the future.

While the game is separate from the team’s other web2 project, MemeFi Club, there are hints that in-game rewards may become exchangeable in the future.

PEPE WICK

Building off John Wick’s identity, the frog protagonist in Pepe Wickembarks on a mission to battle pickle aliens to rescue his kidnapped dog.

Gameplay Overview

New players start with 2,000 in-game currency, which can be used to purchase your first Pepe Wick (randomly assigned between levels 1 and 3).

Players can continue with this character or buy additional Pepe Wicks from the in-game market for a chance at higher levels.

Earning Rewards

Players can earn tokens by completing in-game missions with hired hitmen, powering up, and participating in special events—or they can purchase tokens using TON.

Tappers need to keep the game active and on-screen to earn rewards, with bigger prizes available in increasingly challenging boss battles.

ONGOING

Pixel Tap by Pixelverse, a gaming ecosystem that integrates third-party devs, IPs (intellectual properties), and its own projects, blends tap mechanics with PvP battles. Players earned FI points, the in-game currency, toward the airdrop of $PIXFI tokens that took place July 25.

Tapping Mechanics

The primary way to earn FI points was by tapping the yellow coin, which delayed the timer each time. Alternatively, you could click the Claim button to skip the tapping altogether, but this would fully reset the timer.

PvP Battles

Daily coins could also be secured by upgrading your fighting pet (called bot).

People would upgrade their bots to improve its stats like energy, recharge speed, and power, making it easier to win fights.

In battles, you needed to tap the quickest in one of four areas to beat your opponent.

Winning earned FI based on the bot’s level, while losing would result in half the reward. Success in fights allowed players to upgrade their bot faster.

AIRDROPPED

PIXELTAP

$PIXFI Airdrop

Pixelverse launched its $PIXFI airdrop on July 18, unexpectedly choosing Ethereum as the platform. The team also implemented some rather unusual distribution rules, which didn't sit well with the community.

All players received 20% of the total supply, with an additional 10% allocated to holders of Rare, Epic, and LegendaryNFTs.

While 30% of the total supply might seem reasonable, the team effectively locked 90% of the distributed tokens in a two-year vesting period, with only 10% available for immediate withdrawal.

The remaining tokens can only be earned through continued engagement with Pixelverse products.

Many players and KOLs who covered the game felt betrayed, believing they were treated less favorably than the VCs who backed Pixelverse with $5.5 million in funding.

They viewed the airdrop as overly restrictive and felt the team was disingenuous about the token launch, especially compared to the straightforward Notcoin launch in May.

Pixelchain Introduction

Alongside the airdrop announcement, Pixelverse also introduced Pixelchain, its upcoming EVM-compatible layer-2 network on TON.

In T2E games, ad placements through tasks and quests serve as a major revenue driver.

Developers launch sufficiently engaging T2E games to capture an initial user base.

As the game gains traction and hopes grow, it attracts attention from brands, communities, and KOLs eager to reach this active audience. With thousands or even millions of daily active users, T2E games create a prime environment for advertisers.

Players, driven by the prospect of earning rewards, are highly engaged, making in-game ads an effective way to promote products or services. This seamless integration benefits both advertisers and players, as ads become a natural part of the gaming experience.

For developers, this model can be highly profitable. More active users lead to higher demand for ad placements, which drives up their value. This revenue stream can then be reinvested into further growth—whether through additional ads, user acquisition, or the ultimate launch of the project’s native tokens.

A well-executed T2E game creates a symbiotic ecosystem where advertisers, players, and developers all benefit. It’s a win-win-win scenario, showcasing the powerful potential of tap-to-earn games in our increasingly digitized economy where people are exposed to asset holding and investment opportunities earlier in life.

IS TAP-TO-EARN HERE TO STAY?

As we watch Tap-to-Earn take off, it's becoming clear that this trend may actually show us where digital assets and gamified experiences are headed.

By leveraging Telegram’s massive user base and its seamless integration with the TON blockchain, T2E games are making it easier for people to get into crypto and turn spare moments into opportunities to earn with a bit of fun.

The Play-to-Earn craze of 2022 gave us a taste of what gamified earnings could do, both good and bad, but Tap-to-Earn seems to be putting a different spin on these lessons with its monetization methods.

With its simple design, low barriers to entry, and strong community interest, T2E could stick around, especially as more creative games continue to emerge.

But can it keep the momentum going? That will depend on how these platforms evolve, keep users interested, and create long-term value.

If they succeed, T2E could become the next big gateway into the on-chain world.

HOW ABOUT YOU TAP CRYPTORSY TOO?

Ready to tap into major web3 developments to ignite community interest? Cryptorsy, our cutting-edge web3 marketing studio and growth ecosystem, is at the forefront of on-chain innovations.

Whether you're launching your own tap-to-earn platform or looking to list on the hottest ones, our years of expertise and expansive network are here to ensure your success.

Let’s make your brand the one everyone’s tapping—before someone else does!

€CPRO Offering Plan

Launchpad

Copperlaunch

Tokensoft

18022313761

CPRO Sale

Finalize marketing plan and schedule

Pay ninja and complete general Cryptonite interest form

Link interest form to the CPro store slide and the stake slide, update DocSend andall Cryptonite medium posts with reference to interest form

Update CPRO Economy Post with Graphics and standard footer

Finalize and send email all people interested in CPRO

Launch sales site

Have Starno update Cryptonite live to match new Wizard design

Finalize Cryptonite profile to Starno

Follow-up email to Maria - Magomed

Update bio with Benioff photos and links to interviews

Finalize Scribe post invite on medium

Finalize Scribe invite and send out

Move certain Posts over to Cryptonite’s own page

As Merton reminds us, ‘“Every moment and every event in every man’s life on earth plants something in his soul. For just as the wind carries thousands of winged seeds, so each moment brings with it germs of spiritual vitality that come to rest imperceptibly in the minds and wills of men. Most of these unnumbered seeds perish and are lost, because men are not prepared to receive them: for such seeds as these cannot spring up anywhere except in the soil of freedom, spontaneity and love.”

coinbase.com/join/perkin_i1?src=ios-link

https://www.escapeartist.com/blog/crowdsale-ico-legal-united-states/

Review Mediums CPRO economy to add an anchor title and paragraph to the CPRO Economy slide.

1a. Plan a September Pre-Sale - this is when the wind starts blowing up the crypto lungs again.

1b. Require all token purchasers to fill out KYC forms

2a. In the meantime, have a hardcore focus on recruiting the best imaginable Wizards,

b Put tokens in their pockets to get people excited about the token and build pre-sale mo’

c. Set them up to test the beta and let them use it as their private network for a while to get used to sharing and commenting and kick the tires.

3. In the meantime, build the complete backend to our token creation and management system (which is in the process).

4. Plan for a 4th quarter public DAPP lauqqaa awww nch and token sale—BTC could be$150K by then

Cryptonite PRO token Pre-Sale Offering DRAFT

https://docsend.com/view/2dazgj8c6vfw9yrf

Password: GoCPRO!

https://g.org

Ok

Josh Lawler, Zuber Lawler ($10,000)

1. Advisory, negotiation and drafting of documents in connection with the Cryptonite Ventures Corporation’s creation and issuances of stock to founder, iIndustry advisors and investors activities.

2. Advisory in connection to Cryptonite’s sales of it’s CPRO tokens.

Rayco Garcia ($10,000)

1. Advisory in connection with Cryptonite’s Tokenomics, blockchain features and development, and CPRO token pre-sale sales and marketing.

Starno, ($10,000)

1. Design the CPRO pre-sale website

2. Continue the design of Cryptonite’s Beta DAPP

Pre-Sale Cryptonite Wizard Video ($10,000)

Costa Rica Option

https://cryptopotato.com/costa-rica-a-new-crypto-heaven/

https://freemanlaw.com/costa-rica-and-cryptocurrency/

https://www.buybitcoinworldwide.com/costa-rica/

https://thecostaricanews.com/costa-rica-and-bitcoin-a-crypto-heaven/

Great