CPRO Token Specification

Token Name: Cryptonite PRO (CPRO)

Blockchain: Solana (Token-2022 standard)

Total Supply: 21,000,000,000 CPRO (capped)

FDV at Public Launch ($0.03): $630,000,000

Initial Circulating Supply at TGE: ~4,250,000,000 CPRO (20.2%)

Non-Circulating at TGE: 16,750,000,000 CPRO (79.8%)

Core Utility

Cryptonite fully commits to CPRO as the ecosystem’s most valuable and indispensable currency by extending its utility across all app features and benefits.

Discounts on paid Cryptonite and Friend Network memberships

Buy, sell, trade, and reward expertise, influence, and contributions

Exclusive payment for Cryptonite Wizards subscriptions, Tribes membership, and premium features

In-chat and message tips/rewards via XMTP

Discounts on Cryptonite and 3rd party events, and services

Embedded self-custodial wallet for seamless in-app use

Future: Access tiers

Technology Stack

Helius RPC (mainnet + testnet API keys) — configure webhooks for transfers, vesting, withheld fees

Token-2022 deployment (mint authority → Squads post-mint) — create with transfer fee 20 bp / max 100 bp, authorities as specified

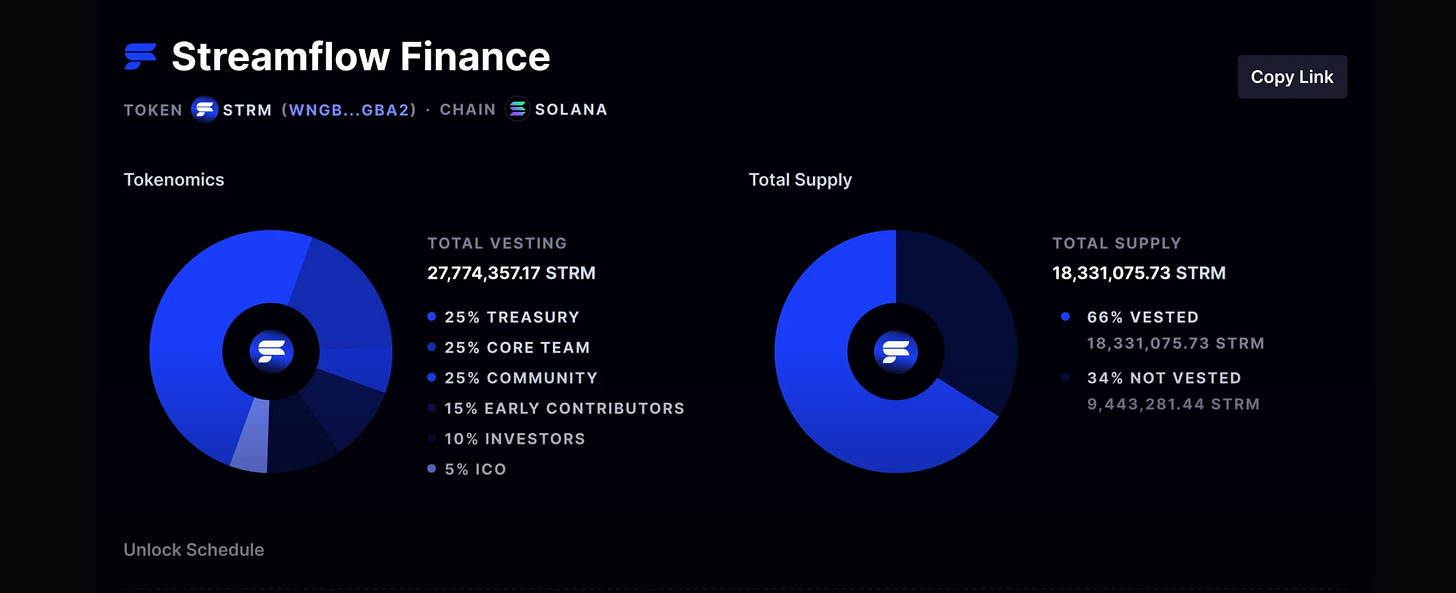

Streamflow — deploy 4 main vesting streams (recipients = Squads multisig)

Squads multisig (3-of-5 or 4-of-7) — treasury vault, buyback/harvest/burn/LP templates

Raydium — pool creation scripts tested on devnet

Dedicated burn wallet/address — test burn transactions

Privy dashboard — Solana + social/passkey/email, gas sponsorship enabled

Stripe + NOWPayments merchant accounts — fiat ramps

Arweave/Bundlr, Sanity.io, PostHog, Sentry, Retool/Appsmith projects

Grok/Perplexity API keys + local Ollama/Llama.cpp setup

Deflationary Mechanics (live at TGE)

0.2% automatic burn on open-market/secondary transfers (user-to-user rewards/tips, DEX trades) via Token-2022 transfer fee hook (initial 20 bp, max 100 bp configurable via Squads multisig)

Fees withheld in recipient token accounts (Token-2022 standard)

Harvest flow: harvestWithheldTokensToMint (permissionless) → withdrawWithheldTokensFromMint(Squads/authorized via dedicated wallet upgradable to multisig) → burn to dedicated dead address

Crank automation: Helius webhooks (Stage 0) + recurring Bull jobs (~24h or threshold) + Squads proposal templates

Explicit no-fee transfers: presale claims, vesting releases (Streamflow), reward accruals/claims, staking operations (if implemented); rewards calculated on gross amount

Authorities & setup: Mint Authority revoked to Squads post-mint; Transfer Fee Config Authority = Squads multisig; Withdraw Withheld Authority = initial single-key → Squads

Devnet E2E testing + external audit of fee/harvest flow

Transparency: Public burn dashboards + on-chain verification

Price Roadmap

$0.01 → Ongoing limited pre-sale (Cryptonite Originals, ~10M CPRO) until v0.5

$0.02 → v0.5 launch pre-sale (Q2 2026, ~260M CPRO)

$0.025 → V1 launch pre-sale (Q3 2026, ~500M CPRO)

$0.03 → Public TGE & DEX listing (est. June–Oct 2026)

Liquidity Strategy (TGE – Stage 3)

Allocation

420M CPRO (2% of total supply, unlocked at TGE) + X% of cumulative pre-sale proceeds (target: 50–70% of total raised, calibrated at TGE to deliver ~$150k–$300k initial liquidity depth at $0.03 price) → Raydium.Pool Structure

Primary: CPRO/SOL CPMM pool (50–60% of liquidity) – preferred for new Token-2022 launches (full-range, set-and-forget, no OpenBook market required, ~0.19 SOL creation cost).Secondary: CPRO/USDC CPMM pool (40–50% of liquidity) – for stable-pair depth and fiat on-ramp synergy.

Pool Creation & Initial Addition (executed via Squads multisig)

Devnet script validation complete (Stage 0 – Raydium SDK / @raydium-io/raydium-sdk).

Mainnet pool creation (CPMM) with initial price set to exactly $0.03.

Liquidity addition transaction (platform/Squads covers gas).

Receive LP tokens into Squads treasury vault.

LP Token Management (immediate post-creation)

70% → burn to dedicated dead address (e.g. 1Burn... or Token-2022 zero address equivalent) – permanent liquidity lock.30% → time-locked 12 months via Streamflow (linear unlock, recipient = Squads multisig vault).

– Stream created with Squads proposal (3-of-5 or 4-of-7).

– No early withdrawal possible; fees earned during lock still claimable by Squads.

Post-Launch Management

Public dashboard (Squads + Streamflow + Helius) showing pool addresses, depth, 24h volume, and burn/lock status.

Treasury / CPRO Growth Fund authorized to add supplemental liquidity (via Squads proposal) if depth falls below target or for buyback support.

No removal of initial liquidity permitted until Streamflow lock expires (enforced by governance).

Raydium fee tier: default 0.25% (or chosen tier) – trading fees accrue to locked LP position.

Risk / Audit Gates

External smart-contract audit of pool creation script + Streamflow integration before mainnet.Devnet E2E test: mint → add liquidity → burn 70% → lock 30% → simulate fee harvest.

Success metrics at TGE+24h: ≥$100k depth per pool, no >5% slippage on $10k trades, LP burn/lock transactions verifiable on explorer.

Vesting & Allocation Summary

Founders & Equity: 3B (14.3%) – 48-month weekly linear from TGE

Advisors & Strategic: 1B (4.8%) – 24-month weekly linear from TGE

CPRO Growth Fund: 8B (38.1%) – 12-year weekly linear from TGE

Treasury/Member Rewards: 4.75B (22.6%) – 12-year weekly linear from TGE

Marketing & Distribution: 1.33B (6.3%) – Unlocked at TGE

Liquidity Pool: 420M (2%) – Unlocked at TGE

Pre-sales: Fully unlocked/liquid at TGE (delivery via 1:1 migration/claim to primary wallet)

TGE Definition

Minting of all 21B tokens + liquidity pool creation + Raydium listing + 1:1 claim/migration of pre-sale allocations + virtual earned balances to user’s primary wallet (Privy embedded or linked external).

Comprehensive CPRO Development Plan

Key Principles

Stage-gate reviews + external audits at end of each stage

Full transparency (on-chain vesting, burns, public dashboards)

Pre-sale funds directed to liquidity + development

Virtual CPRO simulation pre-TGE → real on-chain at TGE

Self-custodial embedded Privy wallets + optional external connect

Flexibility: timelines, presale parameters, feature priority adjustable based on traction, audits, market conditions, regulatory feedback

Devnet E2E testing mandatory before mainnet (mint → vesting → presale sim → claim → transfer/burn → LP)

Full tech stack alignment: Node.js/Express backend, Next.js frontend, MongoDB/Redis, Bull queues, Pinata/IPFS, etc.

Dragonfire Security Layer: Custom component providing foundational security primitives (encryption mechanisms, zero-knowledge elements for privacy, app-specific safeguards for data integrity across on/off-chain flows, sensitive data/wallet/transaction protection)

No transfer fee on staking operations (if added); rewards calculated on gross amount

Stage 0: Third-Party Service Setup & Accounts (Feb–Mar 2026)

Helius RPC (mainnet + testnet API keys) — configure webhooks for transfers, vesting, withheld fees

Token-2022 deployment (mint authority → Squads post-mint) — create with transfer fee 20 bp / max 100 bp, authorities as specified

Streamflow — deploy 4 main vesting streams (recipients = Squads multisig)

Squads multisig (3-of-5 or 4-of-7) — treasury vault, buyback/harvest/burn/LP templates

Raydium — pool creation scripts tested on devnet

Dedicated burn wallet/address — test burn transactions

Privy dashboard — Solana + social/passkey/email, gas sponsorship enabled

Stripe + NOWPayments merchant accounts — fiat ramps

Arweave/Bundlr, Sanity.io, PostHog, Sentry, Retool/Appsmith projects

Grok/Perplexity API keys + local Ollama/Llama.cpp setup

Additional Setup

Database & Cache: MongoDB Atlas (collections: users, presaleAllocations, transactionLogs, feeCollection, adminLogs); Redis/Upstash (caching, sessions, rate limiting, Bull queues)

Backend: Node.js v18+ LTS + Express + TypeScript; key deps (@solana/web3.js, @solana/spl-token, @coral-xyz/anchor, @privy-io/server-auth, @sqds/sdk, stripe, bull, mongoose, winston, etc.)

Frontend: Next.js 14+ App Router + React 18+ + TypeScript + Tailwind; key deps (@privy-io/react-auth, @solana/wallet-adapter-*, @tanstack/react-query, posthog-js, @sentry/nextjs)

Storage: Pinata/IPFS for metadata/assets; Arweave fallback

Analytics/Monitoring/Admin: PostHog, Sentry, Retool/Appsmith dashboards

Security/DevOps: Dragonfire integration; env/secrets management; Redis-backed rate limiting; Winston JSON logging; Jest + Anchor testing

Deliverable: All accounts active, keys secured, devnet E2E tests successful (mint → transfer/withheld → harvest → burn; vesting; Privy sim; DB schemas; backend/frontend skeletons; Dragonfire primitives tested).

Stage 1: v0.5 Launch + $0.02 Pre-Sale (Q2 2026)

Focus: Privacy-first v.05 + $0.02 presale live, (virtual CPRO balances/tips pre-TGE, real claim/migration at TGE). All presale purchases recorded in DB; no on-chain token transfers until TGE.

Prerequisites/Dependencies (from Stage 0 completion):

Helius RPC + webhooks configured for transfers, withheld fees (for future burn cranks), and transaction monitoring.

Token-2022 minted on devnet/mainnet-ready (20 bp fee, authorities set: Squads transfer fee config, dedicated withdraw wallet).

Privy fully set up (Solana + passkeys/email/social, gas sponsorship, embedded wallets).

Streamflow/Squads multisig active.

MongoDB collections ready (users, presaleAllocations, transactionLogs, feeCollection).

Dragonfire security primitives integrated (encryption, ZK elements, sensitive data/wallet protection).

Devnet E2E skeleton working.

Key Additions:

Backend API:

/auth/login (Privy server auth verification, session/JWT handling, rate limiting via Redis, Dragonfire encryption for sensitive data).

/presale/allocation (purchase logic: validate payment (Stripe fiat or NOWPayments crypto), calculate allocation at $0.02, record in DB with limits, anti-whale checks, KYC/AML hooks if required; support virtual CPRO preview).

/presale/claim (simulate virtual balance preview; at TGE: backend triggers Squads-signed claim to user Privy/external wallet, platform covers gas via relayer/Helius staked RPC).

Stripe + NOWPayments webhooks (secure endpoint for payment confirmation, update allocation status, handle refunds/failed tx, logging).

Additional endpoints if needed: /presale/status, /wallet/balance (virtual), webhook verification middleware.

Security: Input validation (Zod/Joi), auth middleware, IP/rate limiting, Winston structured logging, error handling.

Frontend:

Presale landing page (dynamic content from Sanity: pricing at $0.02, allocation calculator, purchase form with fiat/crypto options, progress bar for total raised/remaining).

Wallet connect modal (Privy embedded + optional external Solana wallet adapter; display primary wallet, gas sponsorship status).

Real-time claim/status dashboard (websockets/SSE or TanStack Query polling for allocation balance, claim eligibility, transaction history).

UI/UX: Responsive design (Tailwind), error states, loading indicators, accessibility, PostHog event tracking for purchase funnel.

Virtual CPRO preview display (in-app balance before TGE).

Sanity.io CMS:

Schemas for app text, dynamic pages (presale landing, FAQ, terms), member profiles (if early access), hero banners, pricing tiers.

Workflow: Content publishing pipeline, preview mode in Next.js, webhook integration for real-time updates.

Governance: Versioning, approval process for sensitive text (legal/disclaimers).

XMTP Full Setup:

E2EE messaging integration (user-to-user, group chats).

Virtual in-chat CPRO tips/rewards (simulate tips in DB, display pending balance; no real transfer fee/burn until TGE).

Privacy focus: Leverage XMTP’s encryption + Dragonfire ZK/privacy primitives where applicable; future Confidential Transfers prep.

UI components: Chat interface, tip button/modal with amount selector.

Testing: End-to-end message + tip simulation.

Additional Stage 1 Elements (recommended to add explicitly):

Presale Flow Integration: Full E2E purchase → allocation → virtual balance → claim preview (devnet sim first, then mainnet staging).

Relayer Service: Secure tx signing/submission (Helius staked RPC) for claims/gas sponsorship from Squads funds.

Monitoring & Analytics: Sentry error tracking, PostHog funnel analytics (conversion rates, drop-offs), Retool dashboards for presale metrics (raised, allocations, users).

Testing: Unit/integration tests (Jest), E2E presale flow (Cypress/Playwright on devnet), security scans, load testing for payment endpoints.

Deployment: Staging environment, CI/CD pipeline, environment-specific configs (secrets via env vars).

Compliance/Privacy: Review presale terms for regulatory feedback, data privacy (GDPR alignment), audit log for all allocations/transactions.

Gate: Security Audit + Presale Traction Review:

External smart contract/protocol audit (Token-2022 config, relayer, any Anchor programs) + backend/frontend penetration testing.

Internal Dragonfire review.

Traction metrics: Minimum pre-sale raised, user signups, engagement (chats/tips), holder distribution preview.

Stage review meeting: Adjust timelines, features, or parameters based on traction/market conditions.

Other Considerations:

Success Metrics: Presale live and functional, virtual CPRO flowing (tips/allocations), successful devnet → staging E2E tests, positive audit findings, defined traction thresholds for gate approval.

Risks: Payment webhook reliability, gas cost volatility (mitigated by sponsorship), presale demand overwhelming DB/relayer, privacy edge cases.

Timeline within Q2 2026: Break into weeks/sprints (e.g., API + DB first, then frontend integration, then XMTP/testing, final audit/gate).

Stage 2: V1 Launch + $0.025 Pre-Sale (Q3 2026)

Focus: Full dApp utility + community features

Key Additions:

Backend API & Integrations (expand existing)

/auth/login → Add JWT/OAuth flows, rate limiting, session management, and KYC/AML hooks if required for presale.

/presale/allocation → Include endpoints for user eligibility checks, tiered allocations, anti-bot/Sybil measures (e.g., wallet age/volume checks via Helius APIs).

/presale/claim → Detail webhook handling for Stripe/NOWPayments (idempotency, error retry, refund flows), plus user dashboard for claim status.

Additional endpoints: /user/balance, /staking/stats (if staking live), /presale/info (public sale progress, hard/soft cap).

Secure Relayer Service (critical for gasless claims)

Implementation: Use established patterns (e.g., Octane-inspired or Helius staked endpoints for priority).

Security: Rate limiting, signature verification, whitelisting allowed instructions/programs, nonce/replay protection, monitoring for abuse.

Funding & Ops: Squads multisig for fee wallet, auto-topup logic, fallback if Helius RPC issues.

Gas estimation & sponsorship policy (e.g., max fee per tx, per user daily limit).

BullMQ Jobs & Background Processing

Add more recurring/cron jobs: e.g., presale progress monitoring/alerts, staking reward accrual snapshots, compliance reporting.

Error handling/retries, dead-letter queues, dashboard (Bull Board or custom).

Scaling: Redis config, worker concurrency, monitoring (Prometheus + Grafana if advanced).

Gate: Full Smart Contract Audit + TGE Readiness (expand heavily)

Audit scope: Presale contract/program (if custom), staking program, token mint (SPL Token-2022 if extensions used), any PDAs/vaults.

Auditor selection (top firms like OtterSec, Sec3, Neodyme, or Certik for Solana).

Pre-audit: Internal code review, static analysis (cargo-audit, clippy), Slither-like tools if applicable.

TGE readiness: Token mint revocation (freeze/mint authority to null if planned), liquidity provision plan (e.g., Raydium pool setup post-presale), vesting/lockup contracts for team/early contributors, burn mechanisms if any.

On-chain verification: Program deployed & verified on Solana Explorer, IDL published.

Additional Recommended Items (often missing in early plans)

Frontend/DApp: Presale UI (wallet connect, allocation checker, claim button), staking dashboard (stake/unstake, rewards preview), responsive + mobile support.

Testing: End-to-end (presale flow, claim, stake/unstake), load testing (simulate many claims), devnet → testnet → mainnet migration plan.

Monitoring & Security: On-chain monitoring (Helius webhooks for events), alerting (e.g., failed claims, suspicious tx), bug bounty program launch.

Compliance & Legal: Token classification check (utility vs. security), KYC/Geo-restrictions for presale if needed, terms of service/privacy policy.

Documentation & Community: Updated whitepaper/tokenomics, dev docs (API spec, staking guide), community beta testing (e.g., limited presale test round).

Contingency: Rollback/rescue plans (e.g., upgradeable program if using Anchor 0.30+), emergency multisig controls.

Stage 3: Public Listing at $0.03 + TGE Execution (June–Oct 2026)

Focus: Token generation (full mint), liquidity pool creation + LP token management, mass claims/migration, vesting activation, transfer fee/burn mechanism live, and trading enabled on Raydium.

Prerequisites/Dependencies (from Stage 0–2 completion):

Helius RPC + webhooks fully configured (transfers, withheld fees, vesting events)

Squads multisig (3-of-5 or 4-of-7) operational with treasury vault, pre-funded SOL/gas, harvest/burn/LP proposal templates

Streamflow vesting streams deployed (4 main streams to Squads)

Privy embedded wallets + gas sponsorship enabled

Relayer service secure and tested (Helius staked RPC, rate-limited, whitelisted instructions)

Raydium pool creation scripts validated on devnet/mainnet-beta (Raydium SDK)

BullMQ jobs running (harvesting, batch processing)

Dragonfire Security Layer active (encryption, ZK/privacy primitives, transaction protection)

DB snapshot ready (presaleAllocations + virtual earned balances at TGE timestamp)

Final external audit complete + all devnet/mainnet E2E simulations passed

Pre-TGE Preparation (4–6 weeks prior to execution window)

Final full-scope external security audit (Token-2022 config/extensions, relayer, claim flow, burn harvest logic, Raydium integration, Streamflow vesting) + penetration testing + bug bounty kickoff

Mainnet phased dry-run simulation (mint test supply → LP → sample claims → transfers/burns → vesting release → alerts)

Secure key custody: Squads treasury, withdraw withheld authority (initial single-key → upgrade to Squads), dedicated burn wallet (1Burn... or equivalent dead address), relayer signer

Pre-fund Squads vault sufficiently for claims, harvests, and proposals

Finalize Raydium pools: confirm 420M CPRO (2%) + calibrated portion of pre-sale proceeds (target $150k–$300k initial depth at $0.03); 50–60% CPRO/SOL CPMM, 40–50% CPRO/USDC CPMM

Deploy token metadata (JSON hosted on Pinata/Arweave: name “Cryptonite PRO”, symbol “CPRO”, description, logo, website/socials; initialize-metadata pointer extension)

Configure dashboards: Helius (events), Retool/Squads/Streamflow (LP, vesting, burns), PostHog/Sentry (user/trading), Dune/Helius holder distribution tracker

Marketing/community: announcement timeline, Raydium coordination, anti-snipe/MEV protection (e.g., initial liquidity depth targets), optional community engagement plan

Regulatory/compliance final check (utility token emphasis, KYC/AML on ramps, geo-restrictions if needed)

TGE Execution Sequence (one-time event, <4-hour window recommended)

Mint full 21,000,000,000 CPRO to initial authority wallet (Squads-controlled) using:

text

spl-token create-token --decimals 9 --program-id TokenzQdBNbLqP5VEhdkAS6EPFLC1PHnBqCXEpPxuEb --transfer-fee 20 100→ initialize-metadata → full mint → immediately revoke/disable mint authority (set to null/Squads)

Set remaining authorities: Transfer Fee Config → Squads multisig; Withdraw Withheld → dedicated/upgradable wallet

Create Raydium CPMM pools, add exact liquidity, receive LP tokens to Squads vault

Immediately: burn 70% LP tokens to dedicated dead address; create Streamflow stream for remaining 30% LP tokens (12-month linear unlock to Squads vault)

Activate Token-2022 transfer fee (0.2% initial, max 100 bp configurable)

Execute 1:1 claim/migration: snapshot DB → batch transfers (Bull jobs where possible) or individual relayer txs from Squads → user primary wallets (Privy embedded or linked external); platform covers gas; include rate limiting, anti-bot, retry logic

Activate all vesting streams (founders 3B/48mo weekly linear, advisors 1B/24mo, growth fund 8B/12yr, treasury/rewards 4.75B/12yr) — first releases begin at TGE timestamp

Confirm pools public/tradable (swaps enabled, charts live on Raydium/DexScreener)

Post-TGE Go-Live & Stabilization (immediate–first 7 days)

Activate burn crank: Helius webhooks + recurring Bull jobs (~every 24h or threshold e.g. ≥1M CPRO withheld) → harvestWithheldTokensToMint (permissionless) → withdrawWithheldTokensFromMint (Squads) → burn to dead address. No fees on presale claims, vesting releases, staking (if implemented), or reward operations (rewards on gross amount)

Full monitoring stack live: alerts for volume spikes/dumps (>X% in 1h), large transfers (>1% supply), high withheld accumulation, failed txs/claims, holder concentration

Launch initial marketing push and confirm trading enablement

Enforce no transfer fee on specific operations via instruction checks or program logic

Success Metrics (target first 24–72h)

Liquidity depth: ≥$150k–$300k per pool, ≤5% slippage on $10k trades

Volume: strong initial trading volume (target >$500k–$1M 24h)

Holder distribution: >5,000–10,000 unique holders, top 10 wallets <30–40% concentration

Burn rate: active 0.2% on secondary transfers/tips/DEX trades; first harvest/burn ≥$10k–$50k equivalent

User growth: high claim completion rate (>80–90%), active wallets post-TGE, app engagement metrics (PostHog)

Additional: no critical incidents (hacks, failed claims >1%, LP issues), price stability, on-chain vesting transparency, successful first burn cycle

Risk Mitigation & Contingencies

Failed mint/LP: rollback plan (revoke authorities, pause claims, public communication)

Multisig compromise/emergency: predefined pause/rescue procedures

Claim overload: rate limiting, queuing, daily caps per wallet

MEV/snipe: initial deep liquidity + monitoring

Dragonfire active for all sensitive flows

Deliverables

On-chain proofs: mint tx, LP creation/add/burn/lock txs, vesting activation, first burn tx

Public dashboard live (burned supply, circulating supply, LP status, vesting progress)

Post-mortem report (technical + metrics review)

Squads proposal templates (harvest, supplemental liquidity, fee updates)

Gate: Stage-End Review

On-chain transparency verification

Burn mechanism & no-fee rules validated live

Liquidity/volume/holder metrics review

User growth & claim success analysis

Adjust priorities per Key Principles (market, audit, regulatory feedback)

Estimated Timeline within June–Oct 2026 window

Preparation: 4–6 weeks

Dry-run: 1–2 weeks before

Execution window: single coordinated day (e.g., weekend for lower volatility)

Stabilization: 1–2 weeks monitoring/review

This plan prioritizes the current core spec (21B supply, 0.2% burn focus, staged rollout) while incorporating technical depth for secure, scalable execution.

Squads and Streamflow Mastery

As founder/owner, I want to prioritize mastery of the Squads & Streamflow platforms for security, transparency, and control. These platforms are on-chain, audited, and widely used for Solana token launches. They align directly with our plan:

Squads controls authorities (mint/transfer fee/withheld), treasury actions (harvest/burn/LP/supplemental liquidity), and proposals;

https://docs.squads.so/main/navigating-your-squad/dashboard

Streamflow handles the 4 long-term vesting streams (founders 3B/48mo, advisors 1B/24mo, growth fund 8B/12yr, treasury/rewards 4.75B/12yr) + 30% LP token lock (12-month linear to Squads).

https://docs.streamflow.finance/en/articles/9670473-create-a-token-lock

Platform Descriptions

Squads Multisig (squads.so / app.squads.so)

Squads is a Solana-native multisig platform built on Squads Protocol for secure team/DAO treasury management.

Key functions:

Create a “Squad” wallet with configurable threshold (e.g., 3-of-5 or 4-of-7 signers for high security).

Vault holds SOL, SPL tokens (CPRO), NFTs, and manages authorities (set as mint authority, transfer fee config authority, withdraw withheld authority).

Proposal/voting system: Create proposals for transactions (transfers, burns, harvest, Raydium LP creation/add/burn/lock, Streamflow interactions, fee rate changes); members approve (threshold met), then execute. Separate approve + execute recommended for safety.

Templates for recurring actions (harvest/burn, buyback, supplemental LP).

Program upgrades, token metadata management, integrations with Raydium, SPL Token-2022, Streamflow.

Dashboard for monitoring vault balances, proposals, streams/locks (when integrated).

Security: On-chain enforcement by Solana validators; no centralized custody. Best practices: high thresholds (4/6+ for critical), hardware wallets (Ledger/Trezor), segmented vaults (hot/cold), bug bounties, external audits. Deployment cost: ~0.1 SOL + rent (~0.003 SOL). Devnet/mainnet supported.

Streamflow (streamflow.finance / app.streamflow.finance)

Streamflow is Solana’s leading token distribution protocol for vesting, streaming payments, airdrops, and token locks.

Key functions:

Vesting/Streaming: Custom schedules (linear weekly, cliffs, periodic unlocks). Auto-release and transfer tokens on schedule (no manual cranks needed). Batch creation for multiple recipients. Revocable/irrevocable options.

Token Lock: Lock SPL tokens or LP tokens for fixed periods (e.g., 12 months linear unlock to a recipient like Squads multisig). Ideal for the 30% LP lock (fees earned during lock still claimable by Squads).

Multisig Integration: Set Squads multisig as recipient/owner of streams or locks. Manage (withdraw, top-up, cancel, claim) via Squads proposals (Streamflow contract calls).

Dashboard: Track open streams/locks, balances, unlock progress, public verification (search by token). Bulk import CSV for recipients. SDK for backend integration.

No-fee exceptions align with your plan (e.g., vesting releases bypass transfer fee). Security: Audited contracts, on-chain transparency. Devnet support for testing.

Integration: Squads vault receives vested/unlocked tokens or LP; proposals in Squads call Streamflow instructions (create/claim/manage).

Step-by-Step Setup Plan (Aligned to Your 3 Stages)

Security Best Practices

Use hardware wallets (Ledger/Trezor) for all signers.

Threshold: Start with 3-of-5 (add trusted team/advisors); consider 4-of-7 for treasury post-TGE.

Separate approve vs. execute; avoid auto-execute.

Test everything on devnet first (mandatory E2E per Key Principles).

External audit before mainnet activation.

Monitor via Squads/Streamflow dashboards + Helius/PostHog/Sentry/Retool.

Document all keys, proposals, and txs publicly for transparency.

As CEO: You create the Squad initially (control deployment); add members later via proposal. Fund initial SOL (~0.2–0.5 SOL per environment).

Stage 0: Third-Party Service Setup & Accounts (Feb–Mar 2026) – Core Creation & Devnet Testing

Create Squads multisig (devnet first): Go to app.squads.so (or devnet.squads.so) → Connect wallet (Phantom/Backpack) → “Create a Squad” → Name it (e.g., “Cryptonite Treasury”) → Add initial members (your wallet + 2–4 trusted) → Set threshold (3-of-5) → Confirm & pay deployment fee (~0.1 SOL + rent). Note Squad address.

Fund Squad vault with test SOL/tokens (devnet).

Create proposal templates: For harvest/burn, LP actions, Streamflow interactions (save common instructions).

Set up Streamflow (devnet): Connect wallet → app.streamflow.finance → Create 4 test vesting streams (linear weekly from future “TGE” date, recipients = Squads multisig address, different amounts/periods matching your allocations). Test cancel/top-up/withdraw via Squads proposal.

Test Token Lock: Create a test LP lock (30% equivalent, 12-month linear to Squads).

Upgrade Streamflow withdraw authority to Squads if needed.

E2E test: Simulate vesting release → tokens arrive in Squad vault; lock/unlock flow.

Migrate to mainnet: Repeat creation (new Squad + streams/locks), secure keys, audit integration.

Deliverable: Squad operational, 4 vesting streams deployed (recipients = Squads), LP lock template ready, devnet E2E successful.

Stage 1: v0.5 Launch + $0.02 Pre-Sale (Q2 2026) – Preparation & Virtual Simulation

Squads: Use for presale fund custody (fiat/crypto ramps → Squad vault). Create proposals for virtual allocation adjustments or refunds. Test basic transfers/harvest templates.

Streamflow: No live vesting yet (virtual CPRO simulation in DB). Create placeholder streams on mainnet (small test amounts) or keep devnet. Test recipient flow to Squads.

Integration test: Simulate claim preview → future Streamflow release. Add monitoring dashboards.

Gate prep: Review Squad/Streamflow security in audit (presale traction review).

Stage 2: V1 Launch + $0.025 Pre-Sale (Q3 2026) – Advanced Testing & Readiness

Squads: Expand members if needed (via proposal). Test complex proposals (Raydium pool scripts, fee harvest templates, supplemental liquidity). Integrate relayer signing if Squads signs claims.

Streamflow: Deploy/test final vesting parameters (exact amounts, weekly linear from planned TGE timestamp). Test LP lock creation (12-month to Squads). Batch test releases/withdrawals via Squads proposals.

Full E2E: Presale funds → Squad vault → simulate vesting start → tokens unlock to vault. Test staking (if prioritized) no-fee bypass.

Gate: Full smart contract audit includes Streamflow/Squads integration + TGE readiness (vesting activation plan).

Stage 3: Public Listing at $0.03 + TGE Execution (June–Oct 2026) – Full Activation & Operations

Pre-TGE (4–6 weeks before):

Squads: Pre-fund vault for gas/claims/harvests. Finalize templates (harvest, burn, LP burn/lock, fee config update). Secure withdraw withheld authority (upgrade to Squads).

Streamflow: Create/finalize 4 main vesting streams (exact allocations, weekly linear from TGE timestamp, recipient = Squads multisig). Create LP lock contract (30% LP tokens, 12-month linear unlock to Squads).

TGE Execution:

After mint/LP creation: Squads receives LP tokens → proposal to burn 70% → create Streamflow lock for 30%.

Activate vesting streams (first releases begin). Squads receives vested tokens per schedule.

Claims flow: Backend/relayer → Squads proposal/sign → user wallet (gas sponsored).

Post-TGE Stabilization:

Activate burn crank (Helius/Bull jobs trigger harvestWithheld → Squads withdraw → burn).

Ongoing: Squads proposals for harvests (24h/threshold), supplemental LP, fee updates (0.2% → max 1%). Monitor unlocks in Streamflow dashboard → tokens to Squad vault.

Success metrics verification: On-chain vesting progress, LP lock status, burn volume.

Gate: Stage review (transparency, live burn verified, holder metrics).

Ongoing Mastery Tips for You (CEO)

Weekly review: Squads dashboard (proposals, vault) + Streamflow dashboard (unlock schedule, locks).

Emergency controls: Predefine pause/rescue proposals.

Training: Share read-only access initially; run simulations with team.

Costs: Minimal ongoing (Streamflow fees low; Squads rent covered by vault).

Audit: Include both platforms in every stage-gate audit.

Resources: Squads Docs (docs.squads.so), Streamflow Docs (docs.streamflow.finance), Discord communities for support.

This plan ensures secure, transparent execution matching your Key Principles (stage-gates, audits, devnet E2E, transparency). Start with devnet Squads + Streamflow creation this week. If you need screenshots, video walkthroughs, proposal templates, or help drafting an internal ops guide/RACI matrix, let me know!